Weiss Asset Management LP purchased a new position in CSX Co. (NASDAQ:CSX - Free Report) during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm purchased 46,079 shares of the transportation company's stock, valued at approximately $1,591,000.

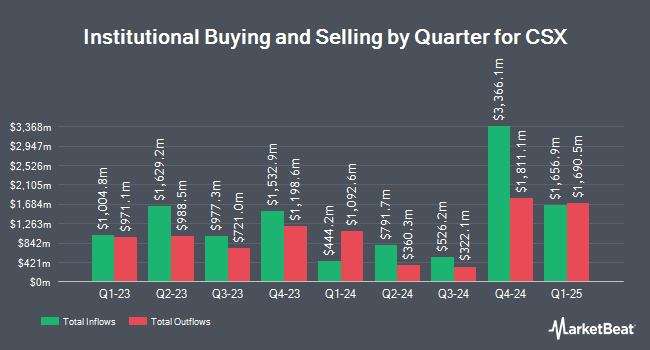

Other institutional investors and hedge funds also recently made changes to their positions in the company. Itau Unibanco Holding S.A. bought a new position in CSX during the second quarter valued at about $26,000. Valley Wealth Managers Inc. grew its holdings in shares of CSX by 177.8% during the 3rd quarter. Valley Wealth Managers Inc. now owns 750 shares of the transportation company's stock worth $26,000 after purchasing an additional 480 shares in the last quarter. MFA Wealth Advisors LLC bought a new stake in shares of CSX during the second quarter valued at approximately $27,000. Morton Brown Family Wealth LLC acquired a new position in shares of CSX in the third quarter valued at $31,000. Finally, Fairscale Capital LLC bought a new position in CSX in the second quarter worth $32,000. Institutional investors own 73.57% of the company's stock.

Analyst Upgrades and Downgrades

CSX has been the topic of several analyst reports. Royal Bank of Canada lowered their price target on shares of CSX from $36.00 to $35.00 and set a "sector perform" rating on the stock in a report on Thursday, October 17th. Evercore ISI dropped their price target on shares of CSX from $38.00 to $37.00 and set an "outperform" rating for the company in a research report on Thursday, October 17th. Susquehanna decreased their price objective on CSX from $42.00 to $40.00 and set a "positive" rating on the stock in a report on Thursday, October 17th. Stephens dropped their target price on CSX from $41.00 to $39.00 and set an "overweight" rating for the company in a report on Thursday, October 17th. Finally, Loop Capital cut their target price on CSX from $43.00 to $42.00 and set a "buy" rating for the company in a research report on Thursday, October 17th. Seven investment analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $38.78.

Read Our Latest Research Report on CSX

CSX Price Performance

Shares of CSX stock traded down $0.17 during midday trading on Friday, reaching $34.45. The company had a trading volume of 10,491,927 shares, compared to its average volume of 10,738,611. The stock has a fifty day simple moving average of $34.84 and a 200 day simple moving average of $34.09. CSX Co. has a 1-year low of $31.74 and a 1-year high of $40.12. The company has a current ratio of 1.39, a quick ratio of 1.23 and a debt-to-equity ratio of 1.43. The company has a market capitalization of $66.43 billion, a price-to-earnings ratio of 18.52, a price-to-earnings-growth ratio of 2.24 and a beta of 1.20.

CSX (NASDAQ:CSX - Get Free Report) last released its earnings results on Wednesday, October 16th. The transportation company reported $0.46 earnings per share for the quarter, missing analysts' consensus estimates of $0.48 by ($0.02). The firm had revenue of $3.62 billion for the quarter, compared to the consensus estimate of $3.68 billion. CSX had a return on equity of 28.92% and a net margin of 24.77%. The company's revenue was up 1.3% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.42 EPS. As a group, equities research analysts forecast that CSX Co. will post 1.84 earnings per share for the current year.

CSX Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be given a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 1.39%. The ex-dividend date is Friday, November 29th. CSX's dividend payout ratio is 25.81%.

CSX Company Profile

(

Free Report)

CSX Corporation, together with its subsidiaries, provides rail-based freight transportation services. The company offers rail services; and transportation of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. It also transports chemicals, agricultural and food products, minerals, automotive, forest products, fertilizers, and metals and equipment; and coal, coke, and iron ore to electricity-generating power plants, steel manufacturers, and industrial plants, as well as exports coal to deep-water port facilities.

Recommended Stories

Before you consider CSX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSX wasn't on the list.

While CSX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.