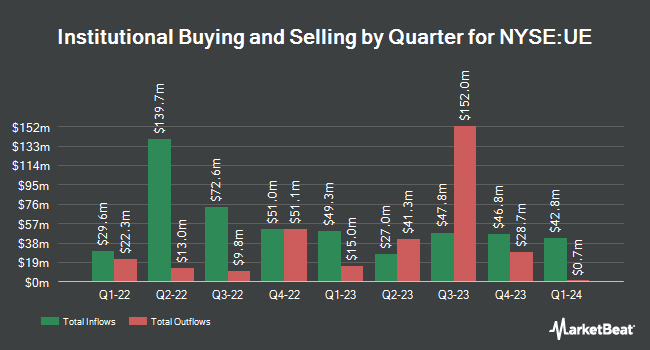

Wealth Enhancement Advisory Services LLC bought a new stake in shares of Urban Edge Properties (NYSE:UE - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 25,702 shares of the real estate investment trust's stock, valued at approximately $550,000.

A number of other institutional investors also recently modified their holdings of the stock. GAMMA Investing LLC lifted its stake in shares of Urban Edge Properties by 25.9% in the 3rd quarter. GAMMA Investing LLC now owns 2,740 shares of the real estate investment trust's stock valued at $59,000 after purchasing an additional 563 shares during the last quarter. IFM Investors Pty Ltd lifted its stake in shares of Urban Edge Properties by 2.1% in the 3rd quarter. IFM Investors Pty Ltd now owns 28,231 shares of the real estate investment trust's stock valued at $604,000 after purchasing an additional 584 shares during the last quarter. Arizona State Retirement System lifted its stake in shares of Urban Edge Properties by 1.9% in the 2nd quarter. Arizona State Retirement System now owns 32,958 shares of the real estate investment trust's stock valued at $609,000 after purchasing an additional 627 shares during the last quarter. Mackenzie Financial Corp raised its holdings in Urban Edge Properties by 7.4% in the 2nd quarter. Mackenzie Financial Corp now owns 11,978 shares of the real estate investment trust's stock worth $221,000 after acquiring an additional 822 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. raised its holdings in Urban Edge Properties by 36.0% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,612 shares of the real estate investment trust's stock worth $97,000 after acquiring an additional 1,221 shares during the period. Institutional investors and hedge funds own 94.94% of the company's stock.

Urban Edge Properties Stock Performance

Shares of NYSE:UE traded up $0.34 on Friday, hitting $23.49. 862,481 shares of the company were exchanged, compared to its average volume of 883,845. The company's 50 day moving average price is $21.56 and its two-hundred day moving average price is $19.58. Urban Edge Properties has a one year low of $15.81 and a one year high of $23.65. The company has a debt-to-equity ratio of 1.13, a quick ratio of 1.30 and a current ratio of 1.30. The firm has a market capitalization of $2.93 billion, a price-to-earnings ratio of 10.53 and a beta of 1.54.

Urban Edge Properties (NYSE:UE - Get Free Report) last issued its earnings results on Wednesday, October 30th. The real estate investment trust reported $0.07 earnings per share for the quarter. Urban Edge Properties had a net margin of 59.23% and a return on equity of 20.89%. The business had revenue of $112.26 million for the quarter. Research analysts expect that Urban Edge Properties will post 1.32 earnings per share for the current year.

Urban Edge Properties Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be paid a dividend of $0.17 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.68 annualized dividend and a yield of 2.89%. Urban Edge Properties's dividend payout ratio is 30.49%.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on UE. Evercore ISI lifted their target price on shares of Urban Edge Properties from $21.00 to $22.00 and gave the stock an "in-line" rating in a report on Monday, September 16th. StockNews.com upgraded shares of Urban Edge Properties from a "sell" rating to a "hold" rating in a report on Friday, August 2nd.

Get Our Latest Report on UE

Urban Edge Properties Profile

(

Free Report)

Urban Edge Properties is a NYSE listed real estate investment trust focused on owning, managing, acquiring, developing, and redeveloping retail real estate in urban communities, primarily in the Washington, DC to Boston corridor. Urban Edge owns 76 properties totaling 17.1 million square feet of gross leasable area.

Read More

Before you consider Urban Edge Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urban Edge Properties wasn't on the list.

While Urban Edge Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.