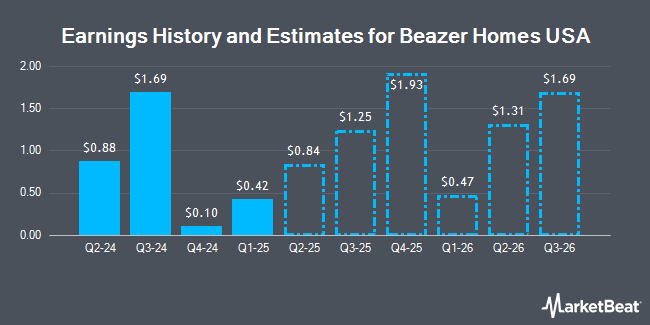

Beazer Homes USA, Inc. (NYSE:BZH - Free Report) - Wedbush increased their Q1 2025 earnings estimates for shares of Beazer Homes USA in a report released on Wednesday, November 13th. Wedbush analyst J. Mccanless now anticipates that the construction company will post earnings of $0.30 per share for the quarter, up from their previous estimate of $0.23. Wedbush has a "Outperform" rating and a $45.00 price objective on the stock. The consensus estimate for Beazer Homes USA's current full-year earnings is $4.70 per share. Wedbush also issued estimates for Beazer Homes USA's Q2 2025 earnings at $0.84 EPS, Q3 2025 earnings at $1.42 EPS, Q4 2025 earnings at $2.09 EPS, FY2025 earnings at $4.65 EPS and FY2026 earnings at $5.85 EPS.

Beazer Homes USA (NYSE:BZH - Get Free Report) last issued its quarterly earnings results on Wednesday, November 13th. The construction company reported $1.69 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.35 by $0.34. The firm had revenue of $806.20 million for the quarter, compared to analyst estimates of $775.42 million. Beazer Homes USA had a return on equity of 11.95% and a net margin of 6.02%. The firm's quarterly revenue was up 24.9% on a year-over-year basis. During the same period last year, the company earned $1.80 EPS.

Other analysts have also recently issued reports about the stock. Zelman & Associates reissued an "underperform" rating on shares of Beazer Homes USA in a research note on Tuesday, September 17th. B. Riley dropped their price target on Beazer Homes USA from $38.00 to $37.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. Finally, StockNews.com lowered Beazer Homes USA from a "hold" rating to a "sell" rating in a research note on Monday, August 5th. Two research analysts have rated the stock with a sell rating and three have given a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $39.67.

Get Our Latest Stock Analysis on Beazer Homes USA

Beazer Homes USA Trading Down 2.0 %

Beazer Homes USA stock traded down $0.67 during trading on Monday, reaching $32.63. The company had a trading volume of 406,629 shares, compared to its average volume of 362,795. Beazer Homes USA has a 12-month low of $25.48 and a 12-month high of $38.22. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.92 and a current ratio of 14.29. The stock's 50 day moving average price is $32.53 and its two-hundred day moving average price is $30.34. The firm has a market capitalization of $1.01 billion, a price-to-earnings ratio of 7.35, a PEG ratio of 1.44 and a beta of 2.18.

Insiders Place Their Bets

In related news, CFO David I. Goldberg sold 6,057 shares of the firm's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $32.06, for a total transaction of $194,187.42. Following the completion of the sale, the chief financial officer now directly owns 131,004 shares of the company's stock, valued at approximately $4,199,988.24. This trade represents a 4.42 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 6.99% of the stock is currently owned by insiders.

Institutional Trading of Beazer Homes USA

Several large investors have recently modified their holdings of BZH. Boston Partners acquired a new position in shares of Beazer Homes USA in the first quarter worth about $15,411,000. Victory Capital Management Inc. boosted its stake in shares of Beazer Homes USA by 711.4% during the 3rd quarter. Victory Capital Management Inc. now owns 225,453 shares of the construction company's stock valued at $7,704,000 after buying an additional 197,666 shares during the last quarter. Assenagon Asset Management S.A. grew its position in shares of Beazer Homes USA by 52.6% during the third quarter. Assenagon Asset Management S.A. now owns 545,983 shares of the construction company's stock worth $18,656,000 after buying an additional 188,084 shares in the last quarter. Mill Road Capital Management LLC raised its holdings in Beazer Homes USA by 89.1% in the third quarter. Mill Road Capital Management LLC now owns 368,069 shares of the construction company's stock valued at $12,577,000 after acquiring an additional 173,474 shares in the last quarter. Finally, Donald Smith & CO. Inc. raised its stake in shares of Beazer Homes USA by 4.9% in the 2nd quarter. Donald Smith & CO. Inc. now owns 3,086,874 shares of the construction company's stock valued at $84,827,000 after purchasing an additional 143,663 shares in the last quarter. 85.65% of the stock is currently owned by institutional investors and hedge funds.

About Beazer Homes USA

(

Get Free Report)

Beazer Homes USA, Inc operates as a homebuilder in the United States. It designs, constructs, and sells single-family and multi-family homes under the Beazer Homes, Gatherings, and Choice Plans names. The company also sells its homes through commissioned new home sales counselors and independent brokers in Arizona, California, Nevada, Texas, Indiana, Delaware, Maryland, Tennessee, Virginia, Florida, Georgia, North Carolina, and South Carolina.

Further Reading

Before you consider Beazer Homes USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beazer Homes USA wasn't on the list.

While Beazer Homes USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.