Wellington Management Group LLP cut its stake in shares of Laureate Education, Inc. (NASDAQ:LAUR - Free Report) by 4.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 4,995,382 shares of the company's stock after selling 223,155 shares during the quarter. Wellington Management Group LLP owned approximately 3.32% of Laureate Education worth $91,366,000 at the end of the most recent reporting period.

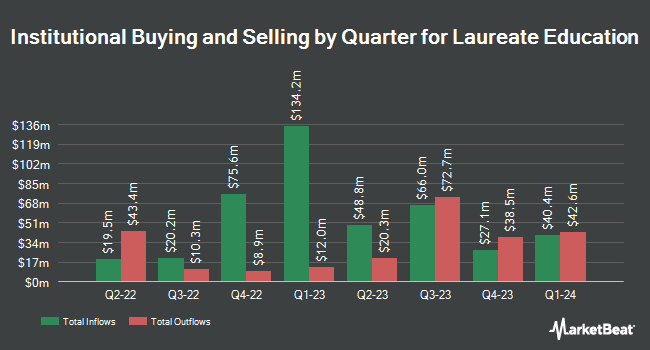

Several other institutional investors also recently bought and sold shares of LAUR. North of South Capital LLP purchased a new stake in shares of Laureate Education during the fourth quarter worth about $22,973,000. Union Bancaire Privee UBP SA acquired a new stake in Laureate Education during the 4th quarter worth $15,057,000. Brandywine Global Investment Management LLC acquired a new stake in shares of Laureate Education in the 4th quarter worth $9,353,000. Hotchkis & Wiley Capital Management LLC acquired a new stake in shares of Laureate Education in the third quarter valued at about $6,757,000. Finally, Teacher Retirement System of Texas increased its holdings in Laureate Education by 132.7% during the 4th quarter. Teacher Retirement System of Texas now owns 430,817 shares of the company's stock valued at $7,880,000 after acquiring an additional 245,707 shares in the last quarter. 96.27% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, BMO Capital Markets boosted their target price on shares of Laureate Education from $21.00 to $23.00 and gave the stock an "outperform" rating in a research report on Monday, February 24th.

View Our Latest Research Report on LAUR

Laureate Education Stock Performance

Shares of Laureate Education stock traded down $0.39 during midday trading on Thursday, hitting $19.17. The company had a trading volume of 84,336 shares, compared to its average volume of 752,526. The business's 50 day simple moving average is $19.66 and its two-hundred day simple moving average is $18.43. The stock has a market cap of $2.89 billion, a PE ratio of 9.89 and a beta of 0.43. The company has a debt-to-equity ratio of 0.15, a current ratio of 0.63 and a quick ratio of 0.63. Laureate Education, Inc. has a 1-year low of $13.26 and a 1-year high of $21.73.

Laureate Education (NASDAQ:LAUR - Get Free Report) last posted its earnings results on Thursday, February 20th. The company reported $0.62 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.42 by $0.20. The company had revenue of $423.40 million during the quarter, compared to analyst estimates of $411.50 million. Laureate Education had a return on equity of 32.35% and a net margin of 18.92%. As a group, equities analysts predict that Laureate Education, Inc. will post 1.51 EPS for the current fiscal year.

Insider Buying and Selling at Laureate Education

In other news, Director Ian Kendell Snow sold 520,831 shares of the firm's stock in a transaction dated Thursday, March 13th. The stock was sold at an average price of $17.47, for a total transaction of $9,098,917.57. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 2.32% of the company's stock.

About Laureate Education

(

Free Report)

Laureate Education, Inc, together with its subsidiaries, offers higher education programs and services to students through a network of universities and higher education institutions. The company provides a range of undergraduate and graduate degree programs in the areas of business and management, medicine and health sciences, and engineering and information technology through campus-based, online, and hybrid programs.

Featured Stories

Before you consider Laureate Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Laureate Education wasn't on the list.

While Laureate Education currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.