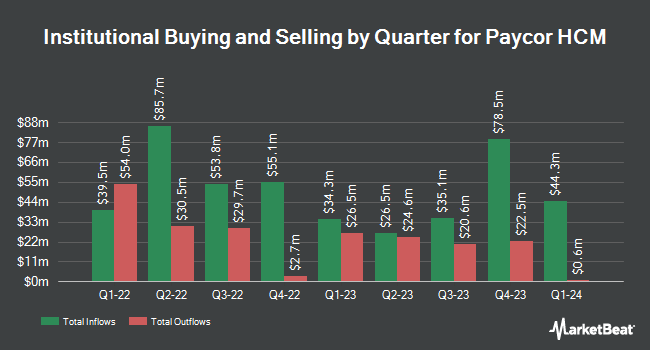

Wealthfront Advisers LLC bought a new position in shares of Paycor HCM, Inc. (NASDAQ:PYCR - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund bought 46,337 shares of the company's stock, valued at approximately $860,000.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Principal Financial Group Inc. bought a new stake in shares of Paycor HCM during the third quarter worth $962,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Paycor HCM by 16.4% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 243,115 shares of the company's stock worth $3,450,000 after acquiring an additional 34,336 shares during the last quarter. ING Groep NV bought a new stake in shares of Paycor HCM during the third quarter worth $4,615,000. Franklin Resources Inc. raised its position in shares of Paycor HCM by 2.7% during the third quarter. Franklin Resources Inc. now owns 1,734,109 shares of the company's stock worth $23,220,000 after acquiring an additional 46,127 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. raised its position in shares of Paycor HCM by 28.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 488,779 shares of the company's stock worth $6,936,000 after acquiring an additional 108,602 shares during the last quarter. Institutional investors own 36.76% of the company's stock.

Paycor HCM Stock Performance

NASDAQ PYCR traded down $0.03 during trading hours on Wednesday, hitting $22.39. 2,226,655 shares of the company traded hands, compared to its average volume of 1,439,398. The business's 50-day moving average is $22.21 and its 200-day moving average is $18.38. Paycor HCM, Inc. has a twelve month low of $10.92 and a twelve month high of $23.49. The stock has a market capitalization of $4.07 billion, a price-to-earnings ratio of -186.57, a P/E/G ratio of 3.84 and a beta of 0.53.

Paycor HCM (NASDAQ:PYCR - Get Free Report) last issued its quarterly earnings results on Wednesday, February 5th. The company reported $0.07 EPS for the quarter, missing the consensus estimate of $0.11 by ($0.04). Paycor HCM had a negative net margin of 3.06% and a positive return on equity of 4.28%. Analysts predict that Paycor HCM, Inc. will post 0.3 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the company. JPMorgan Chase & Co. reiterated an "underweight" rating and issued a $22.50 price objective (up previously from $21.00) on shares of Paycor HCM in a report on Wednesday, January 22nd. The Goldman Sachs Group increased their price target on Paycor HCM from $19.00 to $21.00 and gave the stock a "neutral" rating in a report on Tuesday, November 26th. Mizuho increased their price target on Paycor HCM from $20.00 to $22.50 and gave the stock a "neutral" rating in a report on Wednesday, January 8th. Citigroup increased their price target on Paycor HCM from $21.00 to $22.50 and gave the stock a "neutral" rating in a report on Thursday, January 16th. Finally, Needham & Company LLC downgraded Paycor HCM from a "moderate buy" rating to a "hold" rating in a report on Wednesday, January 8th. One investment analyst has rated the stock with a sell rating, sixteen have issued a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat.com, Paycor HCM currently has an average rating of "Hold" and an average price target of $21.53.

Get Our Latest Analysis on Paycor HCM

Paycor HCM Company Profile

(

Free Report)

Paycor HCM, Inc, together with its subsidiaries, provides software-as-a-service (SaaS) human capital management (HCM) solutions for small and medium-sized businesses (SMBs) primarily in the United States. It offers cloud-native platform to address the comprehensive people management needs of SMB leaders.

Featured Stories

Before you consider Paycor HCM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycor HCM wasn't on the list.

While Paycor HCM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.