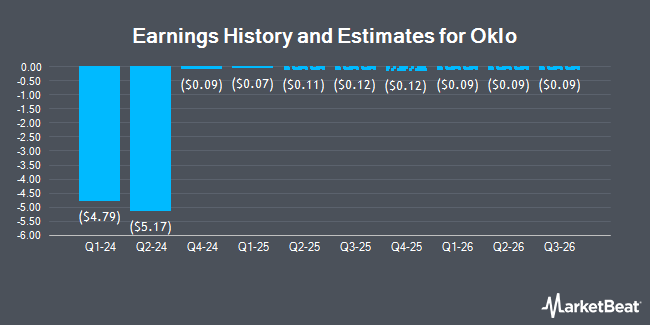

Oklo Inc. (NYSE:OKLO - Free Report) - Investment analysts at Wedbush issued their Q4 2024 earnings estimates for Oklo in a research report issued to clients and investors on Thursday, December 19th. Wedbush analyst D. Ives expects that the company will earn ($0.08) per share for the quarter. Wedbush currently has a "Outperform" rating and a $26.00 price objective on the stock. The consensus estimate for Oklo's current full-year earnings is ($0.59) per share. Wedbush also issued estimates for Oklo's Q1 2025 earnings at ($0.09) EPS, Q2 2025 earnings at ($0.09) EPS, Q3 2025 earnings at ($0.08) EPS, Q4 2025 earnings at ($0.08) EPS, FY2025 earnings at ($0.34) EPS, Q1 2026 earnings at ($0.08) EPS, Q2 2026 earnings at ($0.08) EPS, Q3 2026 earnings at ($0.07) EPS and FY2026 earnings at ($0.30) EPS.

A number of other brokerages have also recently issued reports on OKLO. Seaport Res Ptn upgraded shares of Oklo to a "hold" rating in a report on Friday, September 6th. B. Riley began coverage on Oklo in a research report on Thursday, September 19th. They issued a "buy" rating and a $10.00 price objective for the company. Finally, Citigroup dropped their target price on shares of Oklo from $11.00 to $10.00 and set a "neutral" rating on the stock in a research report on Tuesday, September 24th.

Check Out Our Latest Analysis on Oklo

Oklo Stock Down 1.3 %

OKLO stock traded down $0.27 on Monday, hitting $21.25. 10,362,985 shares of the company's stock traded hands, compared to its average volume of 6,216,455. Oklo has a 1-year low of $5.35 and a 1-year high of $28.12. The stock has a fifty day moving average of $20.73 and a 200-day moving average of $12.52.

Hedge Funds Weigh In On Oklo

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Barclays PLC acquired a new position in shares of Oklo in the third quarter valued at about $58,000. Y Intercept Hong Kong Ltd bought a new position in shares of Oklo during the third quarter worth approximately $94,000. Peapack Gladstone Financial Corp bought a new stake in shares of Oklo in the third quarter valued at approximately $100,000. Sanctuary Advisors LLC bought a new stake in shares of Oklo in the third quarter valued at approximately $100,000. Finally, MML Investors Services LLC acquired a new position in Oklo in the 3rd quarter valued at $104,000. 85.03% of the stock is owned by institutional investors.

About Oklo

(

Get Free Report)

Oklo Inc designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States. It also provides used nuclear fuel recycling services. The company was founded in 2013 and is based in Santa Clara, California.

Featured Articles

Before you consider Oklo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oklo wasn't on the list.

While Oklo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.