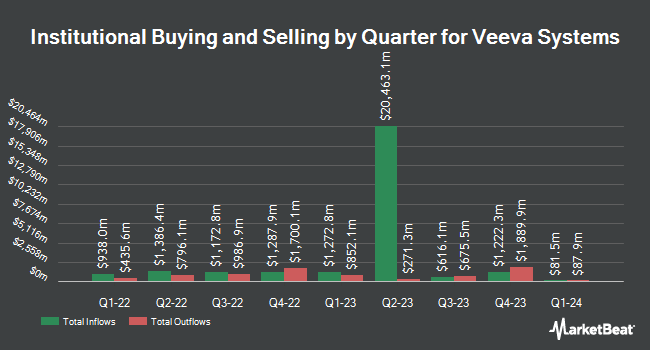

Wealthfront Advisers LLC lifted its holdings in Veeva Systems Inc. (NYSE:VEEV - Free Report) by 29,760.5% in the 4th quarter, according to its most recent filing with the SEC. The firm owned 1,048,700 shares of the technology company's stock after purchasing an additional 1,045,188 shares during the period. Wealthfront Advisers LLC owned about 0.65% of Veeva Systems worth $220,489,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also recently modified their holdings of VEEV. Massachusetts Financial Services Co. MA boosted its position in Veeva Systems by 64.7% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 3,545,451 shares of the technology company's stock valued at $744,084,000 after acquiring an additional 1,392,256 shares in the last quarter. Principal Financial Group Inc. boosted its position in Veeva Systems by 138.9% during the third quarter. Principal Financial Group Inc. now owns 2,179,284 shares of the technology company's stock valued at $457,366,000 after purchasing an additional 1,267,061 shares in the last quarter. JPMorgan Chase & Co. grew its stake in Veeva Systems by 73.2% in the third quarter. JPMorgan Chase & Co. now owns 2,558,592 shares of the technology company's stock valued at $536,972,000 after purchasing an additional 1,081,501 shares during the last quarter. FMR LLC raised its holdings in Veeva Systems by 25.7% in the third quarter. FMR LLC now owns 2,981,244 shares of the technology company's stock worth $625,674,000 after purchasing an additional 610,021 shares in the last quarter. Finally, Raymond James Financial Inc. purchased a new stake in shares of Veeva Systems during the fourth quarter valued at about $95,710,000. 88.20% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of research analysts have recently issued reports on VEEV shares. JPMorgan Chase & Co. lifted their price objective on shares of Veeva Systems from $208.00 to $218.00 and gave the stock a "neutral" rating in a research report on Monday, December 16th. Morgan Stanley lifted their price target on shares of Veeva Systems from $195.00 to $201.00 and gave the stock an "underweight" rating in a report on Thursday, March 6th. Mizuho started coverage on Veeva Systems in a report on Wednesday, December 4th. They set an "outperform" rating and a $275.00 price objective for the company. Scotiabank boosted their target price on Veeva Systems from $240.00 to $245.00 and gave the stock a "sector perform" rating in a research note on Thursday, March 6th. Finally, Barclays upped their target price on Veeva Systems from $260.00 to $275.00 and gave the company an "overweight" rating in a research report on Friday, December 6th. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and sixteen have given a buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $255.28.

Check Out Our Latest Stock Report on VEEV

Veeva Systems Stock Performance

NYSE VEEV opened at $239.38 on Tuesday. The firm has a market capitalization of $38.86 billion, a P/E ratio of 59.11, a PEG ratio of 1.89 and a beta of 0.88. The stock has a 50-day simple moving average of $225.47 and a two-hundred day simple moving average of $220.64. Veeva Systems Inc. has a fifty-two week low of $170.25 and a fifty-two week high of $258.93.

About Veeva Systems

(

Free Report)

Veeva Systems Inc provides cloud-based software for the life sciences industry. It offers Veeva Commercial Cloud, a suite of software and analytics solutions, such as Veeva customer relationship management (CRM) that enable customer-facing employees at pharmaceutical and biotechnology companies; Veeva Vault PromoMats, an end-to-end content and digital asset management solution; Veeva Vault Medical that provides source of medical content across multiple channels and geographies; Veeva Crossix, an analytics platform for pharmaceutical brands; Veeva OpenData, a customer reference data solution; Veeva Link, a data application that allows link to generate real-time intelligence; and Veeva Compass includes de-identified and longitudinal patient data for the United States.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Veeva Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeva Systems wasn't on the list.

While Veeva Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.