WCM Investment Management LLC increased its stake in Addus HomeCare Co. (NASDAQ:ADUS - Free Report) by 2.9% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 498,279 shares of the company's stock after purchasing an additional 13,938 shares during the period. WCM Investment Management LLC owned 2.75% of Addus HomeCare worth $65,250,000 as of its most recent filing with the Securities & Exchange Commission.

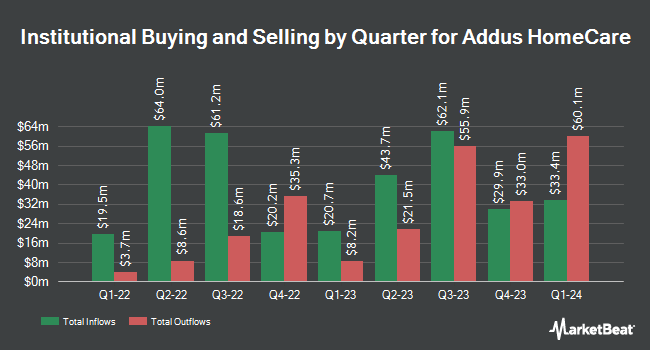

Other institutional investors also recently bought and sold shares of the company. Ellsworth Advisors LLC purchased a new position in Addus HomeCare during the 2nd quarter worth approximately $598,000. Quadrature Capital Ltd purchased a new position in Addus HomeCare during the 1st quarter worth approximately $1,557,000. Lord Abbett & CO. LLC purchased a new position in shares of Addus HomeCare during the 1st quarter valued at approximately $8,274,000. SG Americas Securities LLC purchased a new position in shares of Addus HomeCare during the 2nd quarter valued at approximately $842,000. Finally, Quantbot Technologies LP purchased a new position in shares of Addus HomeCare during the 1st quarter valued at approximately $715,000. 95.35% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Addus HomeCare

In related news, Director Esteban Lopez sold 500 shares of the stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $130.03, for a total value of $65,015.00. Following the completion of the transaction, the director now directly owns 3,866 shares in the company, valued at approximately $502,695.98. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, EVP Michael D. Wattenbarger sold 21,917 shares of the company's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $133.29, for a total value of $2,921,316.93. Following the transaction, the executive vice president now directly owns 7,215 shares in the company, valued at approximately $961,687.35. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Esteban Lopez sold 500 shares of Addus HomeCare stock in a transaction that occurred on Wednesday, September 4th. The shares were sold at an average price of $130.03, for a total transaction of $65,015.00. Following the completion of the sale, the director now owns 3,866 shares of the company's stock, valued at $502,695.98. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 22,917 shares of company stock worth $3,050,082 in the last 90 days. Insiders own 4.60% of the company's stock.

Analysts Set New Price Targets

ADUS has been the subject of several recent research reports. TD Cowen lifted their target price on shares of Addus HomeCare from $128.00 to $137.00 and gave the company a "buy" rating in a report on Thursday, August 8th. Royal Bank of Canada cut their target price on shares of Addus HomeCare from $141.00 to $136.00 and set an "outperform" rating for the company in a report on Wednesday, November 6th. Stephens lifted their target price on shares of Addus HomeCare from $143.00 to $145.00 and gave the company an "overweight" rating in a report on Wednesday, November 6th. Oppenheimer lifted their target price on shares of Addus HomeCare from $140.00 to $145.00 and gave the company an "outperform" rating in a report on Monday, September 23rd. Finally, KeyCorp started coverage on shares of Addus HomeCare in a report on Friday, October 11th. They set an "overweight" rating and a $150.00 target price for the company. One research analyst has rated the stock with a sell rating, eight have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, Addus HomeCare has a consensus rating of "Moderate Buy" and an average target price of $131.63.

View Our Latest Report on Addus HomeCare

Addus HomeCare Trading Up 0.3 %

ADUS traded up $0.37 on Monday, hitting $127.95. 79,586 shares of the company's stock were exchanged, compared to its average volume of 130,649. Addus HomeCare Co. has a fifty-two week low of $81.67 and a fifty-two week high of $136.12. The firm has a 50-day moving average price of $129.50 and a 200-day moving average price of $121.83. The stock has a market cap of $2.32 billion, a price-to-earnings ratio of 29.28, a P/E/G ratio of 2.23 and a beta of 1.04.

Addus HomeCare (NASDAQ:ADUS - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported $1.30 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.28 by $0.02. The firm had revenue of $289.80 million during the quarter, compared to analysts' expectations of $289.42 million. Addus HomeCare had a net margin of 6.50% and a return on equity of 9.62%. Addus HomeCare's revenue was up 7.1% compared to the same quarter last year. During the same period last year, the business earned $1.03 earnings per share. On average, equities analysts predict that Addus HomeCare Co. will post 4.58 EPS for the current year.

Addus HomeCare Company Profile

(

Free Report)

Addus HomeCare Corporation, together with its subsidiaries, provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States. The company operates through three segments: Personal Care, Hospice, and Home Health.

See Also

Before you consider Addus HomeCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Addus HomeCare wasn't on the list.

While Addus HomeCare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.