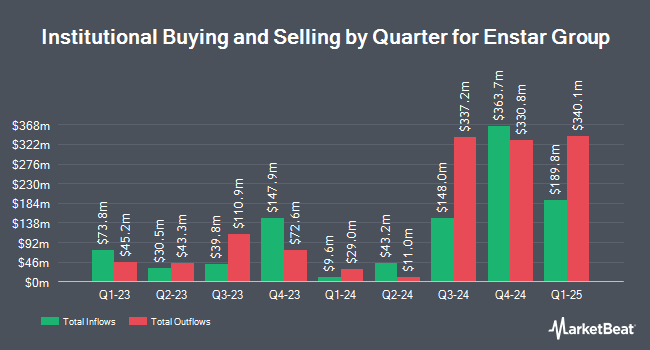

WCM Investment Management LLC trimmed its position in Enstar Group Limited (NASDAQ:ESGR - Free Report) by 20.4% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 99,572 shares of the insurance provider's stock after selling 25,536 shares during the period. WCM Investment Management LLC owned about 0.65% of Enstar Group worth $31,968,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Janus Henderson Group PLC lifted its holdings in Enstar Group by 87.4% in the 1st quarter. Janus Henderson Group PLC now owns 9,834 shares of the insurance provider's stock valued at $3,054,000 after purchasing an additional 4,586 shares in the last quarter. Swiss National Bank increased its stake in shares of Enstar Group by 8.6% during the 1st quarter. Swiss National Bank now owns 24,000 shares of the insurance provider's stock valued at $7,458,000 after acquiring an additional 1,900 shares during the last quarter. BNP Paribas Financial Markets increased its stake in shares of Enstar Group by 48.6% during the 1st quarter. BNP Paribas Financial Markets now owns 8,294 shares of the insurance provider's stock valued at $2,577,000 after acquiring an additional 2,713 shares during the last quarter. Russell Investments Group Ltd. increased its stake in shares of Enstar Group by 759.1% during the 1st quarter. Russell Investments Group Ltd. now owns 6,383 shares of the insurance provider's stock valued at $1,984,000 after acquiring an additional 5,640 shares during the last quarter. Finally, Sequoia Financial Advisors LLC increased its stake in shares of Enstar Group by 640.8% during the 3rd quarter. Sequoia Financial Advisors LLC now owns 26,313 shares of the insurance provider's stock valued at $8,462,000 after acquiring an additional 22,761 shares during the last quarter. 81.01% of the stock is currently owned by hedge funds and other institutional investors.

Enstar Group Trading Down 0.3 %

ESGR traded down $1.06 on Monday, reaching $323.94. 43,530 shares of the company's stock were exchanged, compared to its average volume of 74,779. The company's 50 day moving average is $322.01 and its 200-day moving average is $317.58. The company has a market cap of $4.93 billion, a price-to-earnings ratio of 5.52 and a beta of 0.65. Enstar Group Limited has a twelve month low of $249.24 and a twelve month high of $348.48. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.31 and a current ratio of 0.31.

Analyst Upgrades and Downgrades

Separately, StockNews.com initiated coverage on shares of Enstar Group in a research note on Monday, November 4th. They set a "hold" rating for the company.

Read Our Latest Report on Enstar Group

Enstar Group Company Profile

(

Free Report)

Enstar Group Limited acquires and manages insurance and reinsurance companies and portfolios in run-off in Bermuda and internationally. It engages in the run-off property and casualty; other reinsurance; life and catastrophe; and legacy underwriting businesses; as well as investment activities. The company also provides consulting services, including claims inspection, claims validation, reinsurance asset collection, syndicate management, and IT consulting services to the insurance and reinsurance industry.

Read More

Before you consider Enstar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enstar Group wasn't on the list.

While Enstar Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.