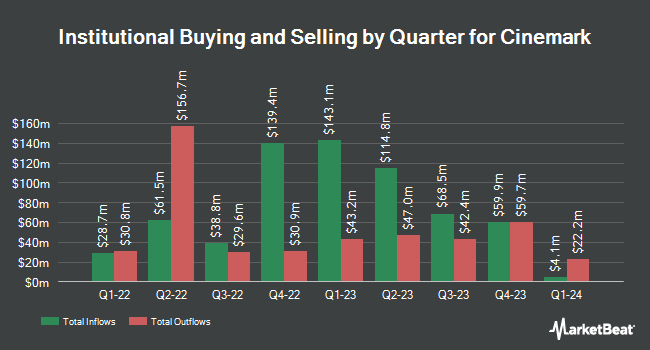

Wellington Management Group LLP lessened its stake in Cinemark Holdings, Inc. (NYSE:CNK - Free Report) by 28.3% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 8,280,631 shares of the company's stock after selling 3,263,581 shares during the quarter. Wellington Management Group LLP owned 6.77% of Cinemark worth $256,534,000 at the end of the most recent reporting period.

Several other large investors also recently made changes to their positions in CNK. O Shaughnessy Asset Management LLC lifted its holdings in shares of Cinemark by 121.2% in the fourth quarter. O Shaughnessy Asset Management LLC now owns 60,597 shares of the company's stock valued at $1,877,000 after purchasing an additional 33,197 shares in the last quarter. Arrowstreet Capital Limited Partnership boosted its position in Cinemark by 100.2% during the 4th quarter. Arrowstreet Capital Limited Partnership now owns 4,104,552 shares of the company's stock worth $127,159,000 after acquiring an additional 2,054,579 shares during the last quarter. denkapparat Operations GmbH bought a new position in shares of Cinemark during the 4th quarter worth approximately $291,000. New Age Alpha Advisors LLC acquired a new stake in shares of Cinemark in the fourth quarter valued at approximately $183,000. Finally, Norges Bank bought a new stake in shares of Cinemark in the fourth quarter worth $25,623,000.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. Benchmark cut their price target on shares of Cinemark from $40.00 to $35.00 and set a "buy" rating on the stock in a research report on Thursday, February 20th. Wedbush reaffirmed a "neutral" rating and issued a $32.00 target price on shares of Cinemark in a report on Tuesday, February 18th. Barrington Research reiterated an "outperform" rating and set a $40.00 price target on shares of Cinemark in a report on Wednesday, February 19th. Wells Fargo & Company cut their price objective on Cinemark from $38.00 to $36.00 and set an "overweight" rating for the company in a research report on Wednesday, January 29th. Finally, Morgan Stanley decreased their target price on Cinemark from $40.00 to $35.00 and set an "overweight" rating on the stock in a report on Thursday, February 20th. One research analyst has rated the stock with a sell rating, four have assigned a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $32.70.

View Our Latest Analysis on Cinemark

Insider Buying and Selling at Cinemark

In other Cinemark news, insider Wanda Marie Gierhart sold 9,119 shares of the firm's stock in a transaction that occurred on Tuesday, February 25th. The shares were sold at an average price of $27.00, for a total value of $246,213.00. Following the sale, the insider now owns 147,414 shares in the company, valued at $3,980,178. This trade represents a 5.83 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Company insiders own 2.30% of the company's stock.

Cinemark Price Performance

Cinemark stock traded down $0.46 during trading hours on Friday, reaching $24.53. 4,202,573 shares of the stock were exchanged, compared to its average volume of 2,926,247. The company has a current ratio of 1.01, a quick ratio of 0.96 and a debt-to-equity ratio of 3.28. Cinemark Holdings, Inc. has a twelve month low of $16.32 and a twelve month high of $36.28. The company has a market cap of $3.00 billion, a P/E ratio of 12.09 and a beta of 2.41. The stock has a 50 day moving average of $27.21 and a two-hundred day moving average of $29.30.

Cinemark (NYSE:CNK - Get Free Report) last announced its quarterly earnings data on Wednesday, February 19th. The company reported $0.33 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.39 by ($0.06). Cinemark had a net margin of 10.16% and a return on equity of 65.83%. The firm had revenue of $814.30 million during the quarter, compared to the consensus estimate of $797.18 million. During the same period last year, the business earned ($0.15) earnings per share. The business's revenue was up 27.5% compared to the same quarter last year. Equities analysts expect that Cinemark Holdings, Inc. will post 1.93 EPS for the current fiscal year.

Cinemark Announces Dividend

The firm also recently disclosed a -- dividend, which was paid on Wednesday, March 19th. Investors of record on Wednesday, March 5th were paid a $0.08 dividend. The ex-dividend date of this dividend was Wednesday, March 5th. Cinemark's dividend payout ratio (DPR) is presently 15.76%.

Cinemark Profile

(

Free Report)

Cinemark Holdings, Inc, together with its subsidiaries, engages in the motion picture exhibition business. As of February 16, 2024, it operated 501 theatres with 5,719 screens in 42 states and 13 countries in South and Central America. Cinemark Holdings, Inc was founded in 1984 and is headquartered in Plano, Texas.

Featured Articles

Before you consider Cinemark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cinemark wasn't on the list.

While Cinemark currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.