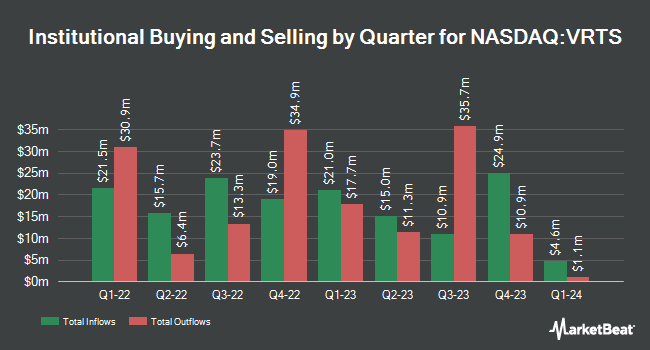

WCM Investment Management LLC lifted its position in shares of Virtus Investment Partners, Inc. (NASDAQ:VRTS - Free Report) by 4.0% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 113,892 shares of the closed-end fund's stock after purchasing an additional 4,359 shares during the quarter. WCM Investment Management LLC owned 1.61% of Virtus Investment Partners worth $23,670,000 at the end of the most recent reporting period.

Other institutional investors also recently modified their holdings of the company. Blue Trust Inc. raised its position in shares of Virtus Investment Partners by 6,550.0% during the second quarter. Blue Trust Inc. now owns 133 shares of the closed-end fund's stock worth $33,000 after purchasing an additional 131 shares during the period. Point72 Asia Singapore Pte. Ltd. bought a new stake in Virtus Investment Partners during the second quarter worth $42,000. nVerses Capital LLC bought a new stake in Virtus Investment Partners during the third quarter worth $42,000. Bessemer Group Inc. bought a new stake in Virtus Investment Partners during the first quarter worth $57,000. Finally, EntryPoint Capital LLC grew its holdings in Virtus Investment Partners by 625.6% during the first quarter. EntryPoint Capital LLC now owns 312 shares of the closed-end fund's stock worth $77,000 after buying an additional 269 shares in the last quarter. 80.52% of the stock is owned by institutional investors and hedge funds.

Virtus Investment Partners Stock Performance

NASDAQ:VRTS traded up $7.40 during trading on Monday, reaching $244.05. The company's stock had a trading volume of 27,585 shares, compared to its average volume of 43,359. The firm has a market cap of $1.73 billion, a price-to-earnings ratio of 14.84 and a beta of 1.45. The company has a debt-to-equity ratio of 0.28, a quick ratio of 15.18 and a current ratio of 15.18. The firm has a 50 day moving average of $211.97 and a 200-day moving average of $218.66. Virtus Investment Partners, Inc. has a 12 month low of $190.42 and a 12 month high of $263.39.

Virtus Investment Partners Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, November 13th. Stockholders of record on Thursday, October 31st will be paid a dividend of $2.25 per share. This is an increase from Virtus Investment Partners's previous quarterly dividend of $1.90. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $9.00 annualized dividend and a dividend yield of 3.69%. Virtus Investment Partners's dividend payout ratio is presently 54.71%.

Analysts Set New Price Targets

Several brokerages recently issued reports on VRTS. Morgan Stanley upped their price target on Virtus Investment Partners from $208.00 to $217.00 and gave the stock an "underweight" rating in a report on Friday, October 18th. Barclays initiated coverage on Virtus Investment Partners in a research note on Tuesday, August 27th. They issued an "underweight" rating and a $206.00 price objective for the company. Two research analysts have rated the stock with a sell rating, two have issued a hold rating and one has given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $233.50.

Get Our Latest Stock Report on Virtus Investment Partners

Virtus Investment Partners Company Profile

(

Free Report)

Virtus Investment Partners, Inc is a publicly owned investment manager. The firm primarily provides its services to individual and institutional clients. It launches separate client focused equity and fixed income portfolios. The firm launches equity, fixed income, and balanced mutual funds for its clients.

See Also

Before you consider Virtus Investment Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtus Investment Partners wasn't on the list.

While Virtus Investment Partners currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.