WELL Health Technologies (TSE:WELL - Get Free Report) had its target price lowered by equities research analysts at Ventum Financial from C$8.00 to C$7.60 in a report released on Wednesday,BayStreet.CA reports. The firm currently has a "buy" rating on the stock. Ventum Financial's target price would suggest a potential upside of 101.59% from the stock's current price.

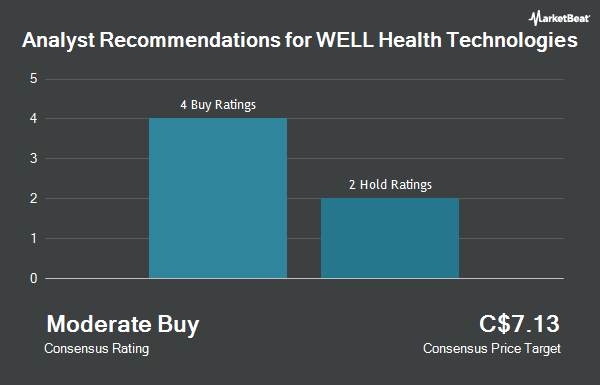

A number of other research analysts also recently weighed in on WELL. Raymond James increased their target price on shares of WELL Health Technologies from C$10.00 to C$11.00 in a research report on Tuesday, December 17th. Royal Bank of Canada dropped their price target on WELL Health Technologies from C$8.50 to C$7.50 and set an "outperform" rating on the stock in a research report on Monday, March 31st. Finally, TD Securities dropped their price objective on shares of WELL Health Technologies from C$8.50 to C$7.50 and set a "buy" rating on the stock in a report on Wednesday, April 16th. One equities research analyst has rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, WELL Health Technologies has a consensus rating of "Moderate Buy" and a consensus target price of C$8.08.

Read Our Latest Analysis on WELL

WELL Health Technologies Stock Performance

TSE:WELL traded down C$0.19 during trading on Wednesday, reaching C$3.77. The company's stock had a trading volume of 1,110,064 shares, compared to its average volume of 1,005,995. WELL Health Technologies has a 12 month low of C$3.48 and a 12 month high of C$7.36. The firm has a market cap of C$942.21 million, a price-to-earnings ratio of 12.77, a price-to-earnings-growth ratio of -1.93 and a beta of 1.20. The firm has a 50 day moving average of C$5.07 and a 200-day moving average of C$5.56. The company has a debt-to-equity ratio of 46.79, a quick ratio of 1.02 and a current ratio of 1.14.

About WELL Health Technologies

(

Get Free Report)

WELL Health Technologies Corp. operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally. It provides omni-channel patient services and solutions to specific markets, such as provider staffing, anesthesia, gastrointestinal health, women's health, primary care, and mental healthcare.

Recommended Stories

Before you consider WELL Health Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WELL Health Technologies wasn't on the list.

While WELL Health Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.