Weiss Asset Management LP acquired a new position in Tri Pointe Homes, Inc. (NYSE:TPH - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 354,579 shares of the construction company's stock, valued at approximately $16,066,000. Weiss Asset Management LP owned approximately 0.38% of Tri Pointe Homes as of its most recent SEC filing.

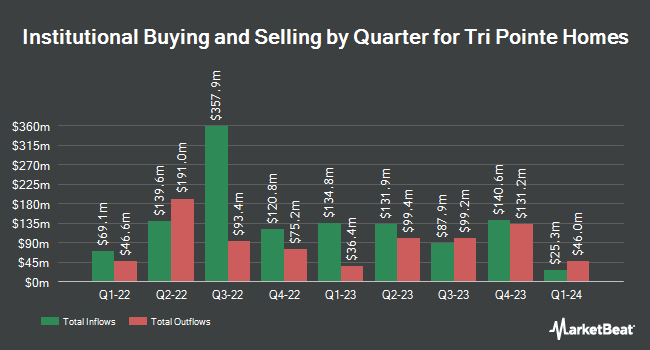

A number of other large investors also recently modified their holdings of TPH. GSA Capital Partners LLP lifted its stake in Tri Pointe Homes by 4.4% in the third quarter. GSA Capital Partners LLP now owns 6,189 shares of the construction company's stock valued at $280,000 after acquiring an additional 258 shares during the last quarter. Empowered Funds LLC increased its holdings in shares of Tri Pointe Homes by 0.3% during the 3rd quarter. Empowered Funds LLC now owns 99,346 shares of the construction company's stock worth $4,501,000 after acquiring an additional 265 shares during the last quarter. Blue Trust Inc. lifted its holdings in Tri Pointe Homes by 31.7% during the 2nd quarter. Blue Trust Inc. now owns 1,774 shares of the construction company's stock valued at $69,000 after purchasing an additional 427 shares during the last quarter. Evergreen Capital Management LLC increased its holdings in shares of Tri Pointe Homes by 7.1% in the second quarter. Evergreen Capital Management LLC now owns 7,863 shares of the construction company's stock valued at $293,000 after purchasing an additional 519 shares during the last quarter. Finally, Diversified Trust Co lifted its stake in shares of Tri Pointe Homes by 4.2% during the 2nd quarter. Diversified Trust Co now owns 13,308 shares of the construction company's stock worth $496,000 after buying an additional 536 shares during the last quarter. 97.01% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on TPH. Zelman & Associates upgraded shares of Tri Pointe Homes from an "underperform" rating to a "neutral" rating and set a $43.00 price target on the stock in a research note on Tuesday, September 17th. Oppenheimer lowered their target price on Tri Pointe Homes from $56.00 to $53.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. Wedbush restated a "neutral" rating and issued a $42.00 price target on shares of Tri Pointe Homes in a research note on Thursday, October 24th. Finally, Royal Bank of Canada dropped their target price on Tri Pointe Homes from $48.00 to $45.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Two research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Tri Pointe Homes presently has a consensus rating of "Moderate Buy" and an average target price of $45.75.

Check Out Our Latest Research Report on Tri Pointe Homes

Tri Pointe Homes Price Performance

NYSE TPH traded down $0.02 during midday trading on Friday, hitting $41.50. The company had a trading volume of 431,279 shares, compared to its average volume of 877,992. The company has a market capitalization of $3.88 billion, a PE ratio of 8.62, a P/E/G ratio of 0.71 and a beta of 1.60. Tri Pointe Homes, Inc. has a twelve month low of $30.27 and a twelve month high of $47.78. The company has a current ratio of 1.64, a quick ratio of 1.64 and a debt-to-equity ratio of 0.28. The firm has a 50-day moving average price of $42.99 and a 200-day moving average price of $41.75.

Tri Pointe Homes (NYSE:TPH - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The construction company reported $1.18 earnings per share for the quarter, topping the consensus estimate of $1.07 by $0.11. Tri Pointe Homes had a net margin of 10.41% and a return on equity of 14.83%. The business had revenue of $1.11 billion during the quarter, compared to analysts' expectations of $1.05 billion. During the same quarter in the prior year, the business posted $0.76 earnings per share. Tri Pointe Homes's revenue was up 34.9% compared to the same quarter last year. As a group, analysts anticipate that Tri Pointe Homes, Inc. will post 4.72 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, General Counsel David Ch Lee sold 5,000 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $44.28, for a total value of $221,400.00. Following the sale, the general counsel now directly owns 85,792 shares in the company, valued at approximately $3,798,869.76. This trade represents a 5.51 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 2.00% of the stock is currently owned by company insiders.

About Tri Pointe Homes

(

Free Report)

Tri Pointe Homes, Inc engages in the design, construction, and sale of single-family attached and detached homes in the United States. The company operates through a portfolio of six regional home building brands comprising Maracay in Arizona; Pardee Homes in California and Nevada; Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe Homes in California, Colorado, and the Carolinas; and Winchester Homes in Maryland and Northern Virginia.

Read More

Before you consider Tri Pointe Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri Pointe Homes wasn't on the list.

While Tri Pointe Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.