Weiss Asset Management LP acquired a new position in Lumentum Holdings Inc. (NASDAQ:LITE - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 17,238 shares of the technology company's stock, valued at approximately $1,093,000.

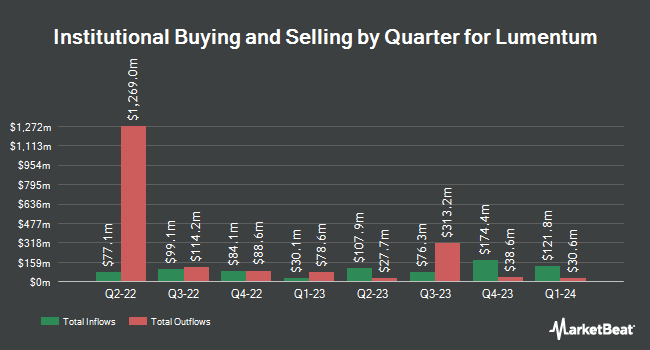

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Envestnet Portfolio Solutions Inc. grew its position in Lumentum by 30.5% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 11,824 shares of the technology company's stock valued at $602,000 after buying an additional 2,762 shares during the period. Mcdonald Partners LLC grew its position in Lumentum by 1.6% during the second quarter. Mcdonald Partners LLC now owns 19,830 shares of the technology company's stock valued at $1,010,000 after buying an additional 318 shares during the period. Leeward Investments LLC MA grew its position in Lumentum by 5.6% during the second quarter. Leeward Investments LLC MA now owns 377,152 shares of the technology company's stock valued at $19,205,000 after buying an additional 20,046 shares during the period. Legacy Capital Group California Inc. acquired a new stake in Lumentum during the second quarter valued at $346,000. Finally, JB Capital LLC grew its position in Lumentum by 85.0% during the second quarter. JB Capital LLC now owns 31,069 shares of the technology company's stock valued at $1,582,000 after buying an additional 14,271 shares during the period. Institutional investors and hedge funds own 94.05% of the company's stock.

Insider Transactions at Lumentum

In other Lumentum news, Director Penny Herscher sold 1,625 shares of Lumentum stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $81.09, for a total transaction of $131,771.25. Following the completion of the sale, the director now directly owns 6,852 shares in the company, valued at $555,628.68. This trade represents a 19.17 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Wajid Ali sold 29,887 shares of Lumentum stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $85.06, for a total transaction of $2,542,188.22. Following the sale, the chief financial officer now owns 56,492 shares of the company's stock, valued at approximately $4,805,209.52. This represents a 34.60 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 101,797 shares of company stock valued at $8,881,428. Corporate insiders own 0.19% of the company's stock.

Analysts Set New Price Targets

LITE has been the topic of several analyst reports. Morgan Stanley raised their price target on shares of Lumentum from $61.00 to $76.00 and gave the company an "equal weight" rating in a research report on Thursday, November 14th. Jefferies Financial Group increased their price objective on shares of Lumentum from $53.00 to $65.00 and gave the company a "buy" rating in a report on Thursday, August 15th. Needham & Company LLC increased their price objective on shares of Lumentum from $65.00 to $70.00 and gave the company a "buy" rating in a report on Thursday, August 15th. Susquehanna increased their price objective on shares of Lumentum from $80.00 to $115.00 and gave the company a "positive" rating in a report on Friday, November 8th. Finally, Craig Hallum increased their price objective on shares of Lumentum from $65.00 to $70.00 and gave the company a "buy" rating in a report on Thursday, August 15th. Three analysts have rated the stock with a sell rating, three have given a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $74.85.

Check Out Our Latest Research Report on LITE

Lumentum Price Performance

Shares of NASDAQ:LITE traded down $3.04 during midday trading on Monday, hitting $89.80. The company's stock had a trading volume of 1,145,902 shares, compared to its average volume of 1,495,426. The business's 50 day simple moving average is $74.95 and its 200 day simple moving average is $60.02. The company has a debt-to-equity ratio of 2.87, a quick ratio of 4.04 and a current ratio of 5.36. The company has a market cap of $6.17 billion, a P/E ratio of -11.21 and a beta of 0.94. Lumentum Holdings Inc. has a 12-month low of $38.28 and a 12-month high of $95.92.

Lumentum Company Profile

(

Free Report)

Lumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Featured Articles

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.