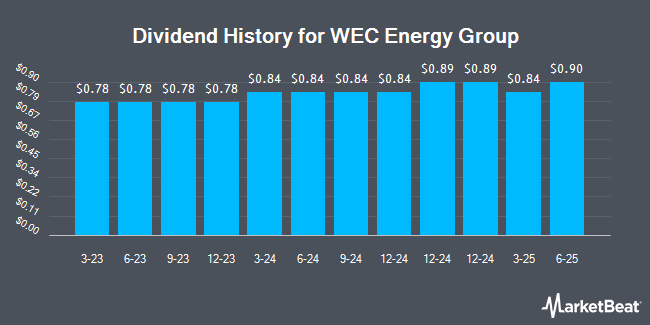

WEC Energy Group, Inc. (NYSE:WEC - Get Free Report) announced a quarterly dividend on Friday, December 6th,Wall Street Journal reports. Stockholders of record on Friday, February 14th will be paid a dividend of 0.8925 per share by the utilities provider on Saturday, March 1st. This represents a $3.57 dividend on an annualized basis and a dividend yield of 3.68%. The ex-dividend date of this dividend is Friday, February 14th. This is an increase from WEC Energy Group's previous quarterly dividend of $0.84.

WEC Energy Group has raised its dividend by an average of 7.2% annually over the last three years and has increased its dividend annually for the last 22 consecutive years. WEC Energy Group has a payout ratio of 64.0% meaning its dividend is sufficiently covered by earnings. Research analysts expect WEC Energy Group to earn $5.23 per share next year, which means the company should continue to be able to cover its $3.34 annual dividend with an expected future payout ratio of 63.9%.

WEC Energy Group Trading Down 0.6 %

Shares of WEC Energy Group stock traded down $0.63 on Friday, hitting $97.09. 1,468,496 shares of the company traded hands, compared to its average volume of 2,123,554. The company has a current ratio of 0.65, a quick ratio of 0.46 and a debt-to-equity ratio of 1.37. The company has a market cap of $30.71 billion, a PE ratio of 23.74, a PEG ratio of 2.67 and a beta of 0.46. The stock's 50 day moving average price is $97.63 and its 200-day moving average price is $89.80. WEC Energy Group has a 52 week low of $75.13 and a 52 week high of $102.79.

WEC Energy Group (NYSE:WEC - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The utilities provider reported $0.82 earnings per share for the quarter, beating analysts' consensus estimates of $0.70 by $0.12. The company had revenue of $1.86 billion for the quarter, compared to the consensus estimate of $1.93 billion. WEC Energy Group had a return on equity of 11.72% and a net margin of 15.14%. The firm's revenue for the quarter was down 4.8% compared to the same quarter last year. During the same quarter last year, the company earned $1.00 earnings per share. Equities research analysts predict that WEC Energy Group will post 4.87 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the company. Scotiabank boosted their price target on WEC Energy Group from $90.00 to $103.00 and gave the stock a "sector outperform" rating in a research note on Tuesday, August 20th. Bank of America upped their price target on shares of WEC Energy Group from $88.00 to $90.00 and gave the company an "underperform" rating in a research note on Thursday, August 29th. BMO Capital Markets raised their price target on shares of WEC Energy Group from $97.00 to $104.00 and gave the stock a "market perform" rating in a report on Monday. Barclays boosted their price objective on shares of WEC Energy Group from $86.00 to $89.00 and gave the company an "underweight" rating in a report on Monday, October 7th. Finally, KeyCorp raised their target price on WEC Energy Group from $108.00 to $109.00 and gave the stock an "overweight" rating in a research note on Wednesday. Three analysts have rated the stock with a sell rating, five have assigned a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, WEC Energy Group currently has an average rating of "Hold" and an average target price of $95.55.

Read Our Latest Research Report on WEC Energy Group

Insider Buying and Selling

In related news, Director Gale E. Klappa sold 1,805 shares of the company's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $99.40, for a total value of $179,417.00. Following the completion of the transaction, the director now owns 273,248 shares of the company's stock, valued at approximately $27,160,851.20. This represents a 0.66 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Scott J. Lauber sold 6,720 shares of the firm's stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $100.89, for a total value of $677,980.80. Following the completion of the sale, the chief executive officer now directly owns 45,709 shares in the company, valued at approximately $4,611,581.01. The trade was a 12.82 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 48,794 shares of company stock valued at $4,866,579 over the last ninety days. Company insiders own 0.34% of the company's stock.

About WEC Energy Group

(

Get Free Report)

WEC Energy Group, Inc, through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. It operates through Wisconsin, Illinois, Other States, Electric Transmission, and Non-Utility Energy Infrastructure segments.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider WEC Energy Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WEC Energy Group wasn't on the list.

While WEC Energy Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.