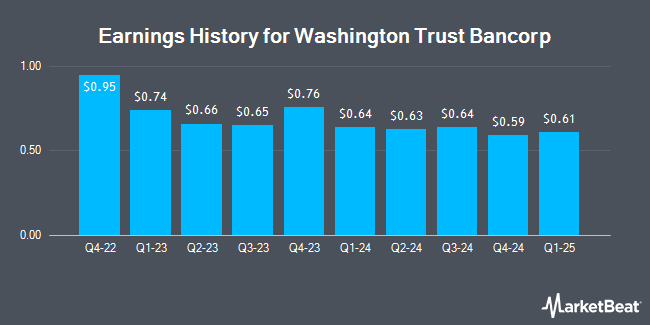

Washington Trust Bancorp (NASDAQ:WASH - Get Free Report) is expected to be announcing its earnings results before the market opens on Monday, April 21st. Analysts expect the company to announce earnings of $0.62 per share and revenue of $53.16 million for the quarter. Investors that wish to register for the company's conference call can do so using this link.

Washington Trust Bancorp (NASDAQ:WASH - Get Free Report) last announced its quarterly earnings data on Wednesday, January 29th. The financial services provider reported $0.59 earnings per share for the quarter, topping the consensus estimate of $0.57 by $0.02. Washington Trust Bancorp had a positive return on equity of 8.99% and a negative net margin of 6.90%. On average, analysts expect Washington Trust Bancorp to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Washington Trust Bancorp Stock Performance

WASH stock traded up $0.08 during midday trading on Friday, hitting $27.21. The stock had a trading volume of 154,537 shares, compared to its average volume of 142,298. Washington Trust Bancorp has a 52 week low of $24.44 and a 52 week high of $40.59. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 2.63. The stock has a 50-day simple moving average of $29.99 and a 200 day simple moving average of $32.56. The firm has a market capitalization of $524.50 million, a price-to-earnings ratio of -17.55 and a beta of 0.76.

Washington Trust Bancorp Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, April 11th. Stockholders of record on Tuesday, April 1st were given a dividend of $0.56 per share. The ex-dividend date was Tuesday, April 1st. This represents a $2.24 annualized dividend and a dividend yield of 8.23%. Washington Trust Bancorp's dividend payout ratio (DPR) is currently -144.52%.

Wall Street Analysts Forecast Growth

WASH has been the subject of a number of analyst reports. StockNews.com upgraded shares of Washington Trust Bancorp from a "sell" rating to a "hold" rating in a research note on Friday, January 31st. Seaport Res Ptn upgraded Washington Trust Bancorp from a "hold" rating to a "strong-buy" rating in a research report on Friday, March 14th.

View Our Latest Report on WASH

Washington Trust Bancorp Company Profile

(

Get Free Report)

Washington Trust Bancorp, Inc operates as the bank holding company for The Washington Trust Company, of Westerly that provides various banking and financial services to individuals and businesses. The company operates in two segments, Commercial Banking and Wealth Management Services. The Commercial Banking segment offers deposit accounts, including interest-bearing and noninterest-bearing demand deposits, NOW and savings accounts, money market and retirement deposit accounts, and time deposits; various commercial and retail lending products, such as commercial real estate loans, including commercial mortgages, and construction and development loans; commercial and industrial loans comprising working capital, equipment financing, and financing for other business-related purposes; residential real estate loans that consist of mortgage and homeowner construction loans; and consumer loans comprising home equity loans and lines of credit, personal installment loans, and loans to individuals secured by general aviation aircraft.

Read More

Before you consider Washington Trust Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Washington Trust Bancorp wasn't on the list.

While Washington Trust Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.