Wealth High Governance Capital Ltda raised its stake in shares of Eli Lilly and Company (NYSE:LLY - Free Report) by 24.0% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 6,200 shares of the company's stock after acquiring an additional 1,200 shares during the quarter. Eli Lilly and Company makes up 1.7% of Wealth High Governance Capital Ltda's portfolio, making the stock its 27th largest holding. Wealth High Governance Capital Ltda's holdings in Eli Lilly and Company were worth $4,786,000 as of its most recent filing with the SEC.

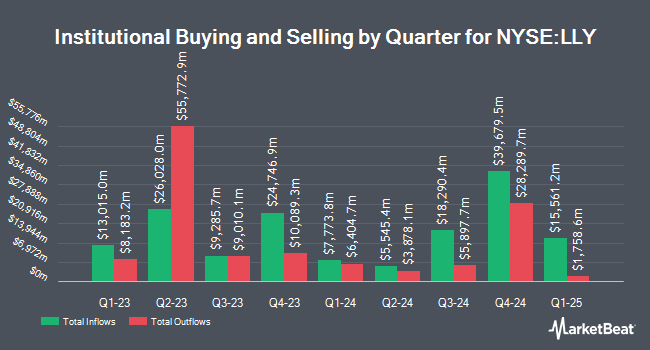

A number of other hedge funds and other institutional investors also recently made changes to their positions in LLY. Geode Capital Management LLC increased its stake in shares of Eli Lilly and Company by 0.5% in the third quarter. Geode Capital Management LLC now owns 17,090,971 shares of the company's stock valued at $15,089,563,000 after buying an additional 85,823 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in Eli Lilly and Company by 2.6% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 6,115,504 shares of the company's stock worth $5,417,970,000 after purchasing an additional 157,741 shares during the period. Fisher Asset Management LLC increased its position in Eli Lilly and Company by 3.5% in the fourth quarter. Fisher Asset Management LLC now owns 5,236,108 shares of the company's stock worth $4,042,276,000 after purchasing an additional 178,007 shares during the period. Proficio Capital Partners LLC increased its position in Eli Lilly and Company by 100,387.1% in the fourth quarter. Proficio Capital Partners LLC now owns 5,202,215 shares of the company's stock worth $4,016,110,000 after purchasing an additional 5,197,038 shares during the period. Finally, Charles Schwab Investment Management Inc. increased its position in Eli Lilly and Company by 4.1% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 5,035,084 shares of the company's stock worth $3,887,085,000 after purchasing an additional 199,864 shares during the period. 82.53% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of analysts recently commented on LLY shares. Wolfe Research started coverage on Eli Lilly and Company in a research report on Friday, November 15th. They issued an "outperform" rating and a $1,000.00 price objective for the company. Citigroup lowered their price objective on Eli Lilly and Company from $1,250.00 to $1,190.00 and set a "buy" rating for the company in a research report on Tuesday, January 28th. Berenberg Bank set a $970.00 price objective on Eli Lilly and Company in a research report on Thursday, January 16th. StockNews.com upgraded Eli Lilly and Company from a "hold" rating to a "buy" rating in a research report on Friday, February 7th. Finally, Morgan Stanley set a $1,146.00 target price on Eli Lilly and Company in a research report on Thursday, March 6th. Three research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $1,009.72.

View Our Latest Stock Report on Eli Lilly and Company

Eli Lilly and Company Trading Down 0.7 %

NYSE LLY opened at $823.95 on Wednesday. The stock has a market capitalization of $781.25 billion, a price-to-earnings ratio of 70.36, a PEG ratio of 1.40 and a beta of 0.34. The stock's 50 day moving average price is $828.77 and its two-hundred day moving average price is $845.45. The company has a debt-to-equity ratio of 2.00, a quick ratio of 0.97 and a current ratio of 1.15. Eli Lilly and Company has a 52 week low of $711.40 and a 52 week high of $972.53.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last released its earnings results on Thursday, February 6th. The company reported $5.32 EPS for the quarter, missing the consensus estimate of $5.45 by ($0.13). Eli Lilly and Company had a net margin of 23.51% and a return on equity of 85.24%. As a group, analysts anticipate that Eli Lilly and Company will post 23.48 earnings per share for the current fiscal year.

Eli Lilly and Company announced that its Board of Directors has initiated a share repurchase program on Monday, December 9th that authorizes the company to buyback $15.00 billion in outstanding shares. This buyback authorization authorizes the company to reacquire up to 2% of its stock through open market purchases. Stock buyback programs are often an indication that the company's leadership believes its stock is undervalued.

Eli Lilly and Company Company Profile

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.