Wasatch Advisors LP boosted its holdings in shares of Weave Communications, Inc. (NYSE:WEAV - Free Report) by 38.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 5,205,665 shares of the company's stock after purchasing an additional 1,444,828 shares during the quarter. Wasatch Advisors LP owned about 7.15% of Weave Communications worth $82,874,000 at the end of the most recent quarter.

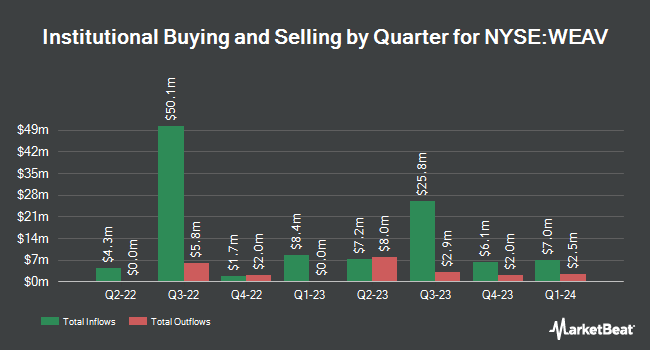

Other institutional investors and hedge funds have also bought and sold shares of the company. Amundi acquired a new stake in Weave Communications during the fourth quarter worth about $66,000. Summit Investment Advisors Inc. boosted its holdings in shares of Weave Communications by 28.9% in the 4th quarter. Summit Investment Advisors Inc. now owns 4,143 shares of the company's stock worth $66,000 after acquiring an additional 928 shares in the last quarter. KLP Kapitalforvaltning AS acquired a new stake in shares of Weave Communications in the fourth quarter valued at $131,000. US Bancorp DE raised its holdings in shares of Weave Communications by 8.4% in the fourth quarter. US Bancorp DE now owns 9,053 shares of the company's stock valued at $144,000 after buying an additional 703 shares during the last quarter. Finally, Cerity Partners LLC acquired a new stake in Weave Communications in the 4th quarter valued at about $159,000. Institutional investors own 86.83% of the company's stock.

Insider Activity at Weave Communications

In other news, CEO Brett T. White sold 54,778 shares of Weave Communications stock in a transaction dated Monday, January 27th. The stock was sold at an average price of $15.86, for a total transaction of $868,779.08. Following the sale, the chief executive officer now directly owns 1,928,364 shares of the company's stock, valued at approximately $30,583,853.04. This trade represents a 2.76 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, insider Branden Neish sold 25,510 shares of the company's stock in a transaction that occurred on Wednesday, March 19th. The shares were sold at an average price of $11.33, for a total value of $289,028.30. Following the completion of the transaction, the insider now directly owns 460,908 shares of the company's stock, valued at $5,222,087.64. This represents a 5.24 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 596,528 shares of company stock worth $8,630,675. Corporate insiders own 36.30% of the company's stock.

Weave Communications Stock Down 4.4 %

NYSE:WEAV traded down $0.41 on Monday, hitting $8.90. 96,408 shares of the company's stock were exchanged, compared to its average volume of 720,210. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.59 and a quick ratio of 1.59. The firm has a 50-day moving average price of $11.94 and a 200-day moving average price of $13.81. The company has a market cap of $666.61 million, a P/E ratio of -22.82 and a beta of 1.97. Weave Communications, Inc. has a 52 week low of $8.10 and a 52 week high of $17.63.

Weave Communications (NYSE:WEAV - Get Free Report) last released its quarterly earnings data on Thursday, February 20th. The company reported ($0.09) EPS for the quarter, missing the consensus estimate of $0.03 by ($0.12). The company had revenue of $54.17 million during the quarter, compared to analyst estimates of $53.23 million. Weave Communications had a negative net margin of 13.87% and a negative return on equity of 28.37%. As a group, analysts expect that Weave Communications, Inc. will post -0.33 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, Raymond James restated a "strong-buy" rating and set a $20.00 target price (up previously from $17.00) on shares of Weave Communications in a research report on Friday, February 21st.

View Our Latest Report on Weave Communications

Weave Communications Company Profile

(

Free Report)

Weave Communications, Inc provides a customer experience and payments software platform in the United States and Canada. Its platform enables small and medium-sized healthcare businesses to maximize the value of their patient interactions and minimize the time and effort spent on manual or mundane tasks.

See Also

Before you consider Weave Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weave Communications wasn't on the list.

While Weave Communications currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.