Wealth High Governance Capital Ltda cut its holdings in shares of e.l.f. Beauty, Inc. (NYSE:ELF - Free Report) by 53.3% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 74,684 shares of the company's stock after selling 85,316 shares during the quarter. e.l.f. Beauty comprises approximately 3.4% of Wealth High Governance Capital Ltda's investment portfolio, making the stock its 10th biggest position. Wealth High Governance Capital Ltda owned 0.13% of e.l.f. Beauty worth $9,377,000 as of its most recent SEC filing.

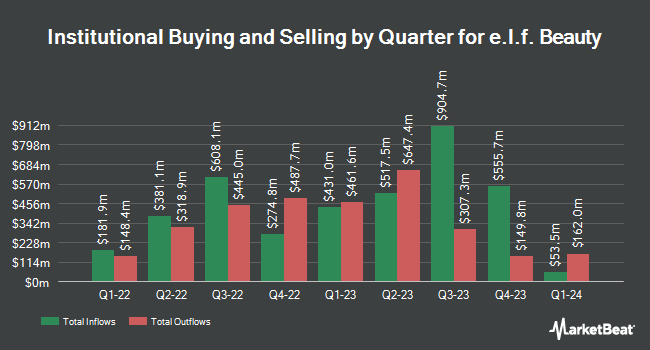

Several other hedge funds also recently bought and sold shares of the stock. Moran Wealth Management LLC lifted its holdings in e.l.f. Beauty by 11.2% during the 4th quarter. Moran Wealth Management LLC now owns 4,567 shares of the company's stock worth $573,000 after buying an additional 460 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank grew its stake in e.l.f. Beauty by 4.9% during the 4th quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 14,251 shares of the company's stock worth $1,789,000 after purchasing an additional 662 shares in the last quarter. PNC Financial Services Group Inc. increased its holdings in e.l.f. Beauty by 4.3% during the 4th quarter. PNC Financial Services Group Inc. now owns 9,796 shares of the company's stock worth $1,230,000 after purchasing an additional 404 shares during the period. Bank Julius Baer & Co. Ltd Zurich boosted its stake in shares of e.l.f. Beauty by 13.2% in the 4th quarter. Bank Julius Baer & Co. Ltd Zurich now owns 44,484 shares of the company's stock valued at $5,704,000 after buying an additional 5,175 shares during the period. Finally, Lisanti Capital Growth LLC acquired a new position in shares of e.l.f. Beauty during the fourth quarter worth about $5,403,000. Hedge funds and other institutional investors own 92.44% of the company's stock.

Analyst Ratings Changes

ELF has been the subject of a number of recent research reports. JPMorgan Chase & Co. lifted their price target on shares of e.l.f. Beauty from $154.00 to $163.00 and gave the stock an "overweight" rating in a research note on Thursday, January 16th. Morgan Stanley reiterated an "equal weight" rating and set a $70.00 target price (down previously from $153.00) on shares of e.l.f. Beauty in a research note on Friday, February 7th. UBS Group reaffirmed a "neutral" rating and set a $74.00 price target (down from $158.00) on shares of e.l.f. Beauty in a report on Friday, February 7th. Raymond James dropped their price objective on e.l.f. Beauty from $175.00 to $120.00 and set a "strong-buy" rating on the stock in a report on Friday, February 7th. Finally, Canaccord Genuity Group decreased their target price on e.l.f. Beauty from $174.00 to $105.00 and set a "buy" rating for the company in a research note on Friday, February 7th. Five research analysts have rated the stock with a hold rating, eleven have given a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $132.94.

Get Our Latest Stock Report on ELF

Insiders Place Their Bets

In related news, Director Maureen C. Watson sold 4,000 shares of the company's stock in a transaction on Friday, March 7th. The stock was sold at an average price of $67.39, for a total transaction of $269,560.00. Following the transaction, the director now owns 1,888 shares of the company's stock, valued at $127,232.32. This represents a 67.93 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. 3.50% of the stock is currently owned by insiders.

e.l.f. Beauty Trading Down 6.0 %

NYSE:ELF opened at $69.58 on Wednesday. e.l.f. Beauty, Inc. has a 12-month low of $61.90 and a 12-month high of $219.77. The company has a current ratio of 1.90, a quick ratio of 1.17 and a debt-to-equity ratio of 0.20. The stock's 50 day simple moving average is $95.51 and its 200-day simple moving average is $112.40. The firm has a market cap of $3.92 billion, a P/E ratio of 41.17, a PEG ratio of 6.76 and a beta of 1.60.

e.l.f. Beauty (NYSE:ELF - Get Free Report) last announced its quarterly earnings data on Thursday, February 6th. The company reported $0.41 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.76 by ($0.35). e.l.f. Beauty had a net margin of 7.55% and a return on equity of 16.88%. Equities analysts anticipate that e.l.f. Beauty, Inc. will post 2.38 EPS for the current year.

About e.l.f. Beauty

(

Free Report)

e.l.f. Beauty, Inc is a holding company, which engages in the provision of inclusive, accessible, clean, vegan and cruelty free cosmetics and skin care products. The company focuses on the e-commerce, national retailers and international business channels. Its brands include elf, elf skin, WELL People and KEYS soulcare.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider e.l.f. Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and e.l.f. Beauty wasn't on the list.

While e.l.f. Beauty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.