Wasatch Advisors LP increased its position in shares of TransMedics Group, Inc. (NASDAQ:TMDX - Free Report) by 83.3% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 441,354 shares of the company's stock after buying an additional 200,603 shares during the period. Wasatch Advisors LP owned about 1.32% of TransMedics Group worth $27,518,000 at the end of the most recent quarter.

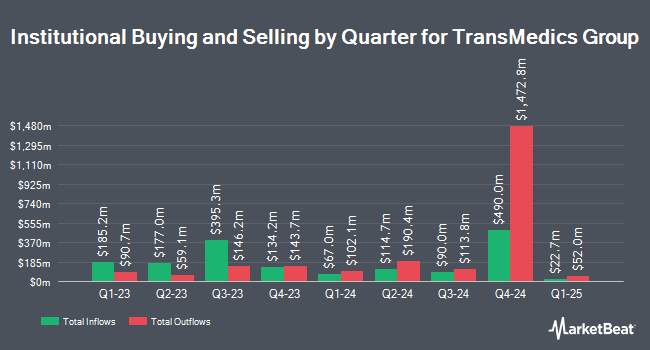

A number of other hedge funds also recently bought and sold shares of the stock. NewEdge Advisors LLC raised its position in TransMedics Group by 86.2% during the fourth quarter. NewEdge Advisors LLC now owns 24,635 shares of the company's stock worth $1,536,000 after acquiring an additional 11,406 shares during the period. Cahill Wealth Management LLC increased its stake in shares of TransMedics Group by 69.8% in the 4th quarter. Cahill Wealth Management LLC now owns 5,920 shares of the company's stock worth $369,000 after acquiring an additional 2,434 shares during the last quarter. Capital Fund Management S.A. raised its holdings in shares of TransMedics Group by 940.3% during the 4th quarter. Capital Fund Management S.A. now owns 125,880 shares of the company's stock worth $7,849,000 after acquiring an additional 113,780 shares during the period. CenterBook Partners LP purchased a new stake in shares of TransMedics Group in the fourth quarter valued at about $522,000. Finally, Raymond James Financial Inc. purchased a new position in TransMedics Group in the fourth quarter worth approximately $3,845,000. Hedge funds and other institutional investors own 99.67% of the company's stock.

Analyst Ratings Changes

Several research firms have recently issued reports on TMDX. Needham & Company LLC reaffirmed a "hold" rating on shares of TransMedics Group in a research report on Wednesday, March 26th. Canaccord Genuity Group restated a "buy" rating and set a $104.00 price target on shares of TransMedics Group in a research report on Tuesday, March 11th. Three investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $122.70.

View Our Latest Stock Report on TMDX

TransMedics Group Trading Up 3.3 %

Shares of NASDAQ:TMDX traded up $2.86 during trading on Friday, hitting $88.24. The company had a trading volume of 971,082 shares, compared to its average volume of 1,343,064. The company has a debt-to-equity ratio of 2.42, a current ratio of 8.20 and a quick ratio of 7.33. TransMedics Group, Inc. has a one year low of $55.00 and a one year high of $177.37. The stock has a market cap of $2.98 billion, a price-to-earnings ratio of 93.87 and a beta of 2.14. The company has a fifty day simple moving average of $72.48 and a two-hundred day simple moving average of $79.44.

TransMedics Group Company Profile

(

Free Report)

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

Featured Articles

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.