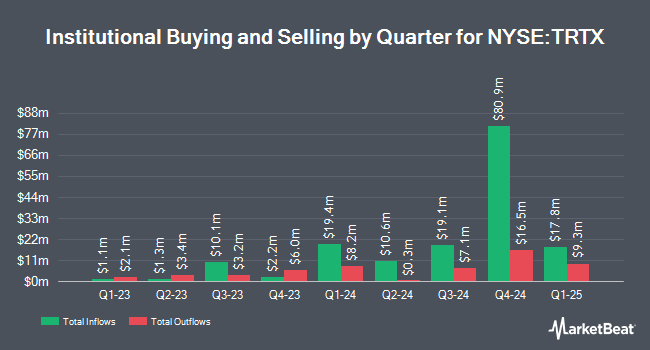

Wellington Management Group LLP bought a new stake in TPG RE Finance Trust, Inc. (NYSE:TRTX - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor bought 703,900 shares of the company's stock, valued at approximately $5,983,000. Wellington Management Group LLP owned approximately 0.87% of TPG RE Finance Trust as of its most recent filing with the SEC.

Several other large investors have also modified their holdings of the stock. Vanguard Group Inc. boosted its holdings in shares of TPG RE Finance Trust by 1.3% during the fourth quarter. Vanguard Group Inc. now owns 4,939,620 shares of the company's stock valued at $41,987,000 after acquiring an additional 63,529 shares during the period. Geode Capital Management LLC grew its holdings in TPG RE Finance Trust by 6.5% in the 3rd quarter. Geode Capital Management LLC now owns 1,456,883 shares of the company's stock worth $12,430,000 after buying an additional 88,592 shares in the last quarter. Arrowstreet Capital Limited Partnership boosted its position in TPG RE Finance Trust by 90.9% during the 4th quarter. Arrowstreet Capital Limited Partnership now owns 1,019,924 shares of the company's stock worth $8,669,000 after acquiring an additional 485,690 shares during the period. Van ECK Associates Corp acquired a new position in TPG RE Finance Trust during the 4th quarter worth $5,588,000. Finally, Condor Capital Management raised its stake in shares of TPG RE Finance Trust by 59.7% during the fourth quarter. Condor Capital Management now owns 438,548 shares of the company's stock valued at $3,728,000 after purchasing an additional 163,934 shares in the last quarter. Institutional investors own 57.12% of the company's stock.

Analyst Upgrades and Downgrades

Separately, JPMorgan Chase & Co. decreased their price target on TPG RE Finance Trust from $8.50 to $7.00 and set an "overweight" rating for the company in a research note on Wednesday.

Check Out Our Latest Report on TPG RE Finance Trust

TPG RE Finance Trust Stock Up 0.5 %

NYSE:TRTX traded up $0.04 on Wednesday, hitting $7.10. 97,203 shares of the company's stock traded hands, compared to its average volume of 635,565. TPG RE Finance Trust, Inc. has a 1 year low of $6.47 and a 1 year high of $9.66. The company has a current ratio of 156.81, a quick ratio of 152.83 and a debt-to-equity ratio of 2.14. The company has a market cap of $574.72 million, a PE ratio of 9.46, a price-to-earnings-growth ratio of 0.25 and a beta of 1.78. The firm has a 50-day moving average price of $8.16 and a 200-day moving average price of $8.48.

TPG RE Finance Trust (NYSE:TRTX - Get Free Report) last released its quarterly earnings data on Tuesday, February 18th. The company reported $0.08 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.26 by ($0.18). The firm had revenue of $34.74 million for the quarter, compared to analyst estimates of $27.98 million. TPG RE Finance Trust had a net margin of 21.79% and a return on equity of 7.57%. Equities analysts anticipate that TPG RE Finance Trust, Inc. will post 0.99 EPS for the current fiscal year.

TPG RE Finance Trust Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Investors of record on Friday, March 28th will be paid a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a dividend yield of 13.53%. The ex-dividend date of this dividend is Friday, March 28th. TPG RE Finance Trust's payout ratio is 128.00%.

TPG RE Finance Trust Profile

(

Free Report)

TPG RE Finance Trust, Inc, a commercial real estate finance company, originates, acquires, and manages commercial mortgage loans and other commercial real estate-related debt instruments in the United States. It invests in commercial mortgage loans; subordinate mortgage interests, mezzanine loans, secured real estate securities, note financing, preferred equity, and miscellaneous debt instruments; and commercial real estate collateralized loan obligations and commercial mortgage-backed securities secured by properties primarily in the multifamily, life science, mixed-use, hospitality, self storage, industrial, and retail real estate sectors.

Further Reading

Before you consider TPG RE Finance Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TPG RE Finance Trust wasn't on the list.

While TPG RE Finance Trust currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.