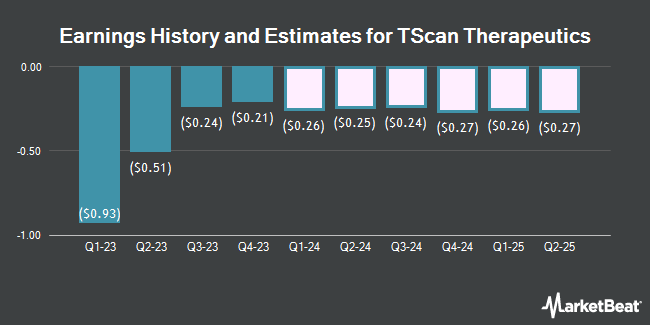

TScan Therapeutics, Inc. (NASDAQ:TCRX - Free Report) - Wedbush raised their FY2028 earnings per share (EPS) estimates for TScan Therapeutics in a report issued on Tuesday, November 12th. Wedbush analyst D. Nierengarten now expects that the company will post earnings of $0.46 per share for the year, up from their previous estimate of $0.40. Wedbush currently has a "Outperform" rating and a $10.00 price target on the stock. The consensus estimate for TScan Therapeutics' current full-year earnings is ($1.17) per share.

Other equities research analysts have also issued research reports about the stock. Needham & Company LLC restated a "buy" rating and issued a $11.00 target price on shares of TScan Therapeutics in a research note on Tuesday. HC Wainwright restated a "buy" rating and set a $15.00 price objective on shares of TScan Therapeutics in a research note on Tuesday, August 13th. Five analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus target price of $12.00.

Get Our Latest Research Report on TCRX

TScan Therapeutics Stock Down 8.2 %

TCRX traded down $0.43 during trading on Thursday, hitting $4.82. The company had a trading volume of 166,315 shares, compared to its average volume of 246,925. The company has a market cap of $255.32 million, a PE ratio of -4.78 and a beta of 0.79. The company has a debt-to-equity ratio of 0.08, a current ratio of 7.77 and a quick ratio of 7.77. TScan Therapeutics has a 1-year low of $3.73 and a 1-year high of $9.69. The business has a 50-day moving average of $5.34 and a 200-day moving average of $6.52.

TScan Therapeutics (NASDAQ:TCRX - Get Free Report) last released its earnings results on Monday, August 12th. The company reported ($0.28) EPS for the quarter, beating the consensus estimate of ($0.30) by $0.02. The company had revenue of $0.54 million during the quarter, compared to analysts' expectations of $1.55 million. TScan Therapeutics had a negative return on equity of 63.11% and a negative net margin of 1,188.88%.

Insider Activity

In other TScan Therapeutics news, insider Zoran Zdraveski sold 164,686 shares of the firm's stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $5.78, for a total value of $951,885.08. Following the sale, the insider now directly owns 4,716 shares in the company, valued at approximately $27,258.48. This trade represents a 97.22 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Barbara Klencke purchased 5,000 shares of the stock in a transaction dated Monday, September 23rd. The shares were purchased at an average price of $5.29 per share, with a total value of $26,450.00. Following the transaction, the director now directly owns 45,000 shares of the company's stock, valued at approximately $238,050. The trade was a 12.50 % increase in their position. The disclosure for this purchase can be found here. In the last three months, insiders acquired 15,000 shares of company stock valued at $82,550. Company insiders own 2.76% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of TCRX. Dimensional Fund Advisors LP acquired a new position in shares of TScan Therapeutics during the second quarter worth approximately $70,000. The Manufacturers Life Insurance Company acquired a new position in TScan Therapeutics during the 2nd quarter worth $90,000. SG Americas Securities LLC bought a new position in shares of TScan Therapeutics in the third quarter worth $78,000. Cornercap Investment Counsel Inc. acquired a new position in shares of TScan Therapeutics during the second quarter valued at $134,000. Finally, MetLife Investment Management LLC raised its stake in shares of TScan Therapeutics by 129.1% during the third quarter. MetLife Investment Management LLC now owns 23,363 shares of the company's stock valued at $116,000 after purchasing an additional 13,164 shares in the last quarter. 82.83% of the stock is owned by institutional investors and hedge funds.

TScan Therapeutics Company Profile

(

Get Free Report)

TScan Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops T cell receptor-engineered T cell (TCR-T) therapies for the treatment of patients with cancer in the United States. The company's lead product candidates include TSC-100 and TSC-101 that is in Phase I clinical trial for the treatment of patients with hematologic malignancies to eliminate residual disease and prevent relapse after allogeneic hematopoietic cell transplantation.

See Also

Before you consider TScan Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TScan Therapeutics wasn't on the list.

While TScan Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.