Wellington Management Group LLP cut its holdings in PJT Partners Inc. (NYSE:PJT - Free Report) by 12.2% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 561,515 shares of the financial services provider's stock after selling 78,324 shares during the period. Wellington Management Group LLP owned 2.37% of PJT Partners worth $88,613,000 at the end of the most recent reporting period.

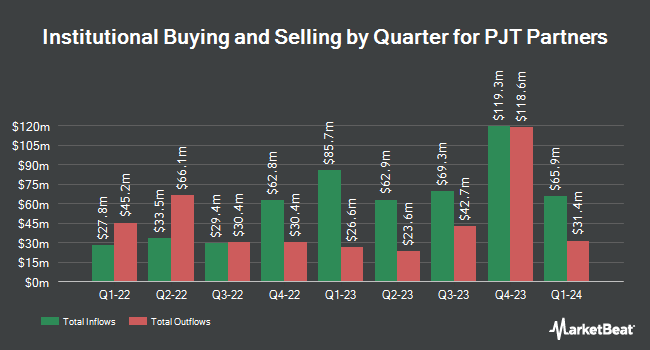

A number of other large investors have also recently added to or reduced their stakes in the business. Sanctuary Advisors LLC lifted its holdings in PJT Partners by 2.9% in the fourth quarter. Sanctuary Advisors LLC now owns 2,274 shares of the financial services provider's stock valued at $375,000 after acquiring an additional 65 shares during the last quarter. Captrust Financial Advisors lifted its holdings in PJT Partners by 2.2% in the third quarter. Captrust Financial Advisors now owns 3,149 shares of the financial services provider's stock valued at $420,000 after acquiring an additional 67 shares during the last quarter. M&T Bank Corp lifted its holdings in PJT Partners by 3.5% in the third quarter. M&T Bank Corp now owns 2,220 shares of the financial services provider's stock valued at $296,000 after acquiring an additional 75 shares during the last quarter. GAMMA Investing LLC lifted its stake in PJT Partners by 32.3% during the fourth quarter. GAMMA Investing LLC now owns 446 shares of the financial services provider's stock worth $70,000 after purchasing an additional 109 shares in the last quarter. Finally, Xponance Inc. lifted its stake in PJT Partners by 7.4% during the fourth quarter. Xponance Inc. now owns 1,659 shares of the financial services provider's stock worth $262,000 after purchasing an additional 115 shares in the last quarter. 89.23% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of research analysts have commented on the company. JMP Securities cut PJT Partners from an "outperform" rating to a "market perform" rating in a research note on Monday, January 13th. Keefe, Bruyette & Woods upped their price target on PJT Partners from $152.00 to $177.00 and gave the stock a "market perform" rating in a research note on Wednesday, February 5th. Finally, Citizens Jmp lowered PJT Partners from a "strong-buy" rating to a "hold" rating in a research report on Monday, January 13th. Five research analysts have rated the stock with a hold rating, Based on data from MarketBeat, PJT Partners currently has an average rating of "Hold" and an average price target of $158.50.

Read Our Latest Analysis on PJT

PJT Partners Stock Performance

Shares of PJT Partners stock traded down $5.23 during trading hours on Thursday, reaching $130.84. 97,855 shares of the company were exchanged, compared to its average volume of 240,894. PJT Partners Inc. has a 1 year low of $90.95 and a 1 year high of $190.28. The stock's fifty day moving average is $152.01 and its 200 day moving average is $152.99. The firm has a market cap of $3.05 billion, a PE ratio of 26.71 and a beta of 0.77.

PJT Partners (NYSE:PJT - Get Free Report) last posted its earnings results on Tuesday, February 4th. The financial services provider reported $1.90 EPS for the quarter, beating the consensus estimate of $1.19 by $0.71. The firm had revenue of $477.30 million for the quarter, compared to analyst estimates of $384.64 million. PJT Partners had a return on equity of 24.03% and a net margin of 9.00%. PJT Partners's revenue for the quarter was up 45.3% compared to the same quarter last year. During the same quarter in the prior year, the company posted $0.96 earnings per share. Research analysts expect that PJT Partners Inc. will post 6.2 earnings per share for the current year.

PJT Partners Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, March 19th. Investors of record on Wednesday, March 5th were issued a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 0.76%. The ex-dividend date was Wednesday, March 5th. PJT Partners's dividend payout ratio (DPR) is presently 20.41%.

PJT Partners Profile

(

Free Report)

PJT Partners Inc, an investment bank, provides various strategic and capital markets advisory, restructuring and special situations, and shareholder advisory services to corporations, financial sponsors, institutional investors, and governments worldwide. It offers advisory services to clients on various transactions, including mergers and acquisitions (M&A), spin-offs, activism defense, contested M&A, joint ventures, minority investments, and divestitures.

Further Reading

Before you consider PJT Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PJT Partners wasn't on the list.

While PJT Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.