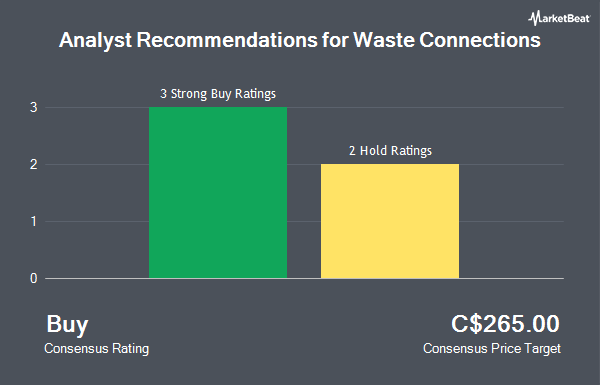

Waste Connections, Inc. (TSE:WCN - Get Free Report) has earned a consensus rating of "Hold" from the six analysts that are currently covering the firm, MarketBeat Ratings reports. Four investment analysts have rated the stock with a hold rating and two have given a buy rating to the company. The average 1 year price objective among analysts that have issued a report on the stock in the last year is C$205.10.

Several research analysts have weighed in on the stock. ATB Capital upped their target price on shares of Waste Connections from C$255.00 to C$260.00 in a research report on Friday, October 25th. Scotiabank upgraded shares of Waste Connections to a "hold" rating in a research report on Friday, October 4th. Finally, Eight Capital set a C$270.00 target price on shares of Waste Connections and gave the company a "neutral" rating in a report on Wednesday, October 9th.

Get Our Latest Report on Waste Connections

Insider Buying and Selling

In related news, Senior Officer Robert Andres Nielsen sold 1,000 shares of the firm's stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of C$260.63, for a total value of C$260,625.00. Also, Director Edward E. Guillet sold 8,000 shares of the company's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of C$249.52, for a total transaction of C$1,996,164.00. Over the last 90 days, insiders have sold 9,571 shares of company stock worth $2,400,841. 0.21% of the stock is owned by insiders.

Waste Connections Stock Performance

Shares of WCN stock traded up C$1.47 during midday trading on Thursday, hitting C$272.30. The company had a trading volume of 19,894 shares, compared to its average volume of 235,538. The company has a debt-to-equity ratio of 100.60, a current ratio of 0.70 and a quick ratio of 0.74. The company's 50 day simple moving average is C$250.96 and its 200 day simple moving average is C$243.90. The stock has a market cap of C$70.25 billion, a price-to-earnings ratio of 60.05, a PEG ratio of 2.22 and a beta of 0.72. Waste Connections has a 52-week low of C$179.67 and a 52-week high of C$273.51.

Waste Connections Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, November 21st. Stockholders of record on Thursday, November 7th were given a $0.426 dividend. This represents a $1.70 dividend on an annualized basis and a dividend yield of 0.63%. The ex-dividend date was Thursday, November 7th. This is a positive change from Waste Connections's previous quarterly dividend of $0.39. Waste Connections's payout ratio is currently 34.37%.

About Waste Connections

(

Get Free ReportWaste Connections, Inc provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada. It offers collection services to residential, commercial, municipal, industrial, and exploration and production (E&P) customers; landfill disposal services; and recycling services for various recyclable materials, including compost, cardboard, mixed paper, plastic containers, glass bottles, and ferrous and aluminum metals.

Recommended Stories

Before you consider Waste Connections, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Connections wasn't on the list.

While Waste Connections currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.