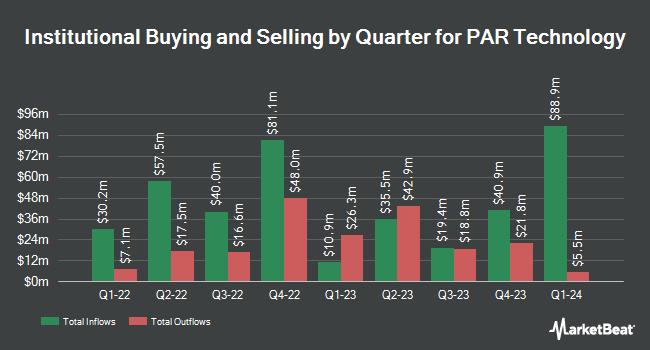

Wasatch Advisors LP trimmed its stake in PAR Technology Co. (NYSE:PAR - Free Report) by 2.5% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 361,062 shares of the software maker's stock after selling 9,445 shares during the quarter. Wasatch Advisors LP owned about 0.99% of PAR Technology worth $18,804,000 as of its most recent filing with the SEC.

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Vanguard Group Inc. raised its holdings in shares of PAR Technology by 2.4% in the 1st quarter. Vanguard Group Inc. now owns 2,159,383 shares of the software maker's stock worth $97,950,000 after purchasing an additional 50,793 shares during the period. Price T Rowe Associates Inc. MD lifted its position in PAR Technology by 14.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 7,655 shares of the software maker's stock valued at $348,000 after buying an additional 954 shares in the last quarter. Moody National Bank Trust Division purchased a new stake in PAR Technology during the second quarter worth approximately $432,000. Harbor Capital Advisors Inc. grew its stake in PAR Technology by 219.0% during the second quarter. Harbor Capital Advisors Inc. now owns 41,182 shares of the software maker's stock worth $1,939,000 after buying an additional 28,273 shares during the period. Finally, SG Americas Securities LLC increased its position in shares of PAR Technology by 36.2% in the second quarter. SG Americas Securities LLC now owns 6,670 shares of the software maker's stock worth $314,000 after acquiring an additional 1,772 shares in the last quarter.

PAR Technology Trading Up 1.3 %

Shares of PAR stock traded up $1.08 on Friday, reaching $81.14. The company had a trading volume of 364,008 shares, compared to its average volume of 635,608. PAR Technology Co. has a 12 month low of $36.16 and a 12 month high of $82.24. The company has a current ratio of 2.13, a quick ratio of 1.91 and a debt-to-equity ratio of 0.67. The stock has a market cap of $2.95 billion, a PE ratio of -324.55 and a beta of 2.14. The company has a 50-day moving average of $63.55 and a 200-day moving average of $54.51.

PAR Technology (NYSE:PAR - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The software maker reported ($0.09) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.10) by $0.01. The firm had revenue of $96.80 million for the quarter, compared to the consensus estimate of $91.01 million. PAR Technology had a negative return on equity of 8.99% and a negative net margin of 0.66%. The company's revenue for the quarter was down 9.6% on a year-over-year basis. During the same quarter last year, the business posted ($0.35) EPS. On average, equities analysts forecast that PAR Technology Co. will post -1.56 earnings per share for the current year.

Analysts Set New Price Targets

A number of brokerages have commented on PAR. Needham & Company LLC restated a "buy" rating and set a $90.00 price objective on shares of PAR Technology in a research note on Tuesday, November 26th. The Goldman Sachs Group boosted their price objective on shares of PAR Technology from $59.00 to $71.00 and gave the stock a "neutral" rating in a report on Tuesday, November 12th. Jefferies Financial Group raised PAR Technology from a "hold" rating to a "buy" rating and lifted their target price for the stock from $45.00 to $60.00 in a research report on Monday, August 12th. Stephens increased their price target on PAR Technology from $83.00 to $90.00 and gave the company an "overweight" rating in a report on Tuesday, November 26th. Finally, Craig Hallum lifted their price objective on PAR Technology from $65.00 to $85.00 and gave the stock a "buy" rating in a report on Monday, November 11th. One analyst has rated the stock with a sell rating, one has given a hold rating and eight have given a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $78.25.

Read Our Latest Report on PAR

About PAR Technology

(

Free Report)

PAR Technology Corporation, together with its subsidiaries, provides omnichannel cloud-based hardware and software solutions to the restaurant and retail industries worldwide. The Restaurant/Retail segment offers PUNCHH, an enterprise-grade customer loyalty and engagement solution; MENU, an eCommerce platform for restaurant brands; BRINK POS, an open cloud, point-of-sale solution; PAR PAYMENT SERVICES, a merchant services business that enables electronic payment and processing services for businesses; and DATA CENTRAL, a back-office solution that leverages business intelligence and automation technologies.

See Also

Before you consider PAR Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PAR Technology wasn't on the list.

While PAR Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.