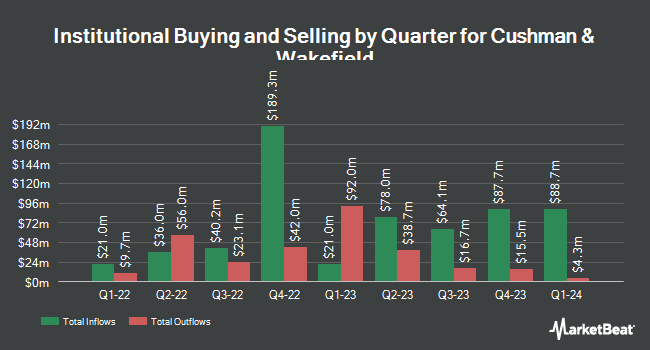

WCM Investment Management LLC grew its position in Cushman & Wakefield plc (NYSE:CWK - Free Report) by 3.4% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 2,534,105 shares of the company's stock after acquiring an additional 84,002 shares during the quarter. WCM Investment Management LLC owned about 1.11% of Cushman & Wakefield worth $34,591,000 at the end of the most recent reporting period.

Other large investors have also modified their holdings of the company. SummerHaven Investment Management LLC lifted its holdings in shares of Cushman & Wakefield by 1.8% during the second quarter. SummerHaven Investment Management LLC now owns 79,929 shares of the company's stock worth $831,000 after purchasing an additional 1,395 shares during the period. Handelsbanken Fonder AB lifted its holdings in shares of Cushman & Wakefield by 6.5% during the third quarter. Handelsbanken Fonder AB now owns 24,500 shares of the company's stock worth $334,000 after purchasing an additional 1,500 shares during the period. GAMMA Investing LLC lifted its holdings in shares of Cushman & Wakefield by 45.8% during the third quarter. GAMMA Investing LLC now owns 5,186 shares of the company's stock worth $71,000 after purchasing an additional 1,629 shares during the period. Blue Trust Inc. lifted its holdings in shares of Cushman & Wakefield by 137.5% during the third quarter. Blue Trust Inc. now owns 3,501 shares of the company's stock worth $48,000 after purchasing an additional 2,027 shares during the period. Finally, CWM LLC lifted its holdings in shares of Cushman & Wakefield by 61.4% during the second quarter. CWM LLC now owns 5,468 shares of the company's stock worth $57,000 after purchasing an additional 2,080 shares during the period. 95.56% of the stock is owned by institutional investors and hedge funds.

Cushman & Wakefield Price Performance

Shares of CWK stock traded up $0.17 during mid-day trading on Monday, reaching $15.09. The stock had a trading volume of 1,275,577 shares, compared to its average volume of 2,219,246. Cushman & Wakefield plc has a 12-month low of $7.28 and a 12-month high of $16.11. The company has a market cap of $3.46 billion, a P/E ratio of 40.76 and a beta of 1.30. The business has a 50-day simple moving average of $13.24 and a 200 day simple moving average of $12.04. The company has a current ratio of 1.18, a quick ratio of 1.21 and a debt-to-equity ratio of 1.76.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The company reported $0.23 EPS for the quarter, beating analysts' consensus estimates of $0.21 by $0.02. The business had revenue of $2.34 billion for the quarter, compared to analyst estimates of $1.61 billion. Cushman & Wakefield had a return on equity of 12.10% and a net margin of 0.94%. The business's revenue for the quarter was up 2.5% compared to the same quarter last year. During the same quarter last year, the company earned $0.21 earnings per share. On average, sell-side analysts anticipate that Cushman & Wakefield plc will post 0.86 earnings per share for the current year.

Analysts Set New Price Targets

CWK has been the subject of several research analyst reports. JPMorgan Chase & Co. increased their price objective on Cushman & Wakefield from $12.00 to $14.00 and gave the stock a "neutral" rating in a research report on Tuesday, July 30th. Raymond James increased their price objective on Cushman & Wakefield from $14.00 to $16.00 and gave the stock an "outperform" rating in a research report on Thursday, July 25th. Three analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $12.80.

Get Our Latest Stock Analysis on CWK

About Cushman & Wakefield

(

Free Report)

Cushman & Wakefield plc, together with its subsidiaries, provides commercial real estate services under the Cushman & Wakefield brand in the United States, Australia, the United Kingdom, and internationally. The company operates through Americas; Europe, Middle East and Africa; and Asia Pacific segments.

Featured Articles

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.