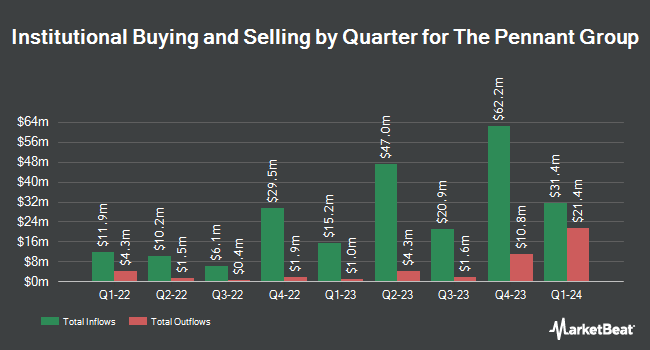

Wasatch Advisors LP decreased its holdings in The Pennant Group, Inc. (NASDAQ:PNTG - Free Report) by 6.9% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,046,569 shares of the company's stock after selling 77,436 shares during the period. Wasatch Advisors LP owned about 3.05% of The Pennant Group worth $37,363,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds also recently bought and sold shares of the stock. Creative Planning boosted its holdings in shares of The Pennant Group by 2.0% in the 2nd quarter. Creative Planning now owns 19,152 shares of the company's stock valued at $444,000 after buying an additional 373 shares in the last quarter. The Manufacturers Life Insurance Company lifted its position in The Pennant Group by 4.4% during the second quarter. The Manufacturers Life Insurance Company now owns 11,227 shares of the company's stock valued at $260,000 after acquiring an additional 471 shares during the last quarter. D.A. Davidson & CO. boosted its stake in The Pennant Group by 4.0% in the third quarter. D.A. Davidson & CO. now owns 15,126 shares of the company's stock valued at $540,000 after acquiring an additional 575 shares in the last quarter. Principal Financial Group Inc. grew its holdings in The Pennant Group by 9.9% in the second quarter. Principal Financial Group Inc. now owns 11,029 shares of the company's stock worth $256,000 after purchasing an additional 991 shares during the last quarter. Finally, Trust Point Inc. increased its position in shares of The Pennant Group by 9.7% during the third quarter. Trust Point Inc. now owns 24,926 shares of the company's stock worth $890,000 after purchasing an additional 2,199 shares in the last quarter. Hedge funds and other institutional investors own 85.88% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on the company. Truist Financial raised their price objective on The Pennant Group from $34.00 to $38.00 and gave the stock a "hold" rating in a research report on Monday, October 7th. Oppenheimer raised their price target on The Pennant Group from $34.00 to $37.00 and gave the stock an "outperform" rating in a report on Friday, November 8th. Stephens restated an "overweight" rating and set a $40.00 price objective on shares of The Pennant Group in a report on Wednesday, October 9th. Finally, Royal Bank of Canada lifted their target price on shares of The Pennant Group from $26.00 to $38.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd.

Read Our Latest Report on The Pennant Group

The Pennant Group Stock Performance

PNTG traded down $0.21 on Friday, reaching $31.18. 109,004 shares of the stock were exchanged, compared to its average volume of 257,682. The Pennant Group, Inc. has a fifty-two week low of $13.24 and a fifty-two week high of $37.13. The firm has a market capitalization of $1.07 billion, a PE ratio of 45.85, a PEG ratio of 3.18 and a beta of 2.02. The company's 50-day moving average price is $33.17 and its 200 day moving average price is $29.62. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.12 and a quick ratio of 1.12.

The Pennant Group Company Profile

(

Free Report)

The Pennant Group, Inc provides healthcare services in the United States. It operates in two segments, Home Health and Hospice Services, and Senior Living Services. The company offers home health services, including clinical services, such as nursing, speech, occupational and physical therapy, medical social work, and home health aide services; and hospice services comprising clinical care, education, and counseling services for the physical, spiritual, and psychosocial needs of terminally ill patients and their families.

Recommended Stories

Before you consider The Pennant Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Pennant Group wasn't on the list.

While The Pennant Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.