Wasatch Advisors LP cut its position in shares of Sangamo Therapeutics, Inc. (NASDAQ:SGMO - Free Report) by 3.2% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 19,442,368 shares of the biopharmaceutical company's stock after selling 648,202 shares during the quarter. Wasatch Advisors LP owned approximately 9.34% of Sangamo Therapeutics worth $16,839,000 at the end of the most recent quarter.

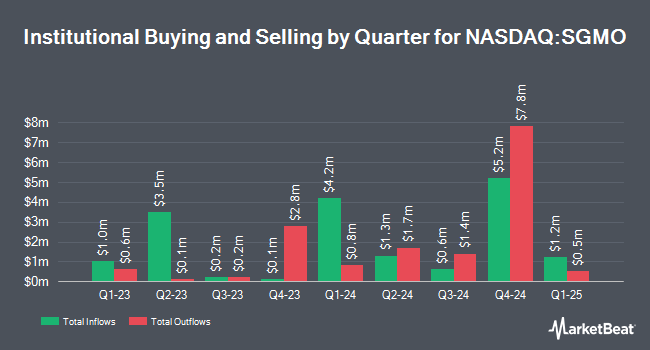

Other institutional investors have also modified their holdings of the company. Cubist Systematic Strategies LLC purchased a new position in Sangamo Therapeutics during the second quarter worth about $67,000. Meritage Portfolio Management lifted its holdings in shares of Sangamo Therapeutics by 8.6% during the 3rd quarter. Meritage Portfolio Management now owns 85,000 shares of the biopharmaceutical company's stock worth $74,000 after acquiring an additional 6,740 shares during the period. Point72 Asia Singapore Pte. Ltd. acquired a new stake in shares of Sangamo Therapeutics in the second quarter worth approximately $89,000. Wealth Enhancement Advisory Services LLC boosted its holdings in shares of Sangamo Therapeutics by 55.4% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 108,945 shares of the biopharmaceutical company's stock valued at $94,000 after purchasing an additional 38,850 shares during the last quarter. Finally, Marshall Wace LLP grew its stake in shares of Sangamo Therapeutics by 56.3% during the 2nd quarter. Marshall Wace LLP now owns 576,219 shares of the biopharmaceutical company's stock valued at $207,000 after buying an additional 207,476 shares during the period. Institutional investors and hedge funds own 56.93% of the company's stock.

Sangamo Therapeutics Price Performance

NASDAQ SGMO traded down $0.04 during trading hours on Friday, hitting $2.26. The company had a trading volume of 3,004,315 shares, compared to its average volume of 7,911,532. The firm's 50 day moving average is $1.57 and its 200 day moving average is $0.97. Sangamo Therapeutics, Inc. has a fifty-two week low of $0.30 and a fifty-two week high of $3.18. The company has a market capitalization of $471.54 million, a price-to-earnings ratio of -3.01 and a beta of 1.10.

Sangamo Therapeutics (NASDAQ:SGMO - Get Free Report) last posted its earnings results on Tuesday, November 12th. The biopharmaceutical company reported $0.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.03) by $0.07. The business had revenue of $49.41 million during the quarter, compared to analyst estimates of $26.55 million. Sangamo Therapeutics had a negative return on equity of 264.16% and a negative net margin of 257.87%. During the same quarter last year, the firm earned ($0.34) earnings per share. On average, equities analysts anticipate that Sangamo Therapeutics, Inc. will post -0.52 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research analysts recently weighed in on the company. StockNews.com upgraded Sangamo Therapeutics from a "hold" rating to a "buy" rating in a report on Thursday. HC Wainwright reaffirmed a "buy" rating and issued a $10.00 price objective on shares of Sangamo Therapeutics in a research note on Thursday, November 14th. Finally, Barclays increased their target price on shares of Sangamo Therapeutics from $3.00 to $9.00 and gave the stock an "overweight" rating in a research report on Thursday, November 14th.

Read Our Latest Analysis on Sangamo Therapeutics

About Sangamo Therapeutics

(

Free Report)

Sangamo Therapeutics, Inc, a clinical-stage genomic medicine company, focuses on translating science into medicines that transform the lives of patients and families afflicted with serious diseases in the United States. The company's clinical-stage product candidates are ST-920, a gene therapy product candidate, which is in Phase 1/2 clinical study for the treatment of Fabry disease; TX200, a chimeric antigen receptor engineered regulatory T cell (CAR-Treg) therapy product candidate that is in Phase 1/2 clinical study for the prevention of immune-mediated rejection in HLA-A2 mismatched kidney transplantation; SB-525, a gene therapy product candidate, which is in Phase 3 clinical trial for the treatment of moderately severe to severe hemophilia A; BIVV003, a zinc finger nuclease gene-edited cell therapy product candidate that is in Phase 1/2 PRECIZN-1 clinical study for the treatment of sickle cell disease.

Read More

Before you consider Sangamo Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sangamo Therapeutics wasn't on the list.

While Sangamo Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.