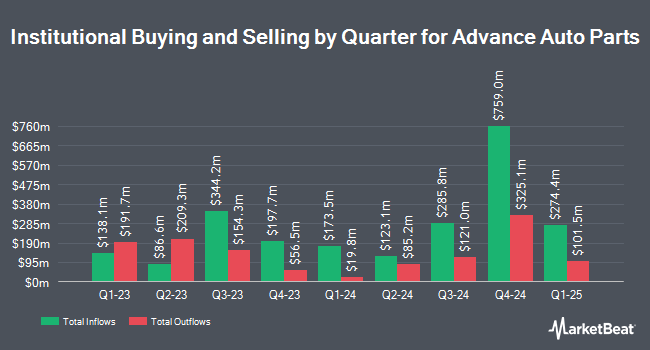

Weiss Asset Management LP lowered its stake in shares of Advance Auto Parts, Inc. (NYSE:AAP - Free Report) by 97.0% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 15,401 shares of the company's stock after selling 503,024 shares during the quarter. Weiss Asset Management LP's holdings in Advance Auto Parts were worth $600,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently made changes to their positions in AAP. Pzena Investment Management LLC raised its position in shares of Advance Auto Parts by 140.3% during the 3rd quarter. Pzena Investment Management LLC now owns 2,908,658 shares of the company's stock valued at $113,409,000 after buying an additional 1,698,155 shares in the last quarter. Dorsal Capital Management LP grew its holdings in shares of Advance Auto Parts by 159.7% during the 2nd quarter. Dorsal Capital Management LP now owns 1,250,000 shares of the company's stock valued at $79,162,000 after purchasing an additional 768,664 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in shares of Advance Auto Parts by 76.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,266,362 shares of the company's stock valued at $80,197,000 after purchasing an additional 547,696 shares during the last quarter. International Assets Investment Management LLC bought a new position in shares of Advance Auto Parts during the 3rd quarter valued at $17,477,000. Finally, Connor Clark & Lunn Investment Management Ltd. bought a new position in shares of Advance Auto Parts during the 3rd quarter valued at $14,684,000. Hedge funds and other institutional investors own 88.75% of the company's stock.

Advance Auto Parts Stock Up 5.5 %

NYSE AAP traded up $2.49 during trading hours on Monday, reaching $47.46. 4,055,054 shares of the company's stock traded hands, compared to its average volume of 2,087,985. Advance Auto Parts, Inc. has a 52-week low of $35.59 and a 52-week high of $88.56. The firm has a market cap of $2.84 billion, a PE ratio of 61.60 and a beta of 1.21. The firm has a 50-day simple moving average of $39.51 and a 200 day simple moving average of $50.71. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.34 and a quick ratio of 0.62.

Advance Auto Parts (NYSE:AAP - Get Free Report) last issued its earnings results on Thursday, November 14th. The company reported ($0.04) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.49 by ($0.53). Advance Auto Parts had a return on equity of 1.82% and a net margin of 0.41%. The firm had revenue of $2.15 billion during the quarter, compared to analysts' expectations of $2.62 billion. During the same period last year, the firm posted ($0.82) earnings per share. The firm's quarterly revenue was down 3.2% on a year-over-year basis. Sell-side analysts anticipate that Advance Auto Parts, Inc. will post -0.51 EPS for the current fiscal year.

Advance Auto Parts Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, January 24th. Stockholders of record on Friday, January 10th will be paid a $0.25 dividend. The ex-dividend date is Friday, January 10th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 2.11%. Advance Auto Parts's dividend payout ratio is presently 136.99%.

Wall Street Analysts Forecast Growth

Several research firms recently commented on AAP. Wedbush reaffirmed an "outperform" rating and set a $55.00 target price on shares of Advance Auto Parts in a report on Friday, November 15th. Roth Mkm reaffirmed a "neutral" rating and set a $40.00 target price on shares of Advance Auto Parts in a report on Wednesday, October 16th. Evercore ISI increased their target price on shares of Advance Auto Parts from $45.00 to $60.00 and gave the company a "hold" rating in a report on Wednesday, November 20th. DA Davidson reaffirmed a "neutral" rating and set a $45.00 target price on shares of Advance Auto Parts in a report on Friday, November 15th. Finally, Truist Financial cut their price target on shares of Advance Auto Parts from $41.00 to $39.00 and set a "hold" rating on the stock in a report on Friday, November 15th. One analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $48.64.

Get Our Latest Analysis on Advance Auto Parts

Insider Transactions at Advance Auto Parts

In other news, EVP Tammy M. Finley sold 1,276 shares of Advance Auto Parts stock in a transaction that occurred on Thursday, December 5th. The shares were sold at an average price of $44.06, for a total value of $56,220.56. Following the completion of the sale, the executive vice president now directly owns 24,266 shares in the company, valued at $1,069,159.96. The trade was a 5.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Company insiders own 0.35% of the company's stock.

Advance Auto Parts Profile

(

Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Recommended Stories

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.