10x Genomics (NASDAQ:TXG - Get Free Report)'s stock had its "sell (e+)" rating reaffirmed by Weiss Ratings in a research note issued on Saturday,Weiss Ratings reports.

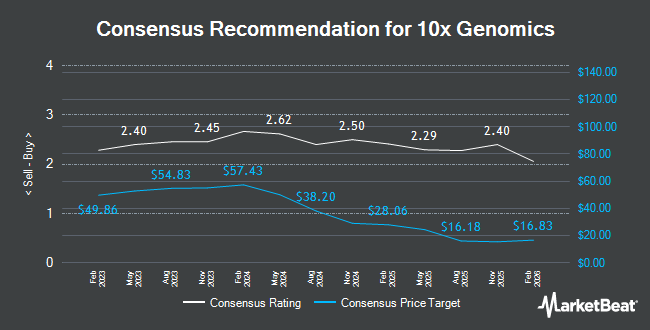

TXG has been the topic of a number of other reports. Morgan Stanley reduced their target price on shares of 10x Genomics from $30.00 to $28.00 and set an "overweight" rating on the stock in a report on Monday, January 13th. Citigroup decreased their target price on shares of 10x Genomics from $35.00 to $23.00 and set a "buy" rating on the stock in a research report on Wednesday, October 30th. Stephens reiterated an "overweight" rating and issued a $30.00 price target on shares of 10x Genomics in a report on Thursday, October 10th. UBS Group decreased their price objective on 10x Genomics from $25.00 to $20.00 and set a "neutral" rating on the stock in a report on Wednesday, October 30th. Finally, JPMorgan Chase & Co. dropped their target price on 10x Genomics from $20.00 to $14.00 and set a "neutral" rating for the company in a research note on Wednesday, October 30th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating, eight have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $23.86.

View Our Latest Research Report on 10x Genomics

10x Genomics Stock Performance

TXG stock traded down $0.01 during trading on Friday, reaching $15.08. 1,324,480 shares of the company were exchanged, compared to its average volume of 1,475,648. 10x Genomics has a 52-week low of $12.95 and a 52-week high of $51.22. The company has a market cap of $1.83 billion, a P/E ratio of -9.86 and a beta of 1.83. The stock's 50 day moving average price is $14.96 and its 200 day moving average price is $17.95.

10x Genomics (NASDAQ:TXG - Get Free Report) last posted its earnings results on Tuesday, October 29th. The company reported ($0.30) EPS for the quarter, topping analysts' consensus estimates of ($0.34) by $0.04. 10x Genomics had a negative return on equity of 25.07% and a negative net margin of 28.93%. The company had revenue of $151.65 million for the quarter, compared to the consensus estimate of $158.84 million. During the same period in the previous year, the business earned ($0.51) earnings per share. 10x Genomics's quarterly revenue was down 1.3% compared to the same quarter last year. As a group, equities research analysts forecast that 10x Genomics will post -1.43 EPS for the current year.

Institutional Investors Weigh In On 10x Genomics

A number of institutional investors have recently modified their holdings of the stock. GAMMA Investing LLC lifted its holdings in 10x Genomics by 451.8% in the third quarter. GAMMA Investing LLC now owns 1,545 shares of the company's stock worth $35,000 after acquiring an additional 1,265 shares during the last quarter. Capital Performance Advisors LLP bought a new stake in 10x Genomics in the third quarter valued at $35,000. Blue Trust Inc. boosted its holdings in shares of 10x Genomics by 136.5% during the third quarter. Blue Trust Inc. now owns 1,776 shares of the company's stock valued at $40,000 after acquiring an additional 1,025 shares during the period. Sound Income Strategies LLC bought a new position in shares of 10x Genomics during the third quarter worth about $46,000. Finally, Venturi Wealth Management LLC increased its holdings in shares of 10x Genomics by 1,108.9% in the 3rd quarter. Venturi Wealth Management LLC now owns 2,442 shares of the company's stock worth $55,000 after acquiring an additional 2,240 shares during the period. Institutional investors and hedge funds own 84.68% of the company's stock.

10x Genomics Company Profile

(

Get Free Report)

10x Genomics, Inc, a life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the America, Europe, the Middle East, Africa, China, and the Asia Pacific. The company provides chromium, chromium connect, and chromium controller instruments, microfluidic chips, slides, reagents, and other consumables products.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider 10x Genomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 10x Genomics wasn't on the list.

While 10x Genomics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.