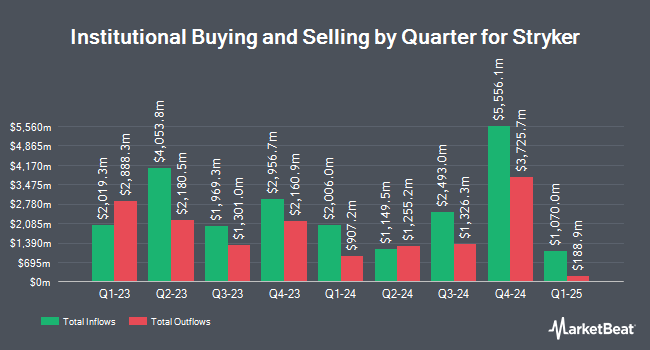

Wellington Management Group LLP trimmed its position in shares of Stryker Co. (NYSE:SYK - Free Report) by 10.2% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 10,094,496 shares of the medical technology company's stock after selling 1,141,140 shares during the period. Stryker makes up about 0.6% of Wellington Management Group LLP's holdings, making the stock its 27th biggest holding. Wellington Management Group LLP owned 2.65% of Stryker worth $3,646,738,000 at the end of the most recent reporting period.

Other large investors have also made changes to their positions in the company. State Street Corp grew its stake in Stryker by 2.2% during the third quarter. State Street Corp now owns 14,582,959 shares of the medical technology company's stock worth $5,279,788,000 after buying an additional 316,404 shares during the period. FMR LLC lifted its position in Stryker by 3.0% during the 3rd quarter. FMR LLC now owns 7,306,994 shares of the medical technology company's stock worth $2,639,725,000 after acquiring an additional 215,782 shares in the last quarter. Clearbridge Investments LLC boosted its holdings in Stryker by 2.9% in the 2nd quarter. Clearbridge Investments LLC now owns 2,323,452 shares of the medical technology company's stock worth $790,554,000 after acquiring an additional 66,482 shares during the period. Parnassus Investments LLC purchased a new stake in shares of Stryker during the third quarter valued at approximately $762,798,000. Finally, Janus Henderson Group PLC lifted its position in shares of Stryker by 1.5% during the third quarter. Janus Henderson Group PLC now owns 1,969,757 shares of the medical technology company's stock worth $711,594,000 after purchasing an additional 28,421 shares in the last quarter. 77.09% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

SYK has been the topic of several analyst reports. JPMorgan Chase & Co. lifted their price target on shares of Stryker from $375.00 to $420.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Wells Fargo & Company upped their price objective on Stryker from $381.00 to $405.00 and gave the company an "overweight" rating in a research note on Wednesday, October 30th. Morgan Stanley upgraded Stryker from an "equal weight" rating to an "overweight" rating and lifted their target price for the stock from $370.00 to $445.00 in a research report on Monday, December 2nd. Evercore ISI upped their price target on Stryker from $380.00 to $384.00 and gave the company an "outperform" rating in a research report on Wednesday, October 30th. Finally, Canaccord Genuity Group lifted their price objective on shares of Stryker from $360.00 to $400.00 and gave the stock a "buy" rating in a report on Wednesday, October 30th. Four equities research analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $398.40.

Get Our Latest Stock Report on Stryker

Stryker Stock Performance

SYK stock traded up $2.57 during trading on Friday, reaching $385.02. 1,049,412 shares of the company's stock were exchanged, compared to its average volume of 1,271,311. The firm has a market cap of $146.78 billion, a PE ratio of 41.26, a P/E/G ratio of 2.94 and a beta of 0.94. The company has a quick ratio of 1.22, a current ratio of 1.91 and a debt-to-equity ratio of 0.66. Stryker Co. has a 1-year low of $285.79 and a 1-year high of $398.20. The company's fifty day moving average price is $370.60 and its 200-day moving average price is $352.99.

Stryker (NYSE:SYK - Get Free Report) last released its earnings results on Tuesday, October 29th. The medical technology company reported $2.87 EPS for the quarter, beating the consensus estimate of $2.77 by $0.10. The firm had revenue of $5.49 billion for the quarter, compared to analysts' expectations of $5.37 billion. Stryker had a net margin of 16.34% and a return on equity of 23.07%. Stryker's quarterly revenue was up 11.9% on a year-over-year basis. During the same quarter last year, the company earned $2.46 EPS. On average, research analysts expect that Stryker Co. will post 12.06 EPS for the current fiscal year.

Insider Buying and Selling

In other Stryker news, VP M Kathryn Fink sold 7,347 shares of the business's stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $366.98, for a total value of $2,696,202.06. Following the sale, the vice president now directly owns 10,042 shares in the company, valued at approximately $3,685,213.16. The trade was a 42.25 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Kevin Lobo sold 57,313 shares of the stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $368.70, for a total transaction of $21,131,303.10. Following the sale, the chief executive officer now directly owns 100,027 shares of the company's stock, valued at approximately $36,879,954.90. This represents a 36.43 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 66,781 shares of company stock valued at $24,612,275 over the last quarter. Corporate insiders own 5.90% of the company's stock.

Stryker Profile

(

Free Report)

Stryker Corporation operates as a medical technology company. The company operates through two segments, MedSurg and Neurotechnology, and Orthopaedics and Spine. The Orthopaedics and Spine segment provides implants for use in total joint replacements, such as hip, knee and shoulder, and trauma and extremities surgeries.

Featured Stories

Before you consider Stryker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stryker wasn't on the list.

While Stryker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.