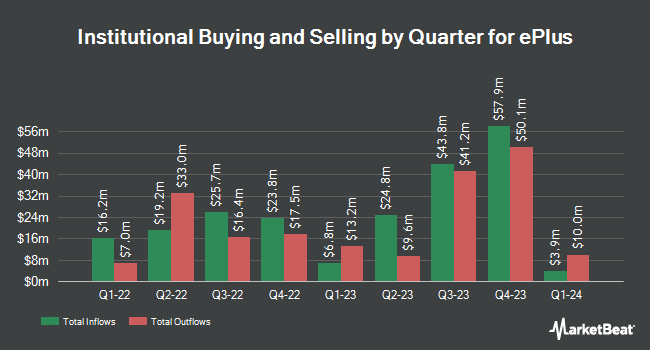

Wellington Management Group LLP lowered its holdings in shares of ePlus inc. (NASDAQ:PLUS - Free Report) by 3.2% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 937,600 shares of the software maker's stock after selling 31,398 shares during the period. Wellington Management Group LLP owned 3.50% of ePlus worth $69,270,000 as of its most recent filing with the SEC.

Several other hedge funds have also recently bought and sold shares of the stock. Swedbank AB bought a new stake in shares of ePlus during the fourth quarter worth $11,082,000. American Century Companies Inc. grew its position in shares of ePlus by 18.2% during the 4th quarter. American Century Companies Inc. now owns 790,332 shares of the software maker's stock valued at $58,390,000 after acquiring an additional 121,945 shares during the period. Raymond James Financial Inc. purchased a new stake in ePlus in the 4th quarter worth approximately $8,683,000. Geode Capital Management LLC raised its position in shares of ePlus by 16.8% during the 3rd quarter. Geode Capital Management LLC now owns 731,909 shares of the software maker's stock valued at $71,987,000 after buying an additional 105,526 shares in the last quarter. Finally, JPMorgan Chase & Co. grew its holdings in shares of ePlus by 126.6% during the 4th quarter. JPMorgan Chase & Co. now owns 124,251 shares of the software maker's stock valued at $9,180,000 after purchasing an additional 69,410 shares during the last quarter. 93.80% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded shares of ePlus from a "hold" rating to a "buy" rating in a research report on Tuesday.

Get Our Latest Research Report on ePlus

ePlus Stock Performance

ePlus stock traded down $1.64 during midday trading on Thursday, reaching $57.77. 30,801 shares of the company traded hands, compared to its average volume of 238,053. ePlus inc. has a 12 month low of $53.83 and a 12 month high of $106.98. The firm has a market capitalization of $1.54 billion, a price-to-earnings ratio of 14.74, a price-to-earnings-growth ratio of 1.83 and a beta of 1.12. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.83 and a quick ratio of 1.69. The business has a 50 day moving average of $65.44 and a two-hundred day moving average of $78.48.

ePlus (NASDAQ:PLUS - Get Free Report) last announced its quarterly earnings data on Wednesday, February 5th. The software maker reported $0.91 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.28 by ($0.37). ePlus had a return on equity of 11.23% and a net margin of 4.93%. As a group, research analysts predict that ePlus inc. will post 3.78 earnings per share for the current year.

ePlus Profile

(

Free Report)

ePlus inc., together with its subsidiaries, provides information technology (IT) solutions that enable organizations to optimize their IT environment and supply chain processes in the United States and internationally. It operates through two segments, Technology and Financing. The Technology segment offers hardware, perpetual and subscription software, maintenance, software assurance, and internally provided and outsourced services; managed services or infrastructure and cloud; and enhanced maintenance support, service desk, storage-as-a-service, cloud hosted and managed, and managed security services; and professional, staff augmentation, cloud consulting, consulting, and security services.

Featured Stories

Before you consider ePlus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ePlus wasn't on the list.

While ePlus currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.