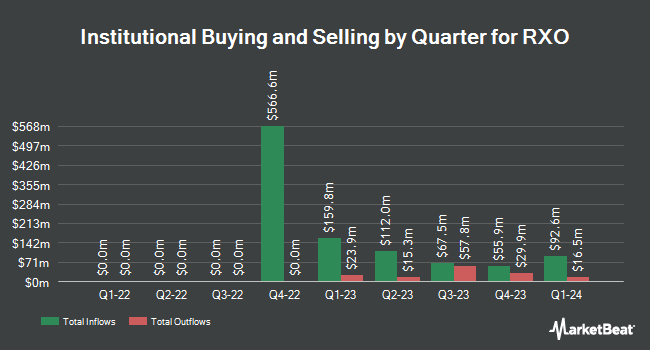

Wellington Management Group LLP lifted its position in shares of RXO, Inc. (NYSE:RXO - Free Report) by 24.8% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,952,884 shares of the company's stock after buying an additional 387,766 shares during the period. Wellington Management Group LLP owned about 1.21% of RXO worth $46,557,000 as of its most recent SEC filing.

A number of other large investors also recently modified their holdings of RXO. Blue Trust Inc. increased its stake in RXO by 79.7% in the 4th quarter. Blue Trust Inc. now owns 1,150 shares of the company's stock worth $27,000 after purchasing an additional 510 shares during the period. Wilmington Savings Fund Society FSB purchased a new position in shares of RXO during the third quarter valued at approximately $28,000. Smartleaf Asset Management LLC increased its stake in shares of RXO by 228.4% during the fourth quarter. Smartleaf Asset Management LLC now owns 1,248 shares of the company's stock valued at $30,000 after buying an additional 868 shares during the period. Nomura Asset Management Co. Ltd. increased its stake in shares of RXO by 68.7% during the third quarter. Nomura Asset Management Co. Ltd. now owns 1,400 shares of the company's stock valued at $39,000 after buying an additional 570 shares during the period. Finally, Thurston Springer Miller Herd & Titak Inc. increased its stake in shares of RXO by 407.0% during the fourth quarter. Thurston Springer Miller Herd & Titak Inc. now owns 1,800 shares of the company's stock valued at $43,000 after buying an additional 1,445 shares during the period. 92.73% of the stock is owned by hedge funds and other institutional investors.

RXO Stock Performance

Shares of NYSE:RXO traded down $0.77 during midday trading on Thursday, reaching $14.17. 392,067 shares of the company's stock traded hands, compared to its average volume of 1,087,038. The company has a market cap of $2.32 billion, a price-to-earnings ratio of -6.69, a P/E/G ratio of 4.55 and a beta of 1.60. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.33 and a current ratio of 1.26. RXO, Inc. has a one year low of $12.39 and a one year high of $32.82. The stock has a 50 day moving average of $19.28 and a 200 day moving average of $24.48.

RXO (NYSE:RXO - Get Free Report) last posted its quarterly earnings data on Wednesday, February 5th. The company reported $0.06 EPS for the quarter, hitting the consensus estimate of $0.06. RXO had a positive return on equity of 1.53% and a negative net margin of 6.26%. As a group, equities research analysts anticipate that RXO, Inc. will post 0.31 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on RXO shares. Oppenheimer cut RXO from an "outperform" rating to a "market perform" rating in a research note on Friday, April 4th. Truist Financial initiated coverage on RXO in a research note on Thursday, March 13th. They set a "buy" rating and a $24.00 target price on the stock. Morgan Stanley reduced their price target on RXO from $27.00 to $25.00 and set an "equal weight" rating on the stock in a research note on Thursday, February 6th. Susquehanna reduced their price target on RXO from $18.00 to $13.00 and set a "negative" rating on the stock in a research note on Wednesday, March 26th. Finally, Barclays reduced their price target on RXO from $24.00 to $22.00 and set an "overweight" rating on the stock in a research note on Wednesday, April 2nd. Two equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $23.60.

Get Our Latest Research Report on RXO

RXO Profile

(

Free Report)

RXO, Inc provides full truckload freight transportation brokering services. It also offers brokered services for managed transportation, last mile, and freight forwarding. The company was incorporated in 2022 and is based in Charlotte, North Carolina.

Featured Articles

Before you consider RXO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RXO wasn't on the list.

While RXO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.