Weiss Asset Management LP acquired a new stake in Textron Inc. (NYSE:TXT - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 24,962 shares of the aerospace company's stock, valued at approximately $2,211,000.

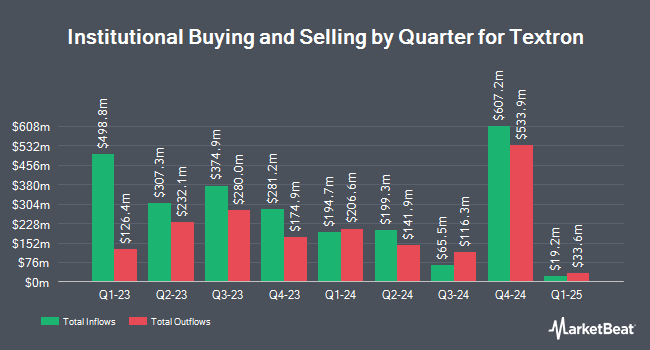

A number of other large investors have also added to or reduced their stakes in TXT. Dimensional Fund Advisors LP increased its stake in shares of Textron by 6.1% in the second quarter. Dimensional Fund Advisors LP now owns 2,808,600 shares of the aerospace company's stock valued at $241,152,000 after buying an additional 160,923 shares during the period. Brandes Investment Partners LP lifted its position in shares of Textron by 20.0% in the 2nd quarter. Brandes Investment Partners LP now owns 1,549,551 shares of the aerospace company's stock worth $133,096,000 after purchasing an additional 258,778 shares during the period. AQR Capital Management LLC boosted its stake in shares of Textron by 18.9% in the 2nd quarter. AQR Capital Management LLC now owns 1,451,293 shares of the aerospace company's stock valued at $124,608,000 after purchasing an additional 231,173 shares during the last quarter. Bank of New York Mellon Corp increased its position in shares of Textron by 0.4% during the second quarter. Bank of New York Mellon Corp now owns 1,398,779 shares of the aerospace company's stock worth $120,099,000 after buying an additional 6,175 shares during the period. Finally, TD Asset Management Inc raised its stake in Textron by 3.2% during the second quarter. TD Asset Management Inc now owns 1,087,342 shares of the aerospace company's stock worth $93,359,000 after buying an additional 33,394 shares during the last quarter. Institutional investors own 86.03% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on TXT. JPMorgan Chase & Co. decreased their price target on Textron from $100.00 to $95.00 and set a "neutral" rating for the company in a report on Monday, October 14th. UBS Group lowered their target price on Textron from $87.00 to $79.00 and set a "sell" rating for the company in a report on Friday, October 25th. Robert W. Baird cut their price target on Textron from $109.00 to $100.00 and set an "outperform" rating on the stock in a report on Friday, October 25th. TD Cowen lowered shares of Textron from a "buy" rating to a "hold" rating and lowered their price objective for the company from $103.00 to $95.00 in a research note on Wednesday, September 25th. Finally, StockNews.com lowered shares of Textron from a "strong-buy" rating to a "buy" rating in a research note on Thursday, September 12th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $101.56.

Read Our Latest Research Report on Textron

Textron Stock Down 0.5 %

TXT stock traded down $0.45 during midday trading on Friday, reaching $82.66. 1,320,996 shares of the company's stock traded hands, compared to its average volume of 983,434. The company has a quick ratio of 0.82, a current ratio of 1.83 and a debt-to-equity ratio of 0.46. The firm's fifty day moving average price is $85.49 and its 200-day moving average price is $86.97. Textron Inc. has a 52 week low of $75.70 and a 52 week high of $97.33. The company has a market cap of $15.33 billion, a price-to-earnings ratio of 18.17, a P/E/G ratio of 1.49 and a beta of 1.25.

Textron (NYSE:TXT - Get Free Report) last posted its earnings results on Thursday, October 24th. The aerospace company reported $1.40 earnings per share for the quarter, missing analysts' consensus estimates of $1.49 by ($0.09). The business had revenue of $3.43 billion during the quarter, compared to analyst estimates of $3.50 billion. Textron had a return on equity of 16.02% and a net margin of 6.30%. The company's revenue was up 2.5% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.49 EPS. As a group, sell-side analysts forecast that Textron Inc. will post 5.52 earnings per share for the current fiscal year.

Textron Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Investors of record on Friday, December 13th will be given a dividend of $0.02 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.08 annualized dividend and a dividend yield of 0.10%. Textron's payout ratio is 1.76%.

About Textron

(

Free Report)

Textron Inc operates in the aircraft, defense, industrial, and finance businesses worldwide. It operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. The Textron Aviation segment manufactures, sells, and services business jets, turboprop and piston engine aircraft, and military trainer and defense aircraft; and offers maintenance, inspection, and repair services, as well as sells commercial parts.

Read More

Before you consider Textron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Textron wasn't on the list.

While Textron currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.