Washington Harbour Partners LP raised its holdings in shares of ZoomInfo Technologies Inc. (NASDAQ:ZI - Free Report) by 17.5% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 368,700 shares of the company's stock after purchasing an additional 54,900 shares during the period. ZoomInfo Technologies accounts for approximately 6.8% of Washington Harbour Partners LP's holdings, making the stock its 5th biggest holding. Washington Harbour Partners LP owned about 0.10% of ZoomInfo Technologies worth $3,805,000 at the end of the most recent quarter.

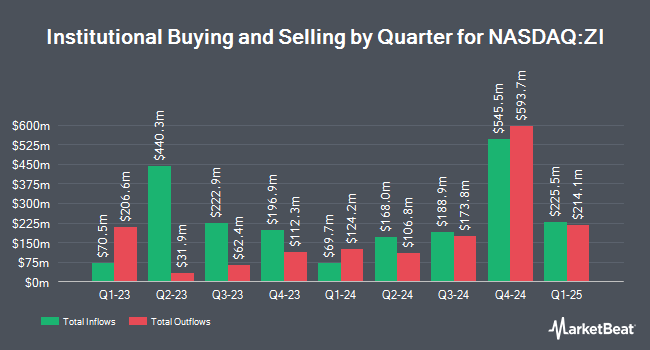

Several other institutional investors also recently modified their holdings of ZI. M&G Plc bought a new stake in shares of ZoomInfo Technologies during the second quarter worth $9,534,000. Victory Capital Management Inc. boosted its position in ZoomInfo Technologies by 83.4% during the third quarter. Victory Capital Management Inc. now owns 163,708 shares of the company's stock valued at $1,689,000 after purchasing an additional 74,455 shares during the last quarter. Versor Investments LP bought a new position in shares of ZoomInfo Technologies in the third quarter valued at $516,000. Hsbc Holdings PLC raised its position in ZoomInfo Technologies by 22.8% during the second quarter. Hsbc Holdings PLC now owns 556,425 shares of the company's stock worth $7,054,000 after acquiring an additional 103,324 shares in the last quarter. Finally, Pacer Advisors Inc. increased its stake in shares of ZoomInfo Technologies by 38.7% during the 3rd quarter. Pacer Advisors Inc. now owns 9,274,829 shares of the company's stock worth $95,716,000 after purchasing an additional 2,585,631 shares during the last quarter. Institutional investors and hedge funds own 95.47% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on ZI. Scotiabank began coverage on ZoomInfo Technologies in a report on Monday, November 18th. They set a "sector perform" rating and a $10.30 price target for the company. Daiwa Capital Markets lowered shares of ZoomInfo Technologies from an "outperform" rating to a "neutral" rating and dropped their target price for the company from $15.00 to $9.00 in a report on Tuesday, August 13th. Mizuho increased their price objective on shares of ZoomInfo Technologies from $9.00 to $11.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 13th. Piper Sandler boosted their target price on shares of ZoomInfo Technologies from $10.00 to $11.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 13th. Finally, Citigroup lifted their price target on shares of ZoomInfo Technologies from $7.00 to $8.50 and gave the stock a "sell" rating in a report on Thursday, November 14th. Four research analysts have rated the stock with a sell rating, thirteen have assigned a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $12.77.

View Our Latest Report on ZoomInfo Technologies

ZoomInfo Technologies Price Performance

ZI traded up $0.07 on Friday, hitting $11.04. 4,497,727 shares of the company's stock were exchanged, compared to its average volume of 7,105,736. The firm has a 50-day moving average price of $10.67 and a 200-day moving average price of $10.96. The stock has a market cap of $3.79 billion, a price-to-earnings ratio of 365.79, a P/E/G ratio of 14.63 and a beta of 1.02. The company has a current ratio of 0.63, a quick ratio of 0.63 and a debt-to-equity ratio of 0.73. ZoomInfo Technologies Inc. has a fifty-two week low of $7.65 and a fifty-two week high of $19.39.

Insider Buying and Selling

In other ZoomInfo Technologies news, CEO Henry Schuck bought 492,500 shares of ZoomInfo Technologies stock in a transaction on Friday, November 15th. The shares were bought at an average cost of $10.25 per share, for a total transaction of $5,048,125.00. Following the acquisition, the chief executive officer now directly owns 12,280,501 shares in the company, valued at $125,875,135.25. This represents a 4.18 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CTO Ali Dasdan sold 4,898 shares of the company's stock in a transaction dated Tuesday, December 3rd. The stock was sold at an average price of $11.01, for a total value of $53,926.98. Following the sale, the chief technology officer now owns 118,659 shares in the company, valued at approximately $1,306,435.59. This trade represents a 3.96 % decrease in their position. The disclosure for this sale can be found here. 8.10% of the stock is owned by company insiders.

ZoomInfo Technologies Profile

(

Free Report)

ZoomInfo Technologies Inc, together with its subsidiaries, provides go-to-market intelligence and engagement platform for sales and marketing teams in the United States and internationally. The company's cloud-based platform provides information on organizations and professionals to help users identify target customers and decision makers, obtain continually updated predictive lead and company scoring, monitor buying signals and other attributes of target companies, craft messages, engage through automated sales tools, and track progress through the deal cycle.

Recommended Stories

Before you consider ZoomInfo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZoomInfo Technologies wasn't on the list.

While ZoomInfo Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.