Wellington Management Group LLP boosted its holdings in shares of Celanese Co. (NYSE:CE - Free Report) by 27.4% during the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 9,460,353 shares of the basic materials company's stock after purchasing an additional 2,036,362 shares during the period. Wellington Management Group LLP owned approximately 8.66% of Celanese worth $1,286,230,000 as of its most recent filing with the SEC.

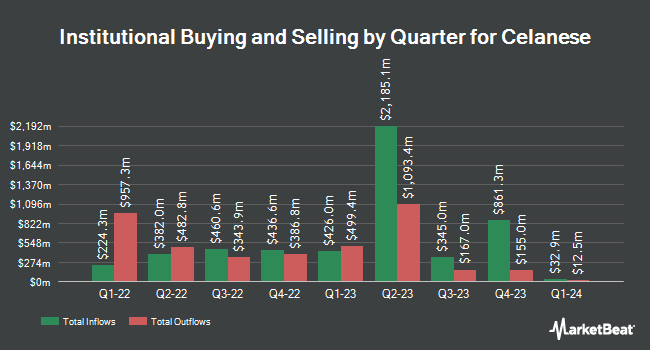

A number of other institutional investors also recently bought and sold shares of CE. Cetera Investment Advisers raised its position in Celanese by 64.1% during the 1st quarter. Cetera Investment Advisers now owns 27,107 shares of the basic materials company's stock worth $4,659,000 after buying an additional 10,587 shares during the last quarter. Cetera Advisors LLC boosted its holdings in Celanese by 447.8% in the 1st quarter. Cetera Advisors LLC now owns 7,072 shares of the basic materials company's stock valued at $1,215,000 after purchasing an additional 5,781 shares in the last quarter. Capital Investment Advisors LLC boosted its holdings in Celanese by 16.9% in the 2nd quarter. Capital Investment Advisors LLC now owns 8,196 shares of the basic materials company's stock valued at $1,105,000 after purchasing an additional 1,183 shares in the last quarter. QRG Capital Management Inc. increased its position in Celanese by 7.8% during the 2nd quarter. QRG Capital Management Inc. now owns 15,611 shares of the basic materials company's stock worth $2,106,000 after purchasing an additional 1,136 shares during the period. Finally, SG Americas Securities LLC raised its stake in shares of Celanese by 100.6% during the 2nd quarter. SG Americas Securities LLC now owns 34,933 shares of the basic materials company's stock worth $4,712,000 after buying an additional 17,521 shares in the last quarter. 98.87% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts recently weighed in on the company. KeyCorp lowered Celanese from an "overweight" rating to a "sector weight" rating in a report on Monday, October 7th. Piper Sandler downgraded shares of Celanese from a "neutral" rating to an "underweight" rating and cut their price target for the company from $150.00 to $98.00 in a report on Friday, November 8th. Vertical Research downgraded shares of Celanese from a "hold" rating to a "sell" rating and set a $130.00 price objective on the stock. in a report on Tuesday, October 29th. Bank of America dropped their target price on shares of Celanese from $137.00 to $128.00 and set an "underperform" rating for the company in a report on Monday, August 12th. Finally, UBS Group lowered Celanese from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $161.00 to $97.00 in a research note on Monday, November 11th. Five equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $116.56.

Check Out Our Latest Stock Report on Celanese

Celanese Trading Up 1.6 %

Celanese stock traded up $1.10 during trading on Friday, hitting $70.54. The company's stock had a trading volume of 2,854,736 shares, compared to its average volume of 3,046,687. The stock's fifty day moving average is $105.19 and its 200 day moving average is $125.00. The company has a debt-to-equity ratio of 1.47, a quick ratio of 0.76 and a current ratio of 1.37. Celanese Co. has a 1-year low of $68.88 and a 1-year high of $172.16. The stock has a market capitalization of $7.71 billion, a price-to-earnings ratio of 7.10, a P/E/G ratio of 0.75 and a beta of 1.17.

Celanese (NYSE:CE - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The basic materials company reported $2.44 EPS for the quarter, missing analysts' consensus estimates of $2.85 by ($0.41). Celanese had a net margin of 10.40% and a return on equity of 13.17%. The company had revenue of $2.65 billion for the quarter, compared to analyst estimates of $2.70 billion. During the same period in the prior year, the company earned $2.50 EPS. The company's revenue was down 2.8% compared to the same quarter last year. As a group, equities research analysts predict that Celanese Co. will post 8.38 EPS for the current year.

Celanese Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, November 13th. Shareholders of record on Wednesday, October 30th were given a dividend of $0.70 per share. This represents a $2.80 dividend on an annualized basis and a yield of 3.97%. The ex-dividend date was Wednesday, October 30th. Celanese's dividend payout ratio (DPR) is presently 28.17%.

About Celanese

(

Free Report)

Celanese Corporation, a chemical and specialty materials company, manufactures and sells high performance engineered polymers in the United States and internationally. It operates through Engineered Materials and Acetyl Chain. The Engineered Materials segment develops, produces, and supplies specialty polymers for automotive and medical applications, as well as for use in industrial products and consumer electronics.

See Also

Before you consider Celanese, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celanese wasn't on the list.

While Celanese currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.