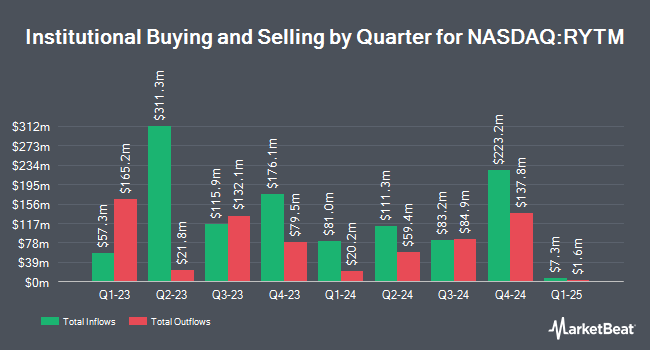

Wellington Management Group LLP lowered its holdings in shares of Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM - Free Report) by 86.3% in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 27,716 shares of the company's stock after selling 174,610 shares during the quarter. Wellington Management Group LLP's holdings in Rhythm Pharmaceuticals were worth $1,452,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors have also recently made changes to their positions in RYTM. CWM LLC increased its position in Rhythm Pharmaceuticals by 62.6% in the second quarter. CWM LLC now owns 657 shares of the company's stock worth $27,000 after buying an additional 253 shares in the last quarter. ORG Wealth Partners LLC bought a new position in shares of Rhythm Pharmaceuticals during the 3rd quarter valued at approximately $63,000. Quest Partners LLC increased its holdings in Rhythm Pharmaceuticals by 513.3% in the 2nd quarter. Quest Partners LLC now owns 1,662 shares of the company's stock worth $68,000 after acquiring an additional 1,391 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. raised its stake in Rhythm Pharmaceuticals by 21.5% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,211 shares of the company's stock worth $114,000 after acquiring an additional 391 shares during the period. Finally, Creative Planning bought a new stake in Rhythm Pharmaceuticals during the 3rd quarter worth approximately $450,000.

Analysts Set New Price Targets

A number of analysts have recently issued reports on the stock. Canaccord Genuity Group reissued a "buy" rating and issued a $80.00 price objective on shares of Rhythm Pharmaceuticals in a research note on Tuesday, November 19th. Guggenheim initiated coverage on shares of Rhythm Pharmaceuticals in a report on Monday, October 21st. They issued a "buy" rating and a $70.00 target price for the company. HC Wainwright reissued a "buy" rating and set a $69.00 price target on shares of Rhythm Pharmaceuticals in a report on Wednesday, December 4th. The Goldman Sachs Group upped their price objective on Rhythm Pharmaceuticals from $59.00 to $66.00 and gave the stock a "buy" rating in a research note on Thursday, December 5th. Finally, TD Cowen increased their target price on Rhythm Pharmaceuticals from $55.00 to $65.00 and gave the stock a "buy" rating in a research report on Wednesday, November 6th. One analyst has rated the stock with a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat, Rhythm Pharmaceuticals has an average rating of "Moderate Buy" and an average price target of $63.70.

View Our Latest Stock Analysis on RYTM

Rhythm Pharmaceuticals Trading Up 3.3 %

Shares of NASDAQ:RYTM traded up $1.79 during mid-day trading on Thursday, reaching $55.48. The stock had a trading volume of 586,267 shares, compared to its average volume of 544,656. The company has a market cap of $3.41 billion, a P/E ratio of -12.81 and a beta of 2.14. The business's 50 day moving average price is $56.11 and its 200 day moving average price is $49.82. Rhythm Pharmaceuticals, Inc. has a 1 year low of $35.17 and a 1 year high of $68.58.

Rhythm Pharmaceuticals (NASDAQ:RYTM - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The company reported ($0.73) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.80) by $0.07. Rhythm Pharmaceuticals had a negative return on equity of 367.36% and a negative net margin of 230.07%. The business had revenue of $33.20 million for the quarter, compared to analysts' expectations of $32.52 million. During the same period in the prior year, the firm earned ($0.76) EPS. The company's revenue for the quarter was up 47.6% on a year-over-year basis. Analysts predict that Rhythm Pharmaceuticals, Inc. will post -4.34 earnings per share for the current fiscal year.

Insider Buying and Selling at Rhythm Pharmaceuticals

In other news, insider Pamela J. Cramer sold 4,688 shares of the firm's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $65.00, for a total value of $304,720.00. Following the completion of the sale, the insider now owns 13,500 shares of the company's stock, valued at $877,500. This trade represents a 25.78 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Jennifer Kayden Lee sold 66,861 shares of the business's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $66.33, for a total value of $4,434,890.13. Following the transaction, the executive vice president now owns 972 shares in the company, valued at approximately $64,472.76. This trade represents a 98.57 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 84,830 shares of company stock worth $5,622,000 over the last 90 days. 5.60% of the stock is owned by insiders.

Rhythm Pharmaceuticals Profile

(

Free Report)

Rhythm Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases. The company's lead product candidate is IMCIVREE (setmelanotide), a rare melanocortin-4 receptor for the treatment of pro-opiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1, leptin receptor (LEPR) deficiency obesity, and Bardet-Biedl and Alström syndrome.

Further Reading

Before you consider Rhythm Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rhythm Pharmaceuticals wasn't on the list.

While Rhythm Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.