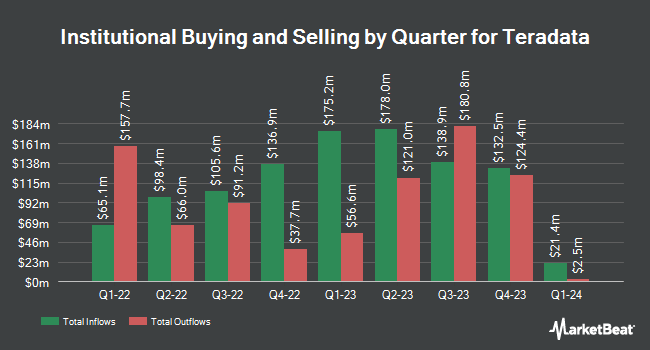

Wealth Enhancement Advisory Services LLC purchased a new stake in Teradata Co. (NYSE:TDC - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 19,928 shares of the technology company's stock, valued at approximately $605,000.

Other institutional investors and hedge funds have also modified their holdings of the company. Crewe Advisors LLC bought a new stake in shares of Teradata in the second quarter valued at about $26,000. GAMMA Investing LLC lifted its position in shares of Teradata by 88.0% in the 3rd quarter. GAMMA Investing LLC now owns 955 shares of the technology company's stock worth $29,000 after acquiring an additional 447 shares during the period. Hexagon Capital Partners LLC lifted its position in shares of Teradata by 111.4% in the 2nd quarter. Hexagon Capital Partners LLC now owns 962 shares of the technology company's stock worth $33,000 after acquiring an additional 507 shares during the period. Allworth Financial LP grew its holdings in shares of Teradata by 75.2% during the 3rd quarter. Allworth Financial LP now owns 1,326 shares of the technology company's stock worth $40,000 after purchasing an additional 569 shares in the last quarter. Finally, International Assets Investment Management LLC increased its position in shares of Teradata by 2,934.1% during the third quarter. International Assets Investment Management LLC now owns 1,335 shares of the technology company's stock valued at $44,000 after purchasing an additional 1,291 shares during the period. 90.31% of the stock is currently owned by institutional investors and hedge funds.

Teradata Trading Up 1.9 %

NYSE TDC traded up $0.57 during trading on Friday, reaching $29.88. 1,570,719 shares of the stock traded hands, compared to its average volume of 950,930. Teradata Co. has a fifty-two week low of $24.02 and a fifty-two week high of $49.44. The company has a quick ratio of 0.72, a current ratio of 0.80 and a debt-to-equity ratio of 4.01. The firm has a market cap of $2.86 billion, a price-to-earnings ratio of 34.88, a price-to-earnings-growth ratio of 1.76 and a beta of 0.80. The stock's 50-day moving average price is $30.12 and its 200 day moving average price is $31.61.

Teradata (NYSE:TDC - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The technology company reported $0.69 EPS for the quarter, topping analysts' consensus estimates of $0.56 by $0.13. The company had revenue of $440.00 million for the quarter, compared to analyst estimates of $417.71 million. Teradata had a return on equity of 145.40% and a net margin of 4.56%. Teradata's revenue was up .5% compared to the same quarter last year. During the same quarter last year, the firm posted $0.14 earnings per share. Analysts predict that Teradata Co. will post 2.32 EPS for the current year.

Insider Buying and Selling

In related news, insider Hillary Ashton sold 14,962 shares of the stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $27.53, for a total transaction of $411,903.86. Following the completion of the transaction, the insider now directly owns 121,382 shares in the company, valued at approximately $3,341,646.46. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, insider Hillary Ashton sold 14,962 shares of the business's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $27.53, for a total value of $411,903.86. Following the sale, the insider now owns 121,382 shares of the company's stock, valued at $3,341,646.46. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, insider Margaret A. Treese sold 5,500 shares of the firm's stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $28.50, for a total transaction of $156,750.00. Following the completion of the transaction, the insider now directly owns 96,783 shares of the company's stock, valued at approximately $2,758,315.50. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.92% of the company's stock.

Wall Street Analysts Forecast Growth

TDC has been the topic of a number of recent research reports. Northland Securities decreased their price target on shares of Teradata from $38.00 to $37.00 and set an "outperform" rating on the stock in a research note on Tuesday. StockNews.com raised shares of Teradata from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, August 6th. Evercore ISI lifted their price objective on Teradata from $34.00 to $37.00 and gave the company an "outperform" rating in a report on Tuesday, October 15th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $32.00 price objective on shares of Teradata in a research note on Tuesday. Finally, JMP Securities downgraded Teradata from an "outperform" rating to a "market perform" rating in a research report on Tuesday, August 6th. Three analysts have rated the stock with a sell rating, four have given a hold rating, four have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, Teradata has a consensus rating of "Hold" and a consensus target price of $39.91.

Get Our Latest Stock Report on Teradata

Teradata Company Profile

(

Free Report)

Teradata Corporation, together with its subsidiaries, provides a connected multi-cloud data platform for enterprise analytics. The company offers Teradata Vantage, an open and connected platform designed to leverage data across an enterprise. Its business consulting services include support services for organizations to establish a data and analytic vision, enable a multi-cloud ecosystem architecture, and identify and operationalize analytical opportunities, as well as to ensure the analytical infrastructure delivers value.

Recommended Stories

Before you consider Teradata, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradata wasn't on the list.

While Teradata currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.