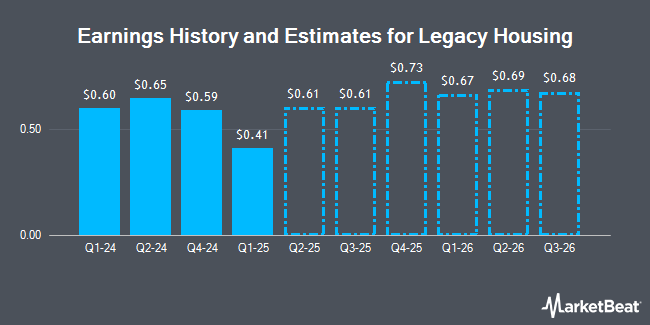

Legacy Housing Co. (NASDAQ:LEGH - Free Report) - Equities researchers at Wedbush cut their Q1 2026 earnings estimates for Legacy Housing in a research note issued to investors on Wednesday, November 13th. Wedbush analyst J. Mccanless now expects that the company will earn $0.67 per share for the quarter, down from their previous estimate of $0.69. Wedbush currently has a "Outperform" rating and a $29.00 price target on the stock. The consensus estimate for Legacy Housing's current full-year earnings is $2.55 per share. Wedbush also issued estimates for Legacy Housing's Q2 2026 earnings at $0.69 EPS and Q3 2026 earnings at $0.68 EPS.

Separately, B. Riley restated a "neutral" rating and set a $29.00 price target (up previously from $25.00) on shares of Legacy Housing in a research report on Monday, August 12th.

Read Our Latest Stock Report on Legacy Housing

Legacy Housing Stock Down 0.0 %

Shares of NASDAQ LEGH traded down $0.01 during mid-day trading on Friday, reaching $25.89. 91,967 shares of the company were exchanged, compared to its average volume of 64,372. Legacy Housing has a 52 week low of $19.42 and a 52 week high of $29.31. The company's 50 day moving average price is $26.69 and its 200 day moving average price is $25.15. The stock has a market capitalization of $625.50 million, a PE ratio of 11.93 and a beta of 1.09.

Institutional Inflows and Outflows

Several hedge funds have recently made changes to their positions in LEGH. State Street Corp increased its position in shares of Legacy Housing by 5.9% in the third quarter. State Street Corp now owns 207,972 shares of the company's stock valued at $5,688,000 after acquiring an additional 11,599 shares during the period. Hotchkis & Wiley Capital Management LLC bought a new stake in shares of Legacy Housing in the third quarter worth about $3,211,000. Zurcher Kantonalbank Zurich Cantonalbank purchased a new position in Legacy Housing during the 3rd quarter valued at about $85,000. BNP Paribas Financial Markets raised its position in Legacy Housing by 17.8% during the 3rd quarter. BNP Paribas Financial Markets now owns 5,600 shares of the company's stock valued at $153,000 after purchasing an additional 848 shares during the last quarter. Finally, Cerity Partners LLC lifted its holdings in Legacy Housing by 141.3% in the 3rd quarter. Cerity Partners LLC now owns 178,276 shares of the company's stock worth $4,876,000 after buying an additional 104,386 shares during the period. 89.35% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other news, Chairman Curtis Drew Hodgson sold 13,387 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $27.73, for a total transaction of $371,221.51. Following the completion of the sale, the chairman now owns 684,486 shares of the company's stock, valued at approximately $18,980,796.78. This represents a 1.92 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Over the last three months, insiders have sold 167,795 shares of company stock valued at $4,477,603. 30.60% of the stock is currently owned by insiders.

About Legacy Housing

(

Get Free Report)

Legacy Housing Corporation engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States. It manufactures and provides for the transport of mobile homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms; and provides wholesale financing to dealers and mobile home parks, as well as retail financing to consumers.

Featured Articles

Before you consider Legacy Housing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legacy Housing wasn't on the list.

While Legacy Housing currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.