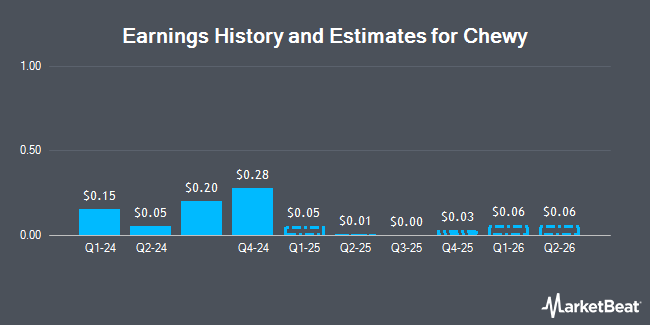

Chewy, Inc. (NYSE:CHWY - Free Report) - Research analysts at Wedbush reduced their Q4 2025 EPS estimates for shares of Chewy in a report issued on Thursday, December 5th. Wedbush analyst S. Basham now forecasts that the company will earn $0.01 per share for the quarter, down from their prior estimate of $0.05. Wedbush has a "Outperform" rating and a $39.00 price target on the stock. The consensus estimate for Chewy's current full-year earnings is $0.34 per share.

Several other research firms also recently weighed in on CHWY. JPMorgan Chase & Co. boosted their target price on shares of Chewy from $37.00 to $38.00 and gave the stock an "overweight" rating in a research report on Thursday. Raymond James lowered Chewy from an "outperform" rating to a "market perform" rating in a research report on Wednesday, August 21st. Piper Sandler lifted their price objective on shares of Chewy from $35.00 to $40.00 and gave the stock an "overweight" rating in a report on Monday, December 2nd. TD Cowen began coverage on shares of Chewy in a research note on Wednesday, October 9th. They set a "buy" rating and a $38.00 target price for the company. Finally, Needham & Company LLC restated a "hold" rating on shares of Chewy in a research report on Thursday. Nine equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $34.15.

Check Out Our Latest Analysis on Chewy

Chewy Price Performance

Shares of NYSE:CHWY traded down $0.68 during midday trading on Monday, reaching $30.90. The company had a trading volume of 4,589,760 shares, compared to its average volume of 8,608,157. The stock has a market capitalization of $12.92 billion, a P/E ratio of 33.96, a PEG ratio of 2.95 and a beta of 1.12. The stock's fifty day moving average price is $30.49 and its 200-day moving average price is $27.42. Chewy has a one year low of $14.69 and a one year high of $39.10.

Chewy (NYSE:CHWY - Get Free Report) last released its quarterly earnings results on Wednesday, December 4th. The company reported $0.20 EPS for the quarter, topping the consensus estimate of $0.05 by $0.15. Chewy had a return on equity of 24.47% and a net margin of 3.51%. The business had revenue of $2.89 billion for the quarter, compared to analysts' expectations of $2.86 billion. During the same quarter in the previous year, the firm posted ($0.08) earnings per share. The company's revenue was up 5.2% compared to the same quarter last year.

Insider Buying and Selling at Chewy

In other Chewy news, major shareholder Argos Holdings Gp Llc sold 1,250,000 shares of the business's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $29.40, for a total value of $36,750,000.00. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, CTO Satish Mehta sold 8,056 shares of the company's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $33.47, for a total transaction of $269,634.32. Following the completion of the sale, the chief technology officer now directly owns 585,962 shares of the company's stock, valued at $19,612,148.14. The trade was a 1.36 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 28,128,804 shares of company stock valued at $827,019,626. Company insiders own 2.10% of the company's stock.

Institutional Trading of Chewy

A number of large investors have recently added to or reduced their stakes in the business. BC Partners Advisors L.P. bought a new stake in shares of Chewy during the 2nd quarter worth $7,517,800,000. FMR LLC boosted its position in shares of Chewy by 166.8% in the 3rd quarter. FMR LLC now owns 3,995,329 shares of the company's stock valued at $117,023,000 after purchasing an additional 2,497,689 shares during the period. Bank of New York Mellon Corp boosted its position in shares of Chewy by 7.8% in the 2nd quarter. Bank of New York Mellon Corp now owns 3,553,104 shares of the company's stock valued at $96,787,000 after purchasing an additional 258,502 shares during the period. Marshall Wace LLP increased its stake in Chewy by 1,028.6% in the 2nd quarter. Marshall Wace LLP now owns 2,892,841 shares of the company's stock worth $78,801,000 after purchasing an additional 2,636,526 shares in the last quarter. Finally, ArrowMark Colorado Holdings LLC raised its holdings in Chewy by 5.3% during the 3rd quarter. ArrowMark Colorado Holdings LLC now owns 2,765,931 shares of the company's stock worth $81,014,000 after buying an additional 138,768 shares during the period. 93.09% of the stock is currently owned by institutional investors.

About Chewy

(

Get Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Read More

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.