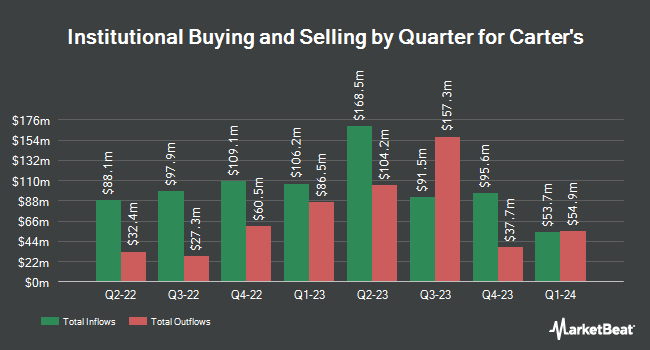

Wasatch Advisors LP lowered its stake in Carter's, Inc. (NYSE:CRI - Free Report) by 4.3% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 638,126 shares of the textile maker's stock after selling 28,749 shares during the quarter. Wasatch Advisors LP owned about 1.77% of Carter's worth $41,465,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Price T Rowe Associates Inc. MD raised its position in Carter's by 35.8% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 42,736 shares of the textile maker's stock valued at $3,619,000 after buying an additional 11,265 shares during the last quarter. Tidal Investments LLC lifted its position in shares of Carter's by 3.8% in the first quarter. Tidal Investments LLC now owns 16,884 shares of the textile maker's stock worth $1,430,000 after purchasing an additional 615 shares in the last quarter. Comerica Bank boosted its holdings in Carter's by 4.8% during the first quarter. Comerica Bank now owns 37,267 shares of the textile maker's stock worth $3,156,000 after purchasing an additional 1,702 shares during the last quarter. Swedbank AB bought a new position in Carter's in the first quarter valued at $547,000. Finally, Harbor Capital Advisors Inc. grew its position in Carter's by 345.8% in the second quarter. Harbor Capital Advisors Inc. now owns 54,785 shares of the textile maker's stock valued at $3,395,000 after purchasing an additional 42,495 shares in the last quarter.

Carter's Stock Performance

CRI traded down $0.44 during trading hours on Friday, reaching $54.57. The company's stock had a trading volume of 484,978 shares, compared to its average volume of 1,197,268. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.96 and a current ratio of 2.21. The company's 50-day moving average is $59.15 and its 200-day moving average is $62.75. Carter's, Inc. has a 52 week low of $50.27 and a 52 week high of $88.03. The firm has a market cap of $1.97 billion, a PE ratio of 8.66, a price-to-earnings-growth ratio of 3.28 and a beta of 1.24.

Carter's Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Monday, November 25th will be issued a dividend of $0.80 per share. This represents a $3.20 annualized dividend and a dividend yield of 5.86%. The ex-dividend date of this dividend is Monday, November 25th. Carter's's payout ratio is 50.79%.

Analysts Set New Price Targets

A number of equities analysts have recently commented on CRI shares. Citigroup upgraded shares of Carter's from a "sell" rating to a "neutral" rating and set a $50.00 price objective for the company in a research note on Tuesday, November 12th. Wells Fargo & Company dropped their target price on Carter's from $72.00 to $65.00 and set an "equal weight" rating on the stock in a report on Monday, October 28th. One investment analyst has rated the stock with a sell rating and seven have issued a hold rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $67.67.

View Our Latest Analysis on Carter's

Carter's Company Profile

(

Free Report)

Carter's, Inc, together with its subsidiaries, designs, sources, and markets branded childrenswear under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally. It operates through three segments: U.S.

Recommended Stories

Before you consider Carter's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carter's wasn't on the list.

While Carter's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.