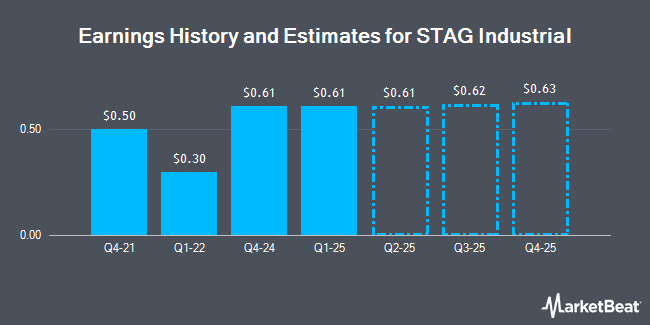

STAG Industrial, Inc. (NYSE:STAG - Free Report) - Stock analysts at Wedbush upped their FY2024 EPS estimates for STAG Industrial in a research report issued to clients and investors on Monday, November 11th. Wedbush analyst R. Anderson now anticipates that the real estate investment trust will earn $2.40 per share for the year, up from their previous forecast of $2.38. Wedbush has a "Outperform" rating and a $45.00 price target on the stock. The consensus estimate for STAG Industrial's current full-year earnings is $2.39 per share. Wedbush also issued estimates for STAG Industrial's Q4 2024 earnings at $0.60 EPS.

STAG has been the subject of several other research reports. Evercore ISI increased their price objective on STAG Industrial from $43.00 to $44.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 28th. Wells Fargo & Company lowered their price target on shares of STAG Industrial from $41.00 to $38.00 and set an "equal weight" rating on the stock in a research note on Monday, November 4th. Finally, Barclays reduced their price objective on shares of STAG Industrial from $42.00 to $40.00 and set an "equal weight" rating for the company in a research note on Monday, October 28th. Five equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, STAG Industrial currently has a consensus rating of "Hold" and an average price target of $41.13.

Get Our Latest Research Report on STAG

STAG Industrial Stock Performance

NYSE STAG traded up $0.35 on Wednesday, hitting $37.14. 1,695,502 shares of the company's stock were exchanged, compared to its average volume of 1,072,778. The firm has a market cap of $6.77 billion, a price-to-earnings ratio of 37.69 and a beta of 1.09. The firm's 50-day moving average price is $38.33 and its two-hundred day moving average price is $37.59. STAG Industrial has a fifty-two week low of $34.09 and a fifty-two week high of $41.63. The company has a debt-to-equity ratio of 0.87, a current ratio of 1.42 and a quick ratio of 1.42.

STAG Industrial Dividend Announcement

The firm also recently disclosed a monthly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be paid a $0.1233 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $1.48 dividend on an annualized basis and a yield of 3.98%. STAG Industrial's payout ratio is 149.49%.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the business. J.Safra Asset Management Corp boosted its stake in shares of STAG Industrial by 708.5% during the 1st quarter. J.Safra Asset Management Corp now owns 663 shares of the real estate investment trust's stock worth $25,000 after purchasing an additional 581 shares during the last quarter. Centerpoint Advisors LLC acquired a new stake in STAG Industrial during the second quarter worth approximately $25,000. UMB Bank n.a. grew its stake in STAG Industrial by 54.1% in the 3rd quarter. UMB Bank n.a. now owns 872 shares of the real estate investment trust's stock worth $34,000 after acquiring an additional 306 shares during the period. GAMMA Investing LLC raised its holdings in STAG Industrial by 56.1% in the 2nd quarter. GAMMA Investing LLC now owns 907 shares of the real estate investment trust's stock valued at $33,000 after acquiring an additional 326 shares during the last quarter. Finally, Wetzel Investment Advisors Inc. purchased a new position in shares of STAG Industrial during the 2nd quarter worth $38,000. 88.67% of the stock is owned by hedge funds and other institutional investors.

About STAG Industrial

(

Get Free Report)

We are a REIT focused on the acquisition, ownership, and operation of industrial properties throughout the United States. Our platform is designed to (i) identify properties for acquisition that offer relative value across CBRE-EA Tier 1 industrial real estate markets, industries, and tenants through the principled application of our proprietary risk assessment model, (ii) provide growth through sophisticated industrial operation and an attractive opportunity set, and (iii) capitalize our business appropriately given the characteristics of our assets.

Read More

Before you consider STAG Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STAG Industrial wasn't on the list.

While STAG Industrial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.