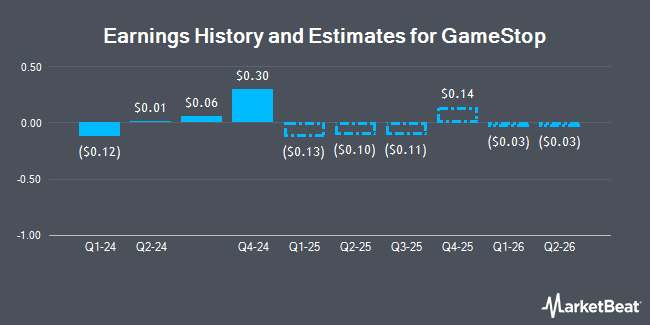

GameStop Corp. (NYSE:GME - Free Report) - Wedbush upped their FY2025 EPS estimates for GameStop in a report issued on Wednesday, December 11th. Wedbush analyst M. Pachter now expects that the company will post earnings of $0.08 per share for the year, up from their previous forecast of $0.01. Wedbush currently has a "Underperform" rating and a $10.00 price target on the stock. The consensus estimate for GameStop's current full-year earnings is $0.01 per share. Wedbush also issued estimates for GameStop's Q1 2026 earnings at $0.03 EPS, Q2 2026 earnings at $0.03 EPS, Q3 2026 earnings at $0.03 EPS, FY2026 earnings at $0.18 EPS and FY2027 earnings at $0.13 EPS.

GameStop (NYSE:GME - Get Free Report) last released its quarterly earnings data on Tuesday, December 10th. The company reported $0.06 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.03) by $0.09. The firm had revenue of $860.30 million for the quarter, compared to analysts' expectations of $887.68 million. GameStop had a net margin of 1.45% and a return on equity of 2.11%. The company's revenue was down 20.2% compared to the same quarter last year.

Separately, StockNews.com raised GameStop to a "sell" rating in a research note on Saturday, October 19th.

Get Our Latest Stock Report on GameStop

GameStop Price Performance

GME traded up $1.42 during midday trading on Monday, reaching $29.41. 8,562,850 shares of the company's stock traded hands, compared to its average volume of 18,991,875. GameStop has a 52 week low of $9.95 and a 52 week high of $64.83. The firm has a fifty day moving average of $25.12 and a two-hundred day moving average of $24.25. The stock has a market capitalization of $13.14 billion, a price-to-earnings ratio of 163.39 and a beta of -0.11.

Insider Transactions at GameStop

In related news, General Counsel Mark Haymond Robinson sold 4,667 shares of the business's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $21.96, for a total transaction of $102,487.32. Following the sale, the general counsel now owns 54,927 shares of the company's stock, valued at $1,206,196.92. The trade was a 7.83 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Daniel William Moore sold 2,624 shares of the company's stock in a transaction that occurred on Friday, October 11th. The stock was sold at an average price of $21.00, for a total value of $55,104.00. Following the completion of the sale, the insider now owns 32,280 shares in the company, valued at $677,880. The trade was a 7.52 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 22,639 shares of company stock valued at $481,000. Company insiders own 12.28% of the company's stock.

Institutional Investors Weigh In On GameStop

Several institutional investors and hedge funds have recently made changes to their positions in GME. UMB Bank n.a. boosted its stake in GameStop by 535.8% during the 3rd quarter. UMB Bank n.a. now owns 1,138 shares of the company's stock valued at $26,000 after purchasing an additional 959 shares during the last quarter. Centerpoint Advisors LLC purchased a new stake in shares of GameStop during the second quarter valued at $47,000. CWM LLC increased its holdings in GameStop by 115.6% in the 2nd quarter. CWM LLC now owns 2,660 shares of the company's stock worth $66,000 after buying an additional 1,426 shares in the last quarter. Quest Partners LLC raised its position in GameStop by 7,156.5% in the 2nd quarter. Quest Partners LLC now owns 6,168 shares of the company's stock worth $152,000 after buying an additional 6,083 shares during the last quarter. Finally, Centaurus Financial Inc. bought a new position in GameStop during the 3rd quarter valued at about $171,000. Institutional investors own 29.21% of the company's stock.

GameStop Company Profile

(

Get Free Report)

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

See Also

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.