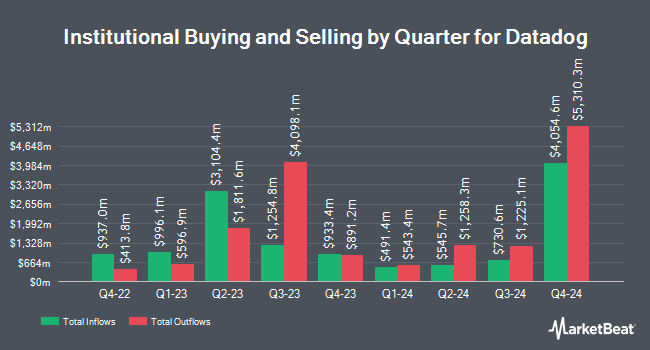

WCM Investment Management LLC decreased its position in Datadog, Inc. (NASDAQ:DDOG - Free Report) by 18.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 4,362,298 shares of the company's stock after selling 1,000,278 shares during the quarter. WCM Investment Management LLC owned 1.29% of Datadog worth $498,174,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. Kodai Capital Management LP purchased a new position in Datadog during the 1st quarter valued at about $116,054,000. DNB Asset Management AS boosted its stake in shares of Datadog by 1,974.5% in the second quarter. DNB Asset Management AS now owns 847,600 shares of the company's stock valued at $109,925,000 after purchasing an additional 806,741 shares during the period. Thrivent Financial for Lutherans grew its holdings in shares of Datadog by 1,597.9% in the second quarter. Thrivent Financial for Lutherans now owns 785,261 shares of the company's stock valued at $101,841,000 after purchasing an additional 739,011 shares in the last quarter. Bank of Montreal Can increased its stake in Datadog by 129.2% during the 2nd quarter. Bank of Montreal Can now owns 610,977 shares of the company's stock worth $79,384,000 after buying an additional 344,431 shares during the period. Finally, Massachusetts Financial Services Co. MA lifted its holdings in Datadog by 9.2% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 3,944,943 shares of the company's stock worth $511,620,000 after buying an additional 331,808 shares in the last quarter. 78.29% of the stock is currently owned by institutional investors and hedge funds.

Datadog Price Performance

Shares of NASDAQ:DDOG traded down $2.09 on Monday, reaching $122.36. The company's stock had a trading volume of 5,550,184 shares, compared to its average volume of 3,804,755. Datadog, Inc. has a 52-week low of $98.80 and a 52-week high of $138.61. The stock's 50-day moving average is $119.67 and its two-hundred day moving average is $119.48. The stock has a market capitalization of $41.25 billion, a P/E ratio of 230.87, a PEG ratio of 22.72 and a beta of 1.10.

Datadog (NASDAQ:DDOG - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported $0.43 earnings per share for the quarter, topping analysts' consensus estimates of $0.37 by $0.06. Datadog had a return on equity of 9.85% and a net margin of 7.58%. The company had revenue of $645.28 million during the quarter, compared to analysts' expectations of $624.92 million. During the same period last year, the firm earned $0.36 EPS. The firm's revenue for the quarter was up 26.7% on a year-over-year basis. Equities analysts forecast that Datadog, Inc. will post 0.42 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Datadog news, CTO Alexis Le-Quoc sold 127,105 shares of the business's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $129.33, for a total value of $16,438,489.65. Following the transaction, the chief technology officer now directly owns 336,165 shares of the company's stock, valued at approximately $43,476,219.45. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, CRO Sean Michael Walters sold 2,322 shares of Datadog stock in a transaction that occurred on Tuesday, October 8th. The stock was sold at an average price of $125.00, for a total value of $290,250.00. Following the sale, the executive now directly owns 183,512 shares in the company, valued at $22,939,000. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CTO Alexis Le-Quoc sold 127,105 shares of the company's stock in a transaction on Monday, October 14th. The stock was sold at an average price of $129.33, for a total value of $16,438,489.65. Following the transaction, the chief technology officer now directly owns 336,165 shares in the company, valued at $43,476,219.45. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 317,186 shares of company stock valued at $39,962,314 over the last three months. 11.78% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

DDOG has been the topic of a number of recent research reports. Monness Crespi & Hardt raised Datadog from a "neutral" rating to a "buy" rating and set a $155.00 price objective on the stock in a research report on Thursday. Needham & Company LLC reduced their price target on Datadog from $165.00 to $140.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. UBS Group reissued an "underperform" rating on shares of Datadog in a research report on Friday, October 18th. Citigroup upped their target price on shares of Datadog from $150.00 to $157.00 and gave the stock a "buy" rating in a research note on Friday. Finally, Cantor Fitzgerald reiterated an "overweight" rating and set a $150.00 price target on shares of Datadog in a report on Monday, July 22nd. One analyst has rated the stock with a sell rating, one has issued a hold rating, twenty-five have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $150.96.

View Our Latest Report on DDOG

Datadog Company Profile

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Stories

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report