Wellington Management Group LLP raised its holdings in shares of SiTime Co. (NASDAQ:SITM - Free Report) by 36.4% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 195,573 shares of the company's stock after purchasing an additional 52,221 shares during the period. Wellington Management Group LLP owned 0.84% of SiTime worth $41,956,000 as of its most recent filing with the Securities and Exchange Commission.

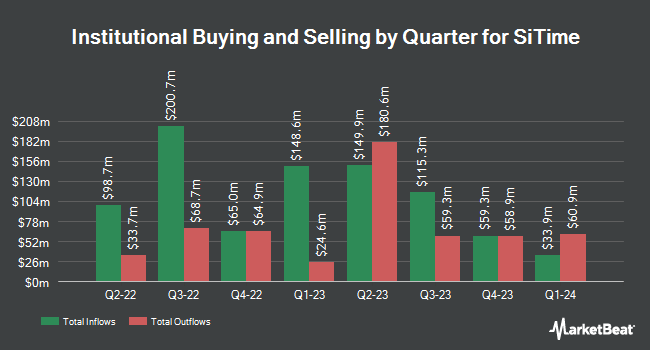

A number of other large investors also recently added to or reduced their stakes in the business. Vanguard Group Inc. increased its stake in shares of SiTime by 2.2% in the 4th quarter. Vanguard Group Inc. now owns 2,468,348 shares of the company's stock valued at $529,535,000 after acquiring an additional 52,310 shares during the last quarter. State Street Corp increased its stake in shares of SiTime by 3.1% in the 3rd quarter. State Street Corp now owns 922,974 shares of the company's stock valued at $158,299,000 after acquiring an additional 27,692 shares during the last quarter. Principal Financial Group Inc. increased its stake in shares of SiTime by 15.4% in the 3rd quarter. Principal Financial Group Inc. now owns 448,930 shares of the company's stock valued at $76,996,000 after acquiring an additional 59,931 shares during the last quarter. Geode Capital Management LLC increased its stake in shares of SiTime by 3.7% in the 3rd quarter. Geode Capital Management LLC now owns 440,922 shares of the company's stock valued at $75,637,000 after acquiring an additional 15,759 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. increased its stake in SiTime by 3.7% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 171,937 shares of the company's stock worth $36,886,000 after purchasing an additional 6,117 shares in the last quarter. 84.31% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at SiTime

In other SiTime news, insider Piyush B. Sevalia sold 1,038 shares of the business's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $157.64, for a total value of $163,630.32. Following the transaction, the insider now directly owns 92,847 shares of the company's stock, valued at approximately $14,636,401.08. The trade was a 1.11 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Fariborz Assaderaghi sold 1,003 shares of the business's stock in a transaction that occurred on Monday, February 3rd. The shares were sold at an average price of $204.42, for a total value of $205,033.26. Following the completion of the transaction, the insider now directly owns 99,678 shares in the company, valued at approximately $20,376,176.76. This trade represents a 1.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 5,542 shares of company stock worth $978,713 over the last 90 days. Insiders own 2.30% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts recently issued reports on the company. Barclays increased their target price on SiTime from $130.00 to $160.00 and gave the stock an "underweight" rating in a research note on Friday, January 17th. Stifel Nicolaus raised their price target on shares of SiTime from $250.00 to $270.00 and gave the stock a "buy" rating in a research note on Thursday, February 6th. Raymond James reissued an "outperform" rating and issued a $250.00 price objective (up previously from $215.00) on shares of SiTime in a report on Thursday, February 6th. Finally, Needham & Company LLC increased their price objective on SiTime from $225.00 to $250.00 and gave the company a "buy" rating in a report on Thursday, February 6th. One investment analyst has rated the stock with a sell rating and four have given a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $232.00.

Get Our Latest Stock Analysis on SITM

SiTime Stock Performance

Shares of NASDAQ SITM traded down $20.40 during mid-day trading on Thursday, reaching $129.51. The company had a trading volume of 78,677 shares, compared to its average volume of 239,095. SiTime Co. has a one year low of $72.39 and a one year high of $268.18. The firm has a market cap of $3.06 billion, a price-to-earnings ratio of -32.42 and a beta of 1.98. The business's 50-day simple moving average is $166.37 and its 200 day simple moving average is $193.91.

About SiTime

(

Free Report)

SiTime Corporation designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally. The company provides resonators and clock integrated circuits, and various types of oscillators. It serves various markets, including communications, datacenter, enterprise, automotive, industrial, internet of things, mobile, consumer, and aerospace and defense.

Featured Stories

Before you consider SiTime, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SiTime wasn't on the list.

While SiTime currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.