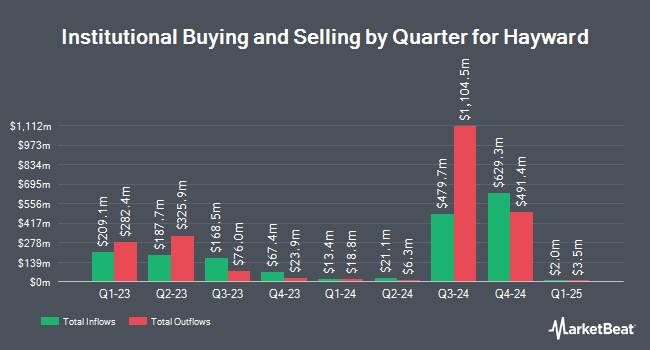

WCM Investment Management LLC lowered its stake in Hayward Holdings, Inc. (NYSE:HAYW - Free Report) by 3.2% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 1,976,720 shares of the company's stock after selling 64,678 shares during the quarter. WCM Investment Management LLC owned approximately 0.92% of Hayward worth $30,204,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also added to or reduced their stakes in HAYW. Lecap Asset Management Ltd. acquired a new stake in shares of Hayward in the fourth quarter valued at about $665,000. Choreo LLC boosted its holdings in Hayward by 3.9% in the fourth quarter. Choreo LLC now owns 29,741 shares of the company's stock valued at $454,000 after acquiring an additional 1,107 shares during the last quarter. Jennison Associates LLC increased its position in Hayward by 6.3% during the 4th quarter. Jennison Associates LLC now owns 3,380,867 shares of the company's stock valued at $51,693,000 after purchasing an additional 201,116 shares during the period. Pacer Advisors Inc. raised its holdings in Hayward by 25.4% during the 4th quarter. Pacer Advisors Inc. now owns 10,196 shares of the company's stock worth $156,000 after purchasing an additional 2,062 shares during the last quarter. Finally, KBC Group NV raised its holdings in Hayward by 56.2% during the 4th quarter. KBC Group NV now owns 6,343 shares of the company's stock worth $97,000 after purchasing an additional 2,283 shares during the last quarter.

Hayward Stock Down 1.7 %

Hayward stock traded down $0.25 during midday trading on Wednesday, hitting $14.10. 1,753,941 shares of the stock were exchanged, compared to its average volume of 1,508,259. The company has a quick ratio of 1.69, a current ratio of 2.62 and a debt-to-equity ratio of 0.70. The stock has a market capitalization of $3.04 billion, a price-to-earnings ratio of 33.57, a price-to-earnings-growth ratio of 1.90 and a beta of 1.16. Hayward Holdings, Inc. has a 52-week low of $11.96 and a 52-week high of $16.87. The business's 50-day moving average price is $15.19 and its 200-day moving average price is $15.06.

Insiders Place Their Bets

In other news, CEO Kevin Holleran sold 50,000 shares of the business's stock in a transaction on Monday, February 3rd. The shares were sold at an average price of $14.52, for a total transaction of $726,000.00. Following the completion of the transaction, the chief executive officer now directly owns 522,799 shares in the company, valued at $7,591,041.48. The trade was a 8.73 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 3.25% of the company's stock.

Analysts Set New Price Targets

HAYW has been the subject of several research analyst reports. Robert W. Baird lifted their price objective on Hayward from $19.00 to $20.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 30th. Stifel Nicolaus raised Hayward from a "hold" rating to a "buy" rating and set a $16.50 target price on the stock in a research report on Wednesday, February 5th. The Goldman Sachs Group raised their target price on Hayward from $14.00 to $16.00 and gave the company a "neutral" rating in a report on Wednesday, October 30th. Finally, KeyCorp reiterated a "sector weight" rating on shares of Hayward in a report on Monday, January 6th.

Get Our Latest Research Report on Hayward

About Hayward

(

Free Report)

Hayward Holdings, Inc designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally. The company offers pool equipment, including pumps, filters, robotics, suction and pressure cleaners, gas heaters and heat pumps, water features and landscape lighting, water sanitizers, salt chlorine generators, safety equipment, and in-floor automated cleaning systems, as well as LED illumination solutions.

Featured Stories

Before you consider Hayward, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hayward wasn't on the list.

While Hayward currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.