Wedbush began coverage on shares of Lithium Americas (NYSE:LAC - Free Report) in a report issued on Thursday, MarketBeat Ratings reports. The firm issued a neutral rating and a $5.00 price target on the stock.

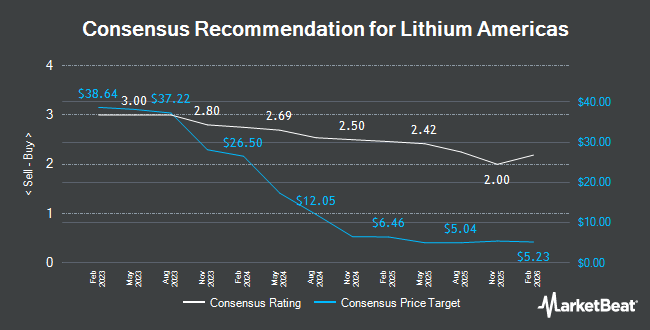

A number of other equities research analysts also recently weighed in on the company. BMO Capital Markets raised Lithium Americas to a "hold" rating in a report on Wednesday, October 23rd. National Bank Financial raised Lithium Americas from a "sector perform" rating to an "outperform" rating in a research report on Thursday, October 17th. B. Riley raised their price objective on shares of Lithium Americas from $4.50 to $5.00 and gave the stock a "buy" rating in a report on Tuesday, November 12th. Finally, Scotiabank dropped their target price on Lithium Americas from $3.00 to $2.50 and set a "sector perform" rating for the company in a research report on Friday, October 18th. Seven investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, Lithium Americas currently has a consensus rating of "Hold" and an average target price of $5.56.

Check Out Our Latest Stock Report on Lithium Americas

Lithium Americas Stock Up 0.3 %

NYSE LAC traded up $0.01 on Thursday, reaching $2.94. 4,409,813 shares of the stock traded hands, compared to its average volume of 5,392,852. The company has a market cap of $648.81 million and a price-to-earnings ratio of -24.50. Lithium Americas has a 12 month low of $2.02 and a 12 month high of $7.71. The firm's fifty day simple moving average is $3.65 and its 200 day simple moving average is $2.99.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in LAC. SG Americas Securities LLC raised its position in shares of Lithium Americas by 131.1% in the 2nd quarter. SG Americas Securities LLC now owns 23,751 shares of the company's stock worth $64,000 after purchasing an additional 13,472 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in shares of Lithium Americas by 9.2% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 264,387 shares of the company's stock valued at $709,000 after purchasing an additional 22,313 shares during the period. International Assets Investment Management LLC purchased a new stake in Lithium Americas in the second quarter worth about $30,000. Van ECK Associates Corp boosted its holdings in shares of Lithium Americas by 69.8% in the 2nd quarter. Van ECK Associates Corp now owns 3,953,127 shares of the company's stock valued at $10,591,000 after buying an additional 1,625,149 shares in the last quarter. Finally, CIBC Asset Management Inc purchased a new stake in shares of Lithium Americas during the second quarter valued at $97,000.

Lithium Americas Company Profile

(

Get Free Report)

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada. Lithium Americas Corp.

Featured Stories

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.