Wendy's (NASDAQ:WEN - Get Free Report) had its price target hoisted by investment analysts at Wedbush from $15.50 to $16.00 in a research note issued on Friday,Benzinga reports. The firm currently has a "neutral" rating on the restaurant operator's stock. Wedbush's price target indicates a potential upside of 6.74% from the stock's current price.

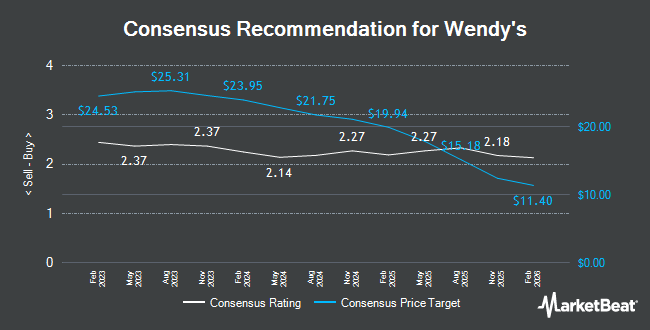

WEN has been the subject of several other reports. Truist Financial lifted their price objective on Wendy's from $21.00 to $22.00 and gave the company a "buy" rating in a report on Friday, November 1st. Stifel Nicolaus lowered their price target on Wendy's from $18.00 to $17.00 and set a "hold" rating for the company in a report on Friday, January 10th. BMO Capital Markets boosted their price target on Wendy's from $19.00 to $20.00 and gave the stock a "market perform" rating in a report on Friday, November 1st. UBS Group lowered their price target on Wendy's from $20.00 to $17.00 and set a "neutral" rating for the company in a report on Tuesday, January 7th. Finally, Morgan Stanley reissued an "underweight" rating and set a $14.00 price target (down previously from $22.00) on shares of Wendy's in a report on Tuesday, January 21st. Two equities research analysts have rated the stock with a sell rating, twelve have given a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $18.93.

View Our Latest Stock Report on WEN

Wendy's Price Performance

NASDAQ WEN traded up $0.69 during midday trading on Friday, hitting $14.99. The company had a trading volume of 9,043,353 shares, compared to its average volume of 4,964,599. The company has a market capitalization of $3.06 billion, a PE ratio of 15.78, a P/E/G ratio of 2.27 and a beta of 0.77. The company has a current ratio of 2.10, a quick ratio of 2.08 and a debt-to-equity ratio of 12.64. The firm has a 50-day moving average price of $15.43 and a 200-day moving average price of $17.08. Wendy's has a twelve month low of $13.72 and a twelve month high of $20.65.

Wendy's (NASDAQ:WEN - Get Free Report) last announced its quarterly earnings data on Thursday, February 13th. The restaurant operator reported $0.25 earnings per share for the quarter, beating the consensus estimate of $0.24 by $0.01. The firm had revenue of $574.27 million during the quarter, compared to analysts' expectations of $564.17 million. Wendy's had a return on equity of 70.02% and a net margin of 8.76%. As a group, analysts anticipate that Wendy's will post 0.99 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Wendy's

Institutional investors have recently made changes to their positions in the stock. Blue Trust Inc. grew its position in shares of Wendy's by 670.3% in the 4th quarter. Blue Trust Inc. now owns 1,402 shares of the restaurant operator's stock valued at $25,000 after buying an additional 1,220 shares during the last quarter. SBI Securities Co. Ltd. bought a new stake in shares of Wendy's in the 4th quarter valued at about $30,000. Colonial Trust Co SC bought a new stake in shares of Wendy's in the 4th quarter valued at about $31,000. GAMMA Investing LLC grew its position in shares of Wendy's by 168.1% in the 4th quarter. GAMMA Investing LLC now owns 2,233 shares of the restaurant operator's stock valued at $36,000 after buying an additional 1,400 shares during the last quarter. Finally, Hillsdale Investment Management Inc. bought a new stake in shares of Wendy's in the 4th quarter valued at about $46,000. Institutional investors own 85.96% of the company's stock.

Wendy's Company Profile

(

Get Free Report)

The Wendy's Co engages in operating, developing, and franchising a system of quick-service restaurants. It offers hamburgers and related products, such as chicken breast sandwiches, nuggets, chili, and baked potatoes, French fries, freshly prepared salads, soft drinks, milk, coffee, frosty deserts, and kid's meals.

See Also

Before you consider Wendy's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wendy's wasn't on the list.

While Wendy's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.