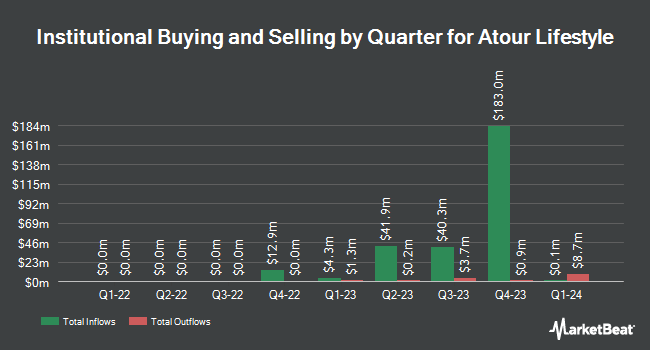

Wellington Management Group LLP bought a new position in shares of Atour Lifestyle Holdings Limited (NASDAQ:ATAT - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 48,228 shares of the company's stock, valued at approximately $1,251,000.

Other hedge funds and other institutional investors also recently modified their holdings of the company. FMR LLC raised its stake in shares of Atour Lifestyle by 352.7% during the 3rd quarter. FMR LLC now owns 889,942 shares of the company's stock worth $23,085,000 after buying an additional 693,342 shares during the last quarter. Jupiter Asset Management Ltd. acquired a new position in Atour Lifestyle during the second quarter worth about $4,406,000. Quadrature Capital Ltd purchased a new stake in shares of Atour Lifestyle in the third quarter valued at about $856,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC acquired a new stake in shares of Atour Lifestyle in the third quarter valued at approximately $2,741,000. Finally, Burgundy Asset Management Ltd. increased its stake in shares of Atour Lifestyle by 41.6% during the 2nd quarter. Burgundy Asset Management Ltd. now owns 613,718 shares of the company's stock worth $11,262,000 after purchasing an additional 180,368 shares in the last quarter. 17.79% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, The Goldman Sachs Group initiated coverage on Atour Lifestyle in a research note on Monday, December 9th. They issued a "buy" rating and a $34.40 target price on the stock.

Get Our Latest Report on Atour Lifestyle

Atour Lifestyle Price Performance

NASDAQ:ATAT traded up $0.67 on Friday, reaching $27.99. The stock had a trading volume of 742,775 shares, compared to its average volume of 990,007. Atour Lifestyle Holdings Limited has a 12-month low of $15.22 and a 12-month high of $29.90. The company has a market cap of $3.85 billion, a price-to-earnings ratio of 24.13, a P/E/G ratio of 0.65 and a beta of 0.52. The firm's fifty day moving average is $26.57 and its two-hundred day moving average is $21.78.

About Atour Lifestyle

(

Free Report)

Atour Lifestyle Holdings Limited, through its subsidiaries, develops lifestyle brands around hotel offerings in the People's Republic of China. The company provides hotel management services, including day-to-day management services of the hotels for the franchisees; and sells hotel supplies and other products.

Recommended Stories

Before you consider Atour Lifestyle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atour Lifestyle wasn't on the list.

While Atour Lifestyle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.