Waystar (NASDAQ:WAY - Get Free Report) had its target price lifted by equities researchers at Royal Bank of Canada from $31.00 to $34.00 in a report issued on Thursday,Benzinga reports. The firm currently has an "outperform" rating on the stock. Royal Bank of Canada's target price would indicate a potential upside of 6.22% from the stock's current price.

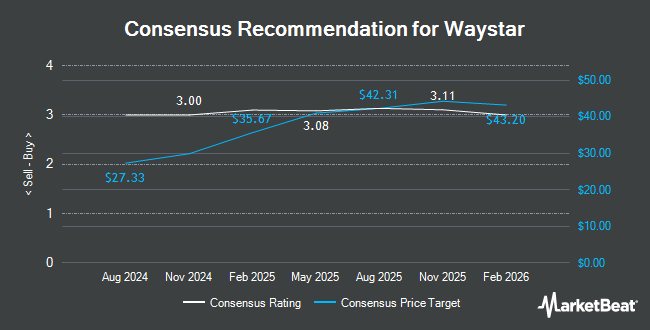

WAY has been the subject of a number of other research reports. JPMorgan Chase & Co. upped their price target on shares of Waystar from $24.00 to $27.00 and gave the stock an "overweight" rating in a report on Monday, August 19th. Evercore ISI upped their price objective on Waystar from $32.00 to $36.00 and gave the stock an "outperform" rating in a research report on Thursday. Bank of America boosted their target price on Waystar from $27.00 to $32.00 and gave the stock a "buy" rating in a research note on Monday, October 14th. Deutsche Bank Aktiengesellschaft raised their price target on shares of Waystar from $27.00 to $31.00 and gave the company a "buy" rating in a research note on Wednesday, August 14th. Finally, The Goldman Sachs Group boosted their target price on shares of Waystar from $34.00 to $39.00 and gave the stock a "buy" rating in a research note on Thursday. Eleven equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock currently has an average rating of "Buy" and an average target price of $31.90.

Get Our Latest Stock Analysis on WAY

Waystar Stock Performance

Shares of NASDAQ WAY traded up $2.57 during mid-day trading on Thursday, reaching $32.01. 3,163,107 shares of the company were exchanged, compared to its average volume of 851,863. The company has a debt-to-equity ratio of 0.46, a quick ratio of 2.15 and a current ratio of 2.15. Waystar has a twelve month low of $20.26 and a twelve month high of $33.25. The firm's 50-day moving average is $27.47.

Waystar (NASDAQ:WAY - Get Free Report) last announced its earnings results on Wednesday, August 7th. The company reported $0.04 EPS for the quarter, topping the consensus estimate of ($0.01) by $0.05. The business had revenue of $234.50 million for the quarter, compared to the consensus estimate of $216.25 million. The firm's revenue for the quarter was up 19.6% compared to the same quarter last year. During the same period in the prior year, the business posted ($0.07) earnings per share. On average, sell-side analysts anticipate that Waystar will post -0.08 EPS for the current year.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the stock. Amalgamated Bank purchased a new stake in Waystar in the 3rd quarter valued at about $41,000. RiverPark Advisors LLC bought a new stake in Waystar during the third quarter worth $78,000. Cubist Systematic Strategies LLC purchased a new position in Waystar in the second quarter worth $145,000. Scientech Research LLC bought a new position in Waystar in the 2nd quarter valued at $289,000. Finally, Federated Hermes Inc. purchased a new stake in shares of Waystar during the 2nd quarter valued at $430,000.

Waystar Company Profile

(

Get Free Report)

Waystar Holding Corp. is a software company which provide healthcare payments. Waystar Holding Corp. is based in LEHI, Utah.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Waystar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waystar wasn't on the list.

While Waystar currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.